Weekly Roundup, 22nd March 2021

We begin today’s Weekly Roundup with the eToro float.

Social Trading

Israeli fintech eToro has announced that it is to list on NASDAQ via a $900M SPAC deal – one of the largest of the year to date – with a shell company (sometimes known as a “blank cheque” company) run by Betsy Cohen.

- The deal includes $250M from the SPAC and values eToro at $10.4 bn.

There have been 258 Spacs worldwide in 2021, beating 2020’s then-record total of 256 in just 10 weeks.

I hadn’t come across Betsy before, but she has an impressive CV:

- She founded Jefferson Bank at age 32 and sold it for $370M.

- She was the second east coast female law professor after Notorious RBG.

Betsy founded The Bancorp in 1999 and chairs the FinTech Acquisition Corp, a sub-firm of which will be the SPAC in the deal.

- An additional $650M will be raised in the deal, from investors like Fidelity, Softbank Vision Fund 2, Third Point LLC, Wellington Management and Ion Investment Group.

eToro I know a little more about, as they were regulars at pre-Covid London investor shows.

- They were founded way back in 2007, and have 20M users globally (!) that have an average age of 34 and are 85% male

- In 2020, they added 5M users (up 275% year on year) and generated $605M in revenues, up 147%

- There were 75M trades on the platform in January 2021

There’s no information on whether eToro is profitable yet.

eToro were early movers in “commission-free” and fractional share trading in the UK, but I have never used them because they have a Cyprus licence and hence a non-UK compensation scheme.

- It also follows Trading 212 (which I do use, and has a UK licence) in blurring the boundaries between its stock-trading and CFD product lines.

eToro says that 85% of AUM is invested in real assets (rather than derivatives).

The rapid growth of the platform has resulted in outages, and the minimum capital required to open an account has been increased from $200 to $1,000.

- The minimum copy trade value has been increased to $500.

eToro were pioneers of social trading, where you follow other people’s trades automatically.

- I think this is an interesting idea, but it has never caught on with the demographic I would be interested in following.

After events this year with RobinHood, Gamestop and crypto (which eToro also offers), I think it’s unlikely that it ever will.

Yoni Assia, CEO of eToro, said:

We founded eToro with the vision of opening the global market for everyone to trade and invest in a simple and transparent way. We created a new category of wealth management – social investing – and we are dominating the market as evidenced by our rapid expansion.

Betsy said:

Fintech Masala, our sponsor platform, seeks out companies with outsized growth, effective controls and excellent management teams. In the last few years, eToro has solidified its position as the leading online social trading platform outside the US, outlined its plans for the U.S. market, and diversified its income streams. It is now at an inflection point of growth, and we believe eToro is exceptionally positioned to capitalise on this opportunity.

I’m not sure who the leading US social trading platform is at the moment – I thought eToro dominated this market globally.

$10 bn is a chunky valuation – more than double what was quoted late in 2020 when eToro’s intention to float was first reported.

- We can perhaps expect some product innovation post the IPO, though how much of this will make it across the Atlantic is unclear.

Lack of trust

In FT Adviser, Rob Higgens wrote about a survey from advice firm My Pension Expert which found that most people in Britain do not trust financial advisers.

- Not exactly earth-shattering news to most of us, but perhaps unwelcome to the IFAs who read this magazine.

Out of 2,000 respondents, 57 per cent did not trust financial advisers, but this rises to 65 per cent among those aged 55 and over.

More than one in four said that they had been pressured by an adviser into purchasing a financial product without fully understanding what it was, while 13 per cent had lost money having followed the recommendations of an adviser within the past year.

Three quarters of Britons also said independent financial advice was too expensive.

It’s possible that older people are more likely to have had a negative experience with an IFA – only 38% of respondents had used an IFA.

- Respondents also felt that advice was too expensive – they wanted more transparency on fees and preferred to use free online services.

More than three-quarters wanted harsher punishments for unethical advisers.

I’ve only used three IFAs in 37 years of investing, and always because I needed them to access or exit products that I couldn’t reach directly.

- You might also add two or three low-cost broker/platform hybrids which I typically used to access tax-shelters at low cost, and a couple of tied salesmen for insurance companies which I was forced to use in the 1980s and 1990s before deregulation.

Almost all of these eight people were a pleasure to deal with, but I never thought that I was getting value for money.

- The work they undertook was mostly helping me to fill in forms that I could have filled in without them.

Even today, IFAs seem to me to be set up to charge a lot of money for pretty basic investing advice which points you at boring solutions.

- Their training is in avoiding regulatory traps and client hand-holding so that you “stay the course”.

Perhaps they shouldn’t be too surprised that we don’t trust them.

Equal weighting

John Authers wrote a couple of times about Rob Arnott’s critique of the “big market delusion”.

When people get excited about future growth, they forget there will be losers. Thus, every company is priced not only on the basis that big disruptive change will happen, but that it will be the big winner.

This is what is happening in the electric vehicle space at the moment.

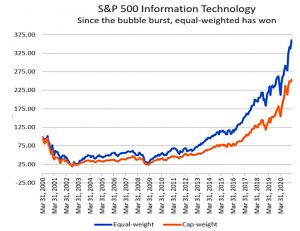

John looked at how much the top 30 firms in the S&P 500 IT sector had changed since the peak of the dot-com boom in March 2000.

- Prompted by a reader, he looked at the performance of an equally- weighted version of the index compared to the market-cap-weighted version.

The equal-weight version did very well, and beat the market cap-weighted version. The equal-weighted index has been ahead constantly throughout the last 21 years, with a strong tendency to do worse when markets are tense.

[And] you needed to sit on losses for more than a decade before breaking even. In absolute terms, buying at the top of a bubble wasn’t the greatest idea.

It’s possible that EV might work out in the long run (in aggregate) – but why buy when the valuations are so high?

Fund manager education

Joachim Klement looked at how education influences fund management style.

- A recent study compared those who graduated from the Universities of Chicago or Pennsylvania with those who went to NYU, UC Berkeley or Northwestern.

The former group were much more likely to have been taught the efficient markets hypothesis (EMH), based on its earlier adoption by those institutions.

The fund managers who were more exposed to the EMH tended to be less active in their portfolios and have a tracking error and active share that is about 10% lower than the average fund manager. Furthermore, the fund managers who have been more exposed to the EMH also had c. 25% more stocks in their portfolios.

The last point would help to explain the first two – the EMH group were being more index-like.

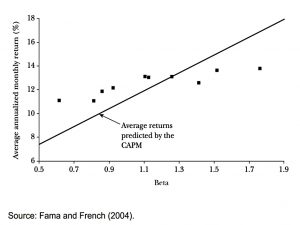

The EMH group also included more high-beta stocks, since according to the CAPM these should have higher returns.

- In practice, this relationship does not exist.

This led the EMH group of managers to underperform by 0.6% pa on average.

Quick Links

I have six for you this week, the first four from the Economist:

- The newspaper wrote about the return of one-to-one commerce

- And said that e-commerce profits may become harder to make.

- The Economist also said that America’s banks have too much cash

- And claimed that non-fungible tokens are useful, innovative and frothy.

- Alpha Architect wrote about conditional volatility targeting

- And explained how to predict stock returns using a simple model.

Until next time.