Weekly Roundup, 23rd May 2022

We begin today’s Weekly Roundup with property.

Property

We’ve had a lot of articles about house prices in the last few weeks. Most recently, the FT told us that increases in UK house prices were slowing as the cost of living climbs – and so does the cost of borrowing money.

- There’s also been the restoration of stamp duty on purchases towards the bottom end of the ladder.

Property prices increased by 9.8 per cent over the year to March, down from 11.3 per cent in February, according to Land Registry figures. The average cost of a home was £278,000, up £24,000 from the same time last year.

So house price inflation is pretty close to the general inflation figure (see below).

The average house price to earnings ratio in the UK is now more than 9.

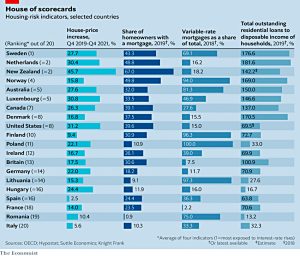

The Economist looked at which housing markets are most exposed to rising interest rates.

- The UK didn’t do too badly.

In Australia and New Zealand, where prices jumped by more than 20% last year, values have got so out of hand that they may be sensitive to even modest rises in interest rates. In America and Britain, where markets are a little less torrid, interest rates may have to approach 4% for house prices to fall.

I don’t think we’ll even hit 3% in the UK, but you never know.

Apart from price levels, the Economist looked at three other factors:

- mortgages vs outright ownership

- variable vs fixed-rate loans, and

- the level of household debt.

The UK has just 30% of homeowners with a mortgage, and only 7.5% of those people have a floating-rate deal.

- This is slightly misleading since almost half of the fixes have less than two years left to run.

Total loans are just above the disposable income of households, which is in the middle of the pack internationally.

And of course, there is still a supply/demand mismatch:

Strong job markets, hordes of millennials nearing home-buying years and a shift to remote working have all increased the demand for more living space. New properties remain scarce, which will sustain competition for homes and help keep prices high. In Britain there were 36% fewer property listings in February compared with the start of 2020.

Rents have also increased by 15% compared to 2020, which makes buying appear attractive.

- All-in-all, we needn’t fear a UK house price collapse.

Inflation

UK inflation hit 9% in the 12 months to April 2022, up from 7% in March.

- RPI rose from 9% in March to 11.1% in April.

This is the highest annual level for more than 40 years and reflects nine months in a row where the figure has been higher than the Bank of England’s (BoE’s) 2% target.

Of course, inflation is personal, and your number could be higher or lower than 9%.

- The problem is that your personal number is hard to track in real time – I only analyse my spending totals once a year.

Energy and transport costs were the big drivers.

- My energy bill is up more than 50% from 18 months ago.

Chancellor Rishi Sunak said inflation is a global phenomenon:

Today’s inflation numbers are driven by the energy price cap rise in April, which in turn is driven by higher global energy prices. We cannot protect people completely from these global challenges but are providing significant support where we can, and stand ready to take further action.

The BoE has raised interest rates to 1%, but that won’t do much against 9% inflation.

- Earlier in May, BoE governor Andrew Bailey said he was powerless to stop inflation from hitting 10% (possibly next month, by the look of things).

The economy is slowing, and further rate rises will most likely lead to a recession (and potentially unemployment, and possibly a house price crash ) – and then maybe rate cuts.

- But perhaps this is the inflation peak for now, with the potential for another spike up in October when the energy price cap goes up again.

In terms of government action, we won’t get the interest rates we need to tame inflation (we’ve started too late for that).

- But for PR purposes, perhaps we’ll get an energy subsidy in the autumn, and perhaps some windfall taxes on energy companies. (( Not a good idea, really ))

60/40

In the FT, Robin Wigglesworth and George Steer (( I couldn’t find a picture )) looked at the demise of the 60/40 portfolio.

According to Man Group:

Since 1960, there have been 44 individual instances of the S&P 500 index enduring five or more consecutive down weeks. Since 1973, US Treasuries have had 31 such losing streaks lasting at least five weeks.

Yet these prolonged sell-offs had never coincided — until the start of May. For the first time in the near 50 years for which we have both data sets, the two sides of a typical 60/40 US portfolio have lost money for five weeks in a row.

Vanguard’s 60/40 fund shows the impact, which is already worse than Covid and dot com, and similar to the 2008 crisis:

Since the combination of falls is unprecedented, we don’t know what will happen next.

- So Man looked instead at what happens after five weeks of S&P declines:

Things don’t look good until we get a year past the declines.

AQR has more bad news:

A global 60/40 is only likely to eke out a 1.9 per cent annual gain after inflation over the next 5-10 years, compared to an average of almost 5 per cent.

Growth

The Economist looked at why long-term economic growth often disappoints.

- It seems that technological progress is overrated.

Back in the 1950s:

Futurists foresaw a world of super-pills, space farms and cities encased in glass. Science and technology would engineer unending riches and everything consumers could ever want.

In fact, real income growth fell from 2.5% pa to just 1.2% post-2000. And as Peter Thiel put it:

We wanted flying cars but instead we got 140 characters.

A recent paper by Thomas Philippon suggests, however, that there has been no slowdown.

We start with Solow’s theory of growth:

On one side labour and capital go in; out the other come all the consumer goods and services.

But this cannot be grown indefinitely:

Adding more labour means the output is divided between more workers. And capital wears out, so more investment is needed over time just to stay put.

What you need is more productivity – more output per unit input.

- Economists refer to total factor productivity (TFP).

- TFP is affected by education levels and the availability of technology.

Solow assumed that TFP would increase exponentially, perhaps so that his model would produce a constant level of growth.

- It could also be that Solow was working during a period of exponential TFP growth (in his case, from the widespread electrification of the US).

Exponential growth is theoretically possible if new knowledge in some ways leverages existing knowledge, but in practice, TFP growth appears to be linear.

This is not a counsel of despair. While the rate of growth in percentage terms may be slowing, Mr Philippon’s model predicts that the size of any increment is roughly constant.

Alternative investments

David Stevenson has some alternative investment suggestions to cope with a bear market.

The article includes a massive list of funds, but highlights include:

- Renewable energy – Foresight Solar, JLEN Environmental Assets, Greencoat UK Wind and Thomas Lloyd Energy Impact

- Energy storage funds — GRID, Harmony and Gore Street

- Defensive multi-asset funds – Ruffer Investment Company, Capital Gearing, Personal Assets and BH Macro

- Equity income – Murray International, City of London Trust, Temple Bar and Henderson International income

- Infrastructure funds – HICL and INPP

- Biopharma Credit

- Digital 9 – digital infrastructure

- Tetragon – hedge funds and stakes in asset managers

- Energy and carbon ETFs

- Dividend ETFs

Lifetime allowance

In FT Adviser, Sally Hickey reported on PensionBee boss Romi Savova’s suggestion that the pensions lifetime allowance should be scrapped because it penalises disciplined savers.

- I used to say the same thing myself, but it now seems clear that HMRC sees the LTA as a nice little earner.

Romi said:

If you do proactively contribute to your pension, the likelihood is that you will hit your lifetime allowance sometime in your 50s. We would be in favour of an elimination of the lifetime allowance and a focus on the annual allowance instead, where we actually see very few people contributing up to the annual allowance.

She also doesn’t like the annual allowance taper for higher earners:

I don’t think that savers should be penalised for putting money into their pensions. [The added complexity] discourages people from saving.

Advice

Research from Hargreaves Lansdown suggests that only half of people would consider taking financial advice.

- HL commissioned Opinium to survey 2000 people.

35% claimed to know what they are doing, 29% said advice was too expensive and 28% said they didn’t have enough money to make it worthwhile.

- 21% also didn’t trust advisors and 7% didn’t want to make a long-term commitment.

Sarah Coles from HL said:

Financial advice myths could be costing us dear. While [advice is] not going to be right for everyone at every stage in life, there’s a risk that an awful lot of us are being led astray by assumptions and misunderstandings about what’s involved.

These comments were a lead-in to a pitch for cheaper, cut-down advice (which HL offers).

- HL also claimed that no long-term commitment is required but while they themselves offer one-off reviews, most IFAs want a slice from your pot each year, as anyone who has tried to make a DB pension transfer will know.

HL was also in the news for switching 120K users of their workplace SIPP into a new default fund run by HL.

- HL runs 487 corporate pension schemes and has swapped out the Schroder Managed Balanced fund for the HL Growth fund.

Four out of five of the 150K members of the HL workplace schemes stick with the default fund.

The new fund uses tracker funds to target 60% developed equities, 10% EM stocks, 10% global smaller companies and 20% bonds.

- Investors stay in the HL fund until 10 years from retirement when they are moved over to a target date fund run by Blackrock.

HL has suggested that an HL equivalent will replace the Blackrock fund at some point in the future.

Quick Links

I have seven for you this week, the first two from The Economist:

- The Economist reported on a swoon in the shares of America’s big retailers

- And said that after a bruising year, Softbank is bracing for more pain.

- Alpha Architect looked at timing fast and slow trends

- And wrote about headwinds, tailwinds and variables in Value Investing.

- Jim Bianco asked how many things does the Fed have to break?

- This computer scientist said that all crypto should “die in a fire”

- And Behavioural Investment looked at the odds of making a good investment.

Until next time.

Re: personal inflation, see:

https://www.ons.gov.uk/economy/inflationandpriceindices/articles/howisinflationaffectingyourhouseholdcosts/2022-03-23