Weekly Roundup, 24th November 2014

Contents

Active funds – costs and closet tracking

Today’s weekly roundup begins with Merryn’s column, which looked at a report from Cass Business School on some of the problems with active funds. The first is the fee structure – flat percentage is the most commonly used and worst option, whilst the recommended symmetric fees (where fund managers share in the downside) is unknown. ((interestingly, Warren Buffett used this fee structure in his original investment partnership))

Even worse is the number of funds that are not active at all, but largely track the index. Given the size of active funds’ fees, this can only lead to serious cumulative underperformance. They can be identified using a score called Active Share, which measure how similar the stocks inside the funds are to the index. Merryn reports that 29% of UK equity funds are closet trackers.

Simon Evan-Cook at Premier Fund Management compared returns for funds across their Active Share scores. Highly active funds returned 10.3% pa (!) over the last 10 years, compared with 4.8% from the index. Low-cost trackers returned 4.9% and moderately active funds returned 5.9%. The closet trackers underperformed the index, scoring 4.6%. These results match those of the original Yale study from 2007 which developed the Active Share measure.

Merryn cautions that survivor bias will explain some of the outperformance of highly active funds, but this measure clearly warrants further investigation. She promises us a list of candidate funds next week.

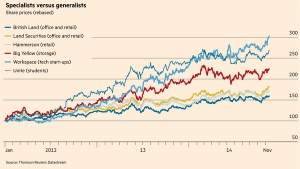

Commercial property flavours

Kate Allen used the chart above to survey the commercial property market in the UK. The key message is that specialists exposed to fast-growing sectors of the economy (in student housing, storage or tech start-ups) are outperforming generalists. The larger companies are beginning to specialise as well, but some like Land Securities, are too big (£13 billion) to fit within a sub-sector.

House price bubble

Tim Harford wrote about house prices. His first point was that the widely used measure of “affordability” (ability to meet interest payments) ignores inflation. In the 1970s and 80s, the first few years after a house purchase were difficult, as mortgage rates were often around 10% pa. After a few years, high inflation meant that the mortgage seemed much smaller relative to the value of the house, and your new salary.

These days, low inflation and mortgage rates mean that repayments seem very affordable, but they cannot get any more affordable, and may need paying at their current level of pain for the entire duration of the mortgage.

He went on to discuss loss aversion, and how those who buy early in booms will set realistic prices when selling – even after a fall – because prices are still higher than when they first bought. Those who bought late are often unwilling to sell at a price lower than they bought.

Last, he showed how Thomas Piketty’s conclusion that “capital is back” is really nothing more than a house price bubble, one that has been inflating for 50 years. Who knows whether it will last for another fifty.

Diversity in markets

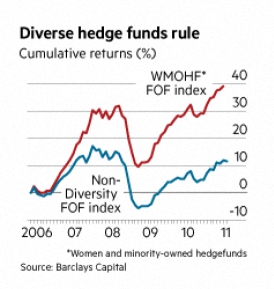

And finally this week, John Authers made a bit of a splash with his column suggesting that diversity improves investment results. Before commenting I should make the same disclaimer as John – I too am white and male. John was reporting on studies in Texas and Singapore which showed that increasing the diversity of participants in trading simulations improved pricing accuracy.

John also mentioned the improved returns from hedge funds owned by women and minorities, commenting that women are less prone to over-confidence and more risk-averse. He stopped just short of calling for quotas to reduce the dominance of white men in finance.

As the authors of the trading simulation study state, it is not the case that the minorities improve performance, rather that a homogenous group is too trusting, impairing its performance in this task (but not necessarily all others). Further, this is not simply a feature of white men (the group in Singapore was not white).

Merryn made a good point about the hedge fund results – it is not surprising that comparing average members of an in-group with exceptional members of an out-group will appear to show outperformance. This is not evidence of superior talent in the out-group and the effect can be expected to diminish as more outsiders are added.

Also, refer back to the mechanism by which the effect in the trading simulation operates: diverse groups are less trusting of each other. It may be the correct moral choice, but diversity in the workplace could be something we wish for others but not ourselves. In my own experience, the happiest teams I worked in were far from the most diverse.

As to the supposed female advantage of risk aversion, I am not convinced that I want my money managed by the risk averse. Results are paramount, not personality traits. I am reminded of the recently abolished car insurance discount for women. My Aunt Edna may not have had an accident in 40 years, but I wouldn’t pay to watch her race Lewis Hamilton around Monaco.