Weekly Roundup, 24th October 2022

We begin today’s Weekly Roundup with inflation.

Inflation

John Authers looked at the latest US inflation figures.

- They were bad, and a little worse than expected.

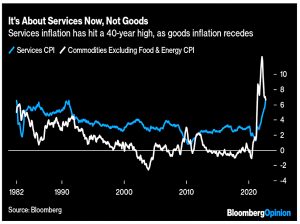

Services inflation is now higher than goods inflation (excluding food and energy).

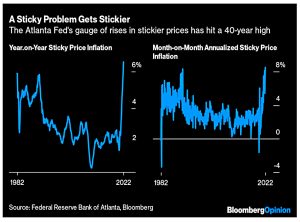

Sticky prices are now rising at the fastest rate in 40 years.

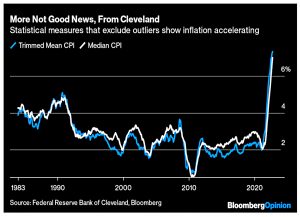

And the trimmed mean inflation is at the highest level since the measure was started in 1984.

Everything is consistent with the realistic worst-case scenario of a year ago, in which the initial extreme price spikes caused by the pandemic would give way to broader price rises as inflation psychology took hold.

So we can expect another 75 bps rate hike (at least) at the next Fed meeting.

John also noted the strange reaction from the stock market – a crash for 15 minutes, followed by a 5% bounce – one of the biggest turnarounds in history, and hard to explain.

It’s fair to say that algorithmic trading has much to do with this. Plenty of people had programmed their computers to buy at just such a point as was reached shortly after the opening.

Why might they have done so? The S&P bottomed at 3,500, evidently a round number, and that level also happened to be the point at which exactly 50% of the rally from the bottom in March 2020 to the top in January 2022 had been retraced [ie. Fibonacci support].

The rise gives the Fed even more ammunition to keep hiking.

UK Tax

On his Tax Policy Associates blog, Dan Neidle looked at the UK tax system.

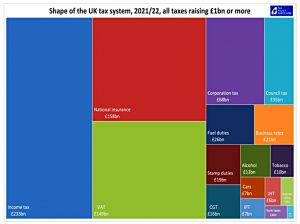

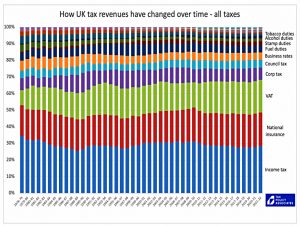

Here’s where the money comes from at the moment.

It hasn’t changed much over the last 40 years, though there’s been a slight shift from income to consumption (VAT).

- Corporation tax hasn’t been slashed, business rates aren’t high and council tax isn’t low.

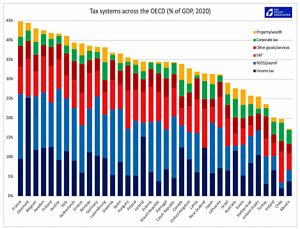

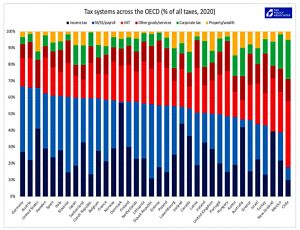

Compared to the rest of the OECD (rather than to its own history), the UK is currently a fairly low-tax country.

Normalising the regimes, we can see that the UK collects less from income and more from capital and land taxes.

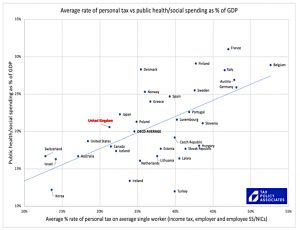

When we plot taxes against welfare spending, we can see that there are no countries to both the left of the UK (low taxes) and above it (high welfare spending).

- So we can’t improve welfare without increasing taxes, and we can’t cut taxes without cutting welfare.

The choice is between moving towards Korea, Switzerland, Australia and the US (which obviously gets my vote), or towards Belgium, France, Italy and Germany.

Hipgnosis

In the FT, Anna Nicolaou and Kaye Wiggins looked at the impact of higher interest rates on the rapid expansion of the Hipgnosis Songs Fund.

- Hipgnosis was launched by Merk Mercuradis (a former manager of pop stars) in 2018 and raised more than £1bn to consolidate back catalogues into a reliable income stream.

HSF has repeatedly tapped investors for cash to make new acquisitions, but it has since burnt through its funds and is unable to raise more because its stock price has fallen. Royalty revenues have fallen for the past two years and the cost of servicing its $600mn of debt is rising. It has not bought a new song for more than a year.

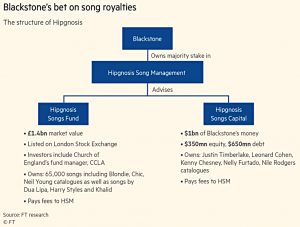

In October 2021, HSF added a new investor – PE group Blackstone.

Mercuriadis sold his private management company, The Family (Music), to Blackstone. The vehicle, which is paid advisory fees by the London-listed fund, was renamed Hipgnosis Songs Management. Blackstone also set up a $1bn fund to buy more song copyrights. The fund, called Hipgnosis Songs Capital, also pays fees to HSM.

HSF has used the fund to buy songs from Leonard Cohen, Justin Timberlake, Nile Rodgers, and Nelly Furtado, but the FT reports that HSF is now failing to complete purchases, potentially damaging industry relationships.

Mercuriadis said:

We have a fiduciary responsibility to our investors to always ensure our underwriting is accurate. Changes in interest rates has meant some deals have had to be underwritten again and re-priced. This is not unique to Hipgnosis or the music industry.

We believe in straight communication with the songwriters and we give them the actual facts. Our reputation in the songwriting community is based on actions not words. We have the trust of the songwriting community and are their preferred choice because we have made our success with them and not at their expense.

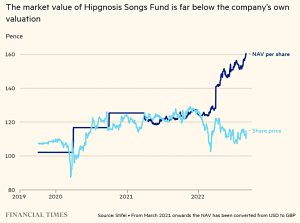

HSF needs to raise equity, but its share price is too low, trading well below NAV.

- Issuing new shares here would dilute existing investors and destroy value.

Rising interest rates have also made HSF’s 4.6% yield less attractive.

- To make things worse, the dividend is only 80% covered by revenues.

Whilst music streaming is growing, song revenues decay through the first six years after release, before stabilising.

HSF is exposed to newer songs: at the end of December, 43 per cent of revenues were generated by songs under 10 years old.

And the discount rate used to value HSF’s catalogue might rise next year to reflect rising interest rates (depressing valuations).

- That said, it’s already at 8.5%.

Soon after the FGT article, HSF announced a refinancing, including a cheaper five-year $700M credit facility and a reduction in its overdraft interest rates from 3.25% over SOFR to 2% over.

- Overall finance costs went down from 7% to 5%, and the debt facility was extended by 2.5 years.

Mercuriadis said:

In an increasingly unpredictable debt market, this deal materially reduces our interest margin and the swaps we hope to close imminently provide longterm certainty and a stable platform to take advantage of our industry’s tailwinds.

Less encouragingly, analyst Stifel suggested that the dividend is only covered at 0.6 times, and the valuation discount rate would need to rise.

Disclosure: I have a small position in HSF, and I am not entirely unconcerned.

Millionaires

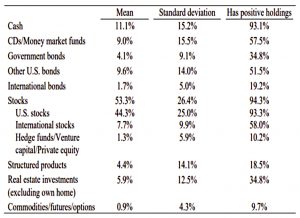

On Alpha Architect, Elisabetta Basilico looked at what is inside the portfolios of millionaires.

- The underlying paper looked at 2,500 investors from the US with at least $1M in investable assets.

They held a fair amount of stocks – 53%, with only 6% of investors having no stocks.

- Unfortunately, 82% of their stocks were from the US (home bias).

A worrying 12% held only one stock, and another 3% had more than 10% of their net worth in each of two or more stocks.

- 46% of investors believe that concentration would lead to higher returns, and 33% believe that it will lead to lower risk.

A large minority believe that value stocks are less risky than growth stocks, though half of these also think that value stocks have lower returns.

- Momentum was seen as risky and leading to lower returns.

Only 10% held alternatives (hedge funds, VC and/or PE) and for these investors, the average allocation was 13%.

- Around half had tried active (stock) investing, and most of these felt that past results were indicative of stock-picking skills.

When it comes to investing, it seems that (US) millionaires are not that different from regular people.

Cash rates

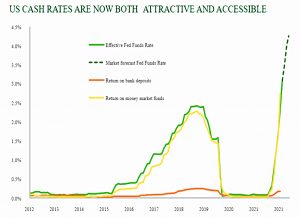

Steve Russell at Ruffer wondered whether rising interest rates might trigger a stampede out of risky assets.

Now there is an alternative. Not only is the official US Federal Funds Rate now in excess of 3%, but ordinary US investors can access similar interest rates.

And the rates available are likely to get better.

- When investors can access more than 4% pa (perhaps by the end of the year), this might prove irresistible.

The search for yield drove many investors to seek extra income by tying up funds in illiquid investments such as private equity and private debt. If there is a rush to shift money into safer yet higher yielding assets, only a small pool of liquid assets can be sold quickly.

Ruffer is very cautious, with stock allocations as low as just before the GFC in 2008.

Woodford

Hargreaves Lansdown has finally been dragged into the Woodford litigation.

- RGL management is the third firm to sue fund administrator Link over its handling of the wind-down of Woodford’s fund, but the first to also seek compensation from HL, which kept Woodfors’s fund on its best buy list until the suspension in 2019.

More than 130K HL clients were invested in the fund.

- RGL will argue that HL should have shared its concerns about the fund’s investments in unlisted firms with its clients.

This would have persuaded some investors not to but the fund, and others to sell.

Alexander Weinberg, a partner at RGL’s lawyers Wallace, said:

The RGL Group is resolute that both Hargreaves Lansdown and Link should be held accountable.

Mini budget reversal

As you will have heard, new chancellor Jeremy Hunt (( Not as new as new PM Rishi Sunak, and now possibly temporary and soon-to-be old chancellor Jeremy Hunt )) has reversed almost all of the tax changes from the recent “mini” Budget.

No longer happening are:

- the cut in corporation tax (already cancelled by Kwarteng)

- the cut to dividend tax rates

- the reversal of IR35 regulations

- VAT-free shopping for foreign visitors

- the freeze on alcohol duty

In addition, the energy price cap will now only apply universally for six months (until April 2023) and will be scaled back (“targeted”) from then.

All we have left are the abolition of the NIC increase and the derisory cuts to stamp duty.

- So it really was a “mini” budget after all.

Quick Links

I have just two for you this week:

- The Economist asked How much trouble is Mark Zuckerberg in?

- And Alpha Architect looked at The Effect of Indexing on Price Discovery and Limits to Arbitrage.

Until next time.

Interesting stuff on HSF.

FWIW, I never understood their business model!