Weekly Roundup, 19th April 2022

We begin today’s Weekly Roundup with a look at property as an investment.

Houses vs Stocks

Alan Miller from SCM (( His wife Gina Miller of the same firm is probably more famous )) looked at whether the commonly-held view that property is the best investment is actually true.

- Alan doesn’t think that it is.

In our view, starting from where we are today, a mixed portfolio of shares and bonds should outperform the average UK house price.

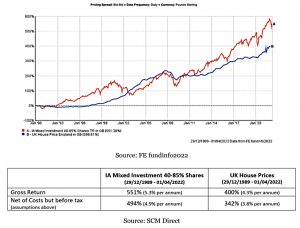

The historical data (from 1989 to 2022) seems to back him up – mixed stock/bond funds (40% to 85% stocks) returned 551% vs 400% for property before costs.

- After costs (for buying and selling in the case of property), funds returned 494% and property 342% (CAGRs of 4.9% and 3.8%).

Property was ahead for a few years, between 2003 and 2009.

The analysis doesn’t include rental yield for property (which has averaged 3.2% pa) but management and maintenance costs are also excluded.

- Alan also notes that a 100% stocks fund would have done even better than the mixed funds.

Stocks also have a liquidity advantage, and I think that a key but underreported factor is that because of high property prices, most UK investors already have a large allocation to property (mine is 27%) so they should be looking to stocks and bonds for diversification.

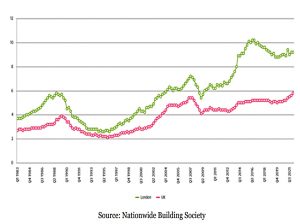

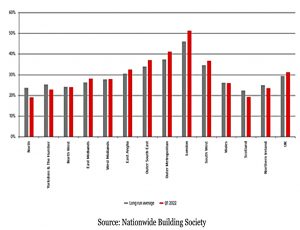

UK property prices have been rising recently (outside London, at least).

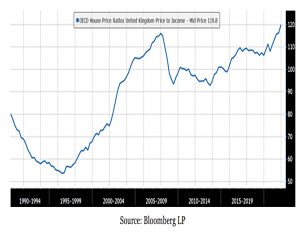

House prices are now at a record ratio to average income.

Apart from in London.

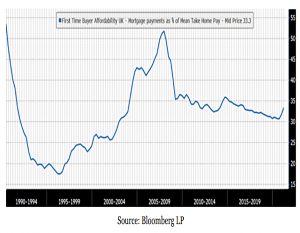

But affordability is falling as mortgage rates rise, and is expected to fall further over the next year.

In London, first time buyer mortgage payments are already more than 50% of take-home pay, before any increased mortgage payments.

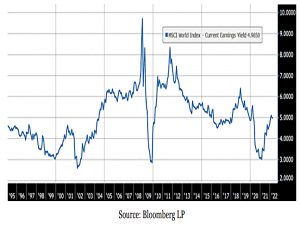

For Alan, global stocks are fairly priced (based on earnings yield).

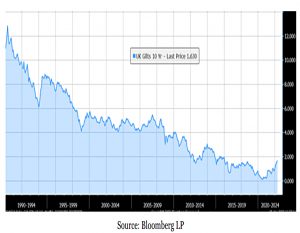

Bonds on the other hand are unattractive because of their low nominal yields.

And even lower real yields.

However, investors do not have to buy an index of world equities (dominated by expensive US tech stocks) or UK government bonds. There are plenty of different choices of mixed equity/bond funds/portfolios.

Alan likes US value stocks, small- and mid-caps in Europe, Japan and EMs.

Growth is effectively being purchased on a 26% discount to a traditional market cap weighted index (based on the PEG ratio).

In bonds, SCM holds corporates and non-Western government bonds with a yield to maturity of 4.2% pa and an average maturity of 6.8 years (cf. 1.5% and 15.2 years for UK gilts).

Much greater returns can be achieved by a diversified but more value orientated mix of bonds and equities [than from property]. Not only are the returns likely to be better but the costs lower and the liquidity significantly.

Bonds

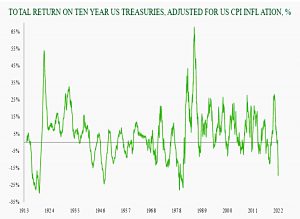

Jasmin Yeo from Ruffer said that bonds are behaving badly.

- The real return on the US ten-year bond over the last two years is minus 20%, the worst performance since 1981.

Traditional balanced portfolios rely on equities and bonds fulfilling their roles – equities for good times, bonds to cushion the bad. But after a torrid three months for markets, investors are being forced to tear up the rulebook.

Investors are replacing bonds with private equity, property and infrastructure.

- In recent years (when inflation was low and predictable) these assets have delivered consistent cash flows.

But they may not be able to keep up with inflation, and might suffer along with equities should economic conditions deteriorate.

- They are also often geared to boost returns and so will be impacted by interest rate rises.

So what is Ruffer doing?

We look to inflation-linked bonds as a key defence in a world of deepening negative real yields using options to offset their duration risk. Other powerful derivative strategies, dynamically managed, can provide convex payoffs in market falls. Exposure to gold and other commodities could also be part

of a diversified solution.

And within stocks, they are going back to a stock-picking approach rather than indexing.

VCT fundraising

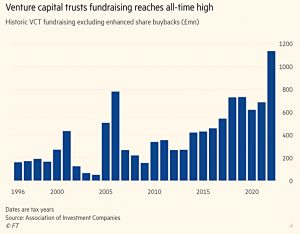

In the FT, Akila Quinio reported that VCTs have raised a record £1.13 bn in the 2021/22 tax year.

- That’s a 65% increase on the previous year, and far more than the previous record of £779M in 2005-06 (which I think was the last year of 40% up0-front tax relief on VCTs).

Alex Davies, CEO of leading BVCT broker Wealth Club, said:

VCTs have finally edged into the mainstream.

An FT survey found that being “capped out” of pensions savings was a major driver of the boom in VCTs investing. The dividend tax increase, announced last October which came into force this month, may have also given the VCT sector a boost.

88% of investors use venture capital trusts for tax relief, with almost two-thirds of them saying the upfront income tax relief was its most important tax benefit.

Pension caps (specifically the LTA) were certainly a key driver for me.

Sea urchins

Also in the FT, Tim Harford looked at the lessons we can learn from sea urchins about economic resilience.

He began with the impact of Covid lockdowns:

Looking at data from five leading European economies plus the US and Japan, output from conventional workplaces fell by 23 per cent between the first and second quarters of 2020. Yet actual output fell by just 13 per cent — severe, but less than half of what one might have expected. This was economic resilience in action.

The reason was that people found ways to do their work from home, often by repurposing equipment they already owned. This unlocking of “potential capital” also happened when the smartphone caught on:

Over a decade ago, people started describing “the sharing economy” or “the peer-to-peer economy”, in which technology was making it easy to arrange carpooling or to link tourists with people in travel hotspots who had spare rooms.

Underutilised assets were matched with people who wanted to use them. The case for peer-to-peer matches was particularly strong in instances where demand fluctuates, from Friday-night rides to rooms near a popular sporting event.

The downside of deploying potential capital is that it squeezes the slack/resilience out of the system.

It’s also the case that systems can be “robust-yet-fragile” – able to deal well with certain shocks but coping badly with others.

The distributed, information-rich, working-from-home economy that coped so well with lockdowns might be extremely vulnerable to certain cyber attacks, or to problems with the electricity grid.

The obvious answer would be to return to the office, but if officers were abandoned during the WFH phase – trading efficiency for flexibility – this would not be possible.

The sea urchins come into things when looking at the surprising resilience of Jamaican coral reefs to over-fishing in the 1960s and 1970s.

- Sea urchins took the place of fish in keeping algae under control.

When a pathogen killed the sea urchins in 1983, the reef was overwhelmed in months.

Because the sea urchins were so good at eating algae, their success masked the fact that they were the last line of defence and that the coral system was in a precarious situation.

Is the internet the long-spined sea urchin of the modern economy? Or is the electricity grid?

There are no easy answers.

- Resilience (usually in the form of redundant capacity) is expensive and can turn out to be useless (Tim references his own call in March 2020 to build more ventilators).

And some forms of resilience (Tim mentions “empathetic communities”) cannot easily be created, particularly since the advent of social media.

Basic income

For Money Week, Stuart Watkins looked at the surprising rollout of Universal Basic Income (UBI).

The response of governments in the rich world to the Covid-19 pandemic made the idea seem plausible – as businesses were shuttered, states picked up the wage bill for workers, sent them cheques in the post, and boosted benefits for the jobless and the sick.

And now trials are been carried out around the world.

South Korea’s presidential candidate Lee Jae-Myung was in favour of introducing one nationwide following a six-month trial he introduced while governor of Kyonggi province.

But Lee lost the election.

In the US, there are more than 20 trial schemes handing out direct cash payments to poor families – Bloomberg reckons they’ll have handed out at least $35m by the time they end if they run as planned.

Note that this is not strict UBI as richer people aren’t included.

Other countries that have run trials include Canada, Brazil, Kenya, Iran, Finland, Germany,

Spain, the Netherlands, Namibia, India, South Africa, China and Japan.

And the idea is washing up on these shores too: the Welsh government has committed to running a trial, and the Scottish government and several English cities are keen too.

Alaska has paid out a state dividend from oil revenues for 40 years.

- That has now reached $2K pa per person.

Such payments do not lead, as some critics fear, to idleness, or people refusing jobs or wasting the money on frivolities, but to more secure and hence happier individuals, families and societies.

But this isn’t real UBI either, as the payments are too low to live on and are funded from a specific source rather than general taxation.

The problem with trialling real UBI is the cost:

Annual costs [in the UK] of more than £260bn, around twice the NHS budget, for a basic income paying only £5,000 a year, or just a third of the poverty line.

Martin Sandhu from the FT suggests funding a £7K pa payment (which would costs 17% of GDP) via a negative income tax.

- Personal allowances and the state pension would be abolished.

- This would cost “just” 5% of GDP, to be raised from wealth taxes and other benefit cuts.

It sounds nice, but it’s really a massive redistribution away from workers and the wealthy to the poorest members of society.

- The immediate impacts on all aspects of the economy are incalculable and the long–term effect would be to remove the incentive to improve your lot.

And vast swathes of society would be dependent on the state.

- Stuart foresees social control, as seen in China’s social credit system.

Crypto

For FT Adviser, Sally Hickey wrote about the new rules that will allow fund managers to hold crypto in their portfolios.

The government will be amending the Investment Manager Exemption to include cryptoassets. The exemption enables non UK-residents to appoint UK based investment managers without having to pay UK tax. The inclusion of cryptoassets in this exemption would mean that income generated from funds holding crypto would not be taxable in the UK.

That’s a little clearer that the original statement that we looked at last week.

Quick Links

I have four for you this week, the first two from UK Dividend Stocks.

- John looked at whether Admiral deserves its 7.5% yield

- And provided his 2022 Q1 portfolio review.

- Monevator looked at when high inflation hurts

- And Alpha Architect examined bond investing in inflationary times.

Until next time.