Weekly Roundup, 15th March 2021

We begin today’s Weekly Roundup with a look at consumer spending.

Contents

Consumer spending

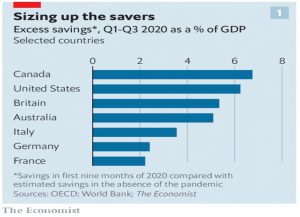

The Economist wondered whether consumers will spend the enormous piles of cash they are sitting on.

- Consumers across 21 rich countries saved $6 trn in the first nine months of 2020, rather than the expected $3 trn.

In America excess savings may soon exceed 10% of GDP, in part because of President

Joe Biden’s $1.9trn stimulus plan.

This is all somewhat unusual – most recessions don’t come with 5% of GDP spent on furlough schemes and stimulus payments.

- Instead, workers take pay cuts and lose their jobs.

On top of the continuing (and in many cases inflated) income, lockdown means less opportunity to spend.

If all this money were to be spent, OCED GDP growth for 2021 might hit 10%, even higher than after World War II.

- It would also produce inflation, for a while at least.

But it’s hard to say just how much of it will be consumed.

There seems little doubt that in all rich countries wealthier people have accumulated most of the excess savings. They have been the least likely to lose work. A big share of their spending is discretionary, say on holidays or meals out; and it is many of these services that have been shut down during the pandemic.

And the rich are less likely to spend.

America (and to a lesser extent, Japan) are the exceptions since a lot of direct stimulus money was sent to those on lowish incomes.

- This will be treated as “extra income” which consumers are more likely to spend than “additional wealth”.

The dollar

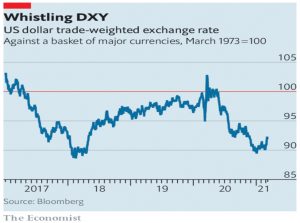

Buttonwood reported that the dollar has strengthened on the back of higher GDP growth forecasts and rising Treasury yields.

- It also helps that no other currencies are doing particularly well.

- Sterling was, until recently, and oil-driven currencies like the Canadian dollar and Norwegian Krone – and resource-driven money like the Australian dollar – have also been doing OK.

The other factor is risk appetite.

- The dollar is a safe haven and in times of crisis (last March, say), people want dollars.

The Economists reports that there are also a lot of stale short positions in the dollar, which could conceivably be forced to cover should the dollar continue to rise.

- But the dollar could also weaken later in the year, as an over-stimulated economy leads to a bigger trade deficit, and eventually provides a boost to other economies.

Takeovers

In the FT, John Lee wrote about his request that the Takeover Panel should improve shareholder access to information during takeover bids.

Boards have to make an announcement only when there is “a firm intention” to make a bid coming from a potential buyer. This can mean that acquisition talks drag on for many months with any number of offers, perhaps from more than one party, without a statement being made.

Signature Aviation, which had 10 approaches from February 2020, is the example that he uses.

Nothing was disclosed to shareholders until December. Finally, last month, a deal was struck at 411p a share. Any shareholder who sold in ignorance of a possible bid seriously lost out, as the takeover price was above the market price for all of 2020, and far above an April low of 153p.

John’s own small-cap portfolio is looking good:

I cannot think of a current holding where the outlook looks negative.

John mentions Treatt, Anpario, Concurrent Technologies, Lokn’Store, Appreciate, Christie, STV, Vianet, and Vitec.

- He has added to Tate & Lyle and Titon and bought into Duke Royalty and Tatton Asset Management.

Inflation

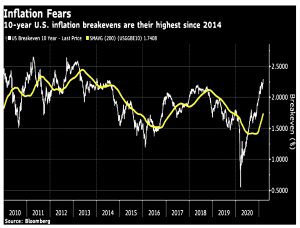

John Authers looked at inflation, with monetary policy meetings looming from the Fed, the BoE and the BoJ.

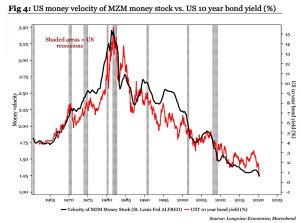

- 10-year US treasuries are at 1.63% and breakevens are at their highest since 2014.

But as John points out, the absolute levels remain historically low and should not worry a Fed targeting average inflation above 2% pa.

- Inflation itself is also low, but this is to be expected until activity returns to pre-lockdown levels.

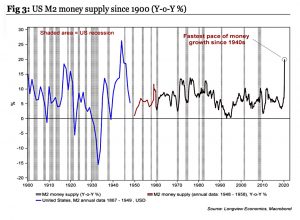

Fears of inflation stem largely from a massive increase in the money supply.

This hasn’t translated into inflation yet because the velocity of money has fallen.

- The rise in bond yields signals an expectation that this is about to change.

This change is also supported by demographics, with the larger group of Millenials starting to displace the smaller Gen X group from the key age range of 20 to 54.

Inflation expectations

Joachim Klement looked at inflation expectations and a paper from Ulrike Malmendier and three colleagues.

- It seems there are two behavioural biases that lead people to feel that inflation is higher than the official numbers.

The first is loss aversion:

If we want to buy something where we know how much it “should” cost (or how much it cost the last time we bought it) and today it costs more, then we experience this higher price as a loss.

Since we react more strongly to losses than to gains, we notice a price increase more than prices that have gone down.

The second effect is related to frequency:

We form our expectations not by how important an event or a purchase is, but how often we do it. The more often we see the same information, the more likely

we are to accept it as true, even if it is not.

This also underlies the spread of conspiracy theories, but in the context of inflation, it means that we are highly influenced by small items that we purchase regularly, like groceries.

- And of course, we notice the items in our shopping baskets that have increased in price more than those which have fallen.

Food isn’t really a major part of our overall inflation basket. For a middle-class person, it accounts for somewhere between 10% and 25% of our total expenses. This effect makes inflation feel higher than it really is.

Fixed mortgages

Fintech firm Habito has launched the longest-ever fixed-rate mortgages in the UK.

- You can fix rates for between 10 and 40 years, with no exit/early redemption fees.

Rates start at 3% pa and loans from 60% LTV to 90% LTV are available.

Fixed-rate mortgages are popular in Europe and the US, but they have never caught on in the UK.

- In part, this is because mortgage lenders in the UK are deposit-taking retail banks who in theory might need to quickly repay the money they lend out.

- Habito doesn’t take deposits and will instead raise money int he capital markets.

In addition, the persistent fall in interest rates over the past few decades meant that the timing wasn’t ideal for a fixed-rate product.

- But it will be interesting to see if people really do think that rates are now about to increase.

Quick Links

I have five for you this week, the first four from the Economist:

- The newspaper said that Biden’s stimulus package is a high-stakes gamble

- Warned that jet engine makers face a long recovery from the pandemic

- Said that oil markets are preparing for lofty prices and restrained supply

- And wondered whether Roblox might be the next meme stock.

- And Alpha Architect tested whether low-volatility factor investing is risk-based or behaviourally based or both.

Until next time.