Weekly Roundup, 19th June 2018

We begin today’s Weekly Roundup in the FT, with The Chart That Tells A Story. This week it was about emerging markets’ popularity.

Contents

Emerging markets

It’s been another quiet week (apart from the World Cup), so it’s another short Roundup.

Kate Beioley reported on a spike in retail purchases of emerging market funds.

- It’s interesting timing – although EMs generally look cheap, a US-driven trade war could be negative for many EM countries.

Pensions frugality

Merryn wrote about a report from the IFS that suggests that pensioners are not spending enough.

- I’ll have more on this in a future post.

Apparently most people have 70% of what they started retirement with even at the age of 90.

- It seems people want to leave an inheritance, but Merryn isn’t in favour of this.

She thinks the problem is the decline (through lack of value for money) of annuities.

- She challenges the finance industry to come up with a product that provides some form of guaranteed income but doesn’t take away the investor’s capital.

This is a tricky one.

- I plan to increase my spending in retirement (my real retirement that is, once my partner has also retired) but I also plan to retain a big enough pot to fund that spending indefinitely.

Dying with nothing left in the bank is a laudable aim, but in practice it’s difficult to achieve when you don’t know the date of your death.

Floor area

Judith Evans reported that there are now no regions in which the average worker can afford to buy the average home.

- As you would expect, houses in London are the least affordable, but now even the North East is out of reach.

Londoners on the median salary can now only afford one-third of the average house, even with a 25% deposit.

I think we can expect new builds to become even smaller than they already are.

Buying opportunity

Eternal optimist Ken Fisher saw the Italian debt crisis as a buying opportunity for Italian stocks and for the rest of Southern Europe.

- 10 year Italian bond yields are the same as 10-year Treasuries, which means that the market is not worried.

- Italy’s debt maturity has risen to seven years, which means that short-term interest rates won’t impact debt service costs by much.

- Annual interest payments are less than 4% of Italian GDP, and only 14% of tax revenues (“a multi-generational low”

Trade war fears

John Authers looked at how markets have reacted to fears of a trade war.

- Prices of industrial metals – directly affected by Trump’s new tariffs – have fallen, as have the share prices of the companies that produce them.

But there has been no panic.

- The Vix is low and gold has not risen.

- Stocks are down for the week, but within a normal range.

But earnings growth of more than 20% in the US has not led to a new high since January.

- Instead, the market PE multiple has dropped from 20 to 17.4.

At the same time, US exporters have fared better than those companies more exposed to the US economy.

- And internationally, stocks with exposure to China are down less than those with exposure to developed markets.

The same is true since Trump was elected, not just since January.

So on balance, the markets don’t seem to be pricing in trade barriers and more difficult dealings with China.

Fed rate rises

The Economist looked at the consequences of likely Fed rate rises.

- The ratio of assets held across borders to world GDP has tripled since 1995, increasing the risk of feedback loops.

Correlations are at their highest levels for 130 years, particularly in equities, where the risk-on / risk-off regime still reigns.

Since most trade and FX reserves are dollar-denominated, the US has a particularly significant role.

The Fed must prioritise US economic conditions when setting policy, but changes in global risk appetite in response to Fed moves can feed back as changes in price of assets help by Americans, and change in the prospects for US exporters and multinationals.

- These in turn can influence Fed policy, closing the feedback loop.

The taper tantrum of 2013 is a good example.

- With interest rates outside the US at close to zero, the rest of the world is in poor shape to cope with a repeat.

Quick links

- The Times reported that equity crowdfunding platform CrowdCube is losing money.

- FT Adviser reported that the Lords is considering scrapping RPI, which is used to index many DB pensions.

- Using the lower (but more accurate) SPI would help companies with their deficits, but at the expense of pensioners.

- The same site reported that releasing £50K of equity from your home could end up costing you £133K.

- Money Observer reported calls (from accountants) for AIM stocks to be stripped of IHT relief.

- A new paper showed that housing subsidies push up property prices.

- David Stevenson wrote about a potential share-dealing price war.

- ERN looked at the reasons (good and bad) to invest in individual stocks rather than funds.

- Alpha Architect looked at the long-run returns from commodities.

- Enterprising investor looked at the same topic.

- Enterprising Investor also had an in-depth look at the Kelly Criterion.

- In the FT, Robin Wrigglesworth looked at volatility (old article that I missed back in April).

- Bloomberg reported that the tips from Hedge Funds are really just the stocks they are trying to get rid of.

- Wired looked at the hustlers in the cryptocurrency markets.

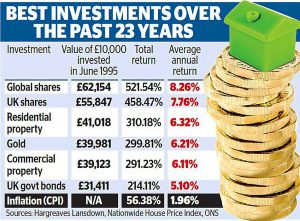

- And This is Money looked at the returns from property compared to stocks.

- Spoiler alert – stocks win.

Until next time.