Weekly Roundup, 2nd August 2021

We begin today’s Weekly Roundup with a look at carbon.

Carbon

The Economist had three articles on carbon.

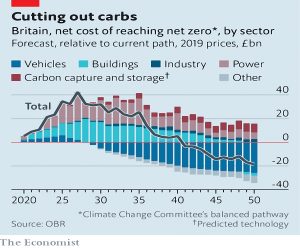

- The first looked at the very high costs of the UK getting to net-zero carbon emissions.

- Britain is one of only six countries to make a legal commitment to net-zero (125 others have said they will get there).

The IMF calculated in 2019 that letting climate change rip would cost 7% of global GDP by 2100.

- The UK’s OBR has now worked out that an unchallenged 4% rise in global temperatures would push up the UK’s borrowing from 100% of GDP now to 300% of GDP in 2100.

To reach net-zero, we need to spend £1.3 trn over 30 years, which will generate £991bn in savings.

- That’s a net spend of £321 bn.

Unfortunately, the spending comes before the saving – breakeven is reached in 2040.

- 2027 is the year of peak net spend.

Funding this should be interesting – the public is keen on green spending, but less so on new taxes to pay for it.

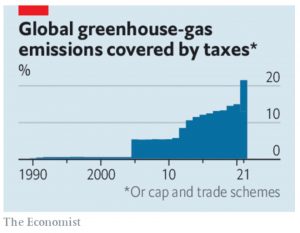

The second article looked at taxing carbon emissions; so did the third.

- Carbon taxes are a good way to tackle a classic externality, but like most things international, it helps if they apply everywhere.

Unfortunately, international coordination is very difficult.

- It’s interesting that the G20 has managed to cobble together a minimum corporate tax, but not a minimum carbon tax.

This month, the EC announced a tariff on carbon-intensive imports produced outside its own “cap and trade” carbon-pricing system.

- The goal is to stop EU firms from moving production to more pollution-friendly jurisdictions.

Unlike other tariffs, the Economist is in favour of these.

On to practicality: the EU will need to work out how much carbon has been emitted to produce something, and how much tax has been applied to these emissions.

- Good luck with that. The EU get out is to assume that no news is bad news:

Where the carbon intensity of a foreign producer’s processes cannot be estimated they will be assumed to be as dirty as the worst 10% of European companies.

House Crowd

I realise that this is old news, but in all this Covid/lockdown/vaccination blur, I missed the fact that House Crowd has fallen into administration.

House Crowd (HC) offered bridging and development finance loans to property developers through P2P.

- Investors were offered returns of up to 10% pa (with a claimed average return of 9.2%).

Founder Frazer Fearnhead was a fixture at the London investor shows a few years ago.

- He also appeared on Dragon’s Den – he didn’t get any investors, which is not surprising when he wanted £1M for 5% equity in HC.

HC got hold of my email address and mailed me regularly about their P2P property opportunities.

- They also raised money on the crowdfunding platform Seedrs.

I was never sold on property P2P, and I didn’t invest (in either sense).

The emails stopped before Covid got started and I forgot all about House Crowd.

- But it seems that they went into administration in February 2021.

The latest update on their loan book was in October 2019 (when the emails stopped).

- More than 25% of all loans since launch in 2013 had defaulted and 10.7% were in default at that time (even though HC didn’t class loans as in default for 180 days).

In November 2020, the last data update (minus loan book performance) was:

- 60,245 investors, 1,812 projects, £68.5M in loans, £8.6M in interest paid out

In 2019, HC was still claiming that no client money had been lost at that point.

- But property P2P doesn’t qualify for FSCS protection – even when held within an IF-ISA with a claimed 7% pa return – so it’s highly likely that client money has now been lost.

£52.7M in capital and interest is reported to be owed.

- 300 investors have formed an action group and ironically plan to raise money for possible litigation via crowdfunding.

Companies House (CH) data shows that Fearnhead took a £390K loan from HC.

- HC went into “voluntary requirement” measures with the FCA in 2020 after non-executive directors (NEDs) raised concerns about non-compliance with industry rules.

When the FCA offered to lift the measures, HC couldn’t raise the capital to recapitalise its balance sheet (even via Covid recovery loans).

- The NEDs then recommended administration.

Pension age

On Pensions Expert, Amy Austin reported that government plans to raise the normal minimum pension age (NMPA) from 55 to 57 will provide an opportunity to lock in access at age 55.

- However, the process involves a transfer.

Draft legislation will give individuals an opportunity to join a pension scheme by April 5 2023, where the scheme rules on February 11 2023 already state that the member has an unqualified right to take pension benefits below the age of 57.

The NMPA itself won’t increase until April 2028.

The “loophole” has its origins in protection for members of the police, firefighters and armed services.

- This protection was to be preserved even when members were block transferred to a new scheme.

So now the protection has been extended to individual transfers. Former pensions minister Steve Webb, now of LCP, said:

Today’s announcements provide a window for people to lock in to age 55 if they wish. Schemes that already have a right to access at 55 written into their rules will have this protected even after the 2028 change, and other savers may be able to join such schemes.

Pension savers should find out where their own scheme stands. If their scheme’s access age will rise to 57, they may wish to review where they hold their pension.

David Stevenson looked at the platform data from the white-label low-cost share-dealing platform DriveWealth (DW).

- DW is the underlying platform for Freetrade and Revolut in the UK.

They had a 20% increase in AUM for 2Q21, though trading volumes slowed from April.

- But the big message is the importance of fractional shares.

DriveWealth saw 95% of trades on the platform with a fractional component, showing how fundamentally important it is for retail investors to buy just dollars worth of stock to build a nest egg.

I’m pretty surprised by this – I actively avoid using fractional shares.

- But it chimes with a couple of YouTube videos I saw recently from some of my fellow UK money bloggers.

These guys are running example portfolios on Freetrade (( Presumably in the hope of driving affiliate signups which win them free shares )) that are sized in the hundreds of pounds.

David concludes:

Sure low cost or free dealing is important but being able to own parts of an expensive share is almost as important – it’s the silent revolution that is powering the democratisation of investing.

I agree, but I wouldn’t describe it as democratisation.

- What we have is a lot of fairly young, fairly poor people being drawn into trading individual shares before it is appropriate for them.

But what do I know, perhaps it will all end well.

Crypto

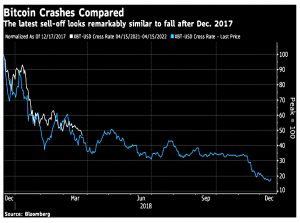

John Authers took a rare look at bitcoin, comparing the 2021 crash with the sell-off in early 2018:

Like me, John is impressed by bitcoin’s ability to bounce back from at least four crashes of 70%, but:

Its descent from a recent peak has followed exactly the same path so far. It’s always tempting to look for patterns where there are none. But bitcoin’s history rhymes so strongly that it’s hard to dismiss as coincidental.

Inflation

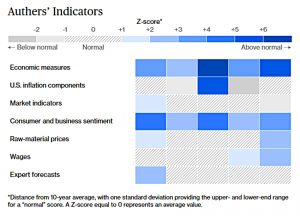

John has also been tracking inflation, via 35 numbers he calls Authers’ Indicators.

- In the heat map below, more blue means more inflationary.

The map is now as grey as it’s been since John put the indicators together a few months ago.

The good news, if the market is to be believed, is that we can forget about the inflation scare. The bad news is that it might also be time to abandon hopes for a strong reopening and economic recovery from the pandemic.

While the row of official inflation data is ugly, the highest in decades, the market indicators are shading gray. As far as the bond market is concerned, the inflationary picture is actually less worrying than it has been for most of the last 10 years.

Consumer and business sentiment remains inflationary, which could become a self-fulfilling prophecy.

- But economists are no longer worried.

Quick Links

I have just three for you this week, the first two from The Economist:

- The newspaper reported that Facebook is eyeing a future beyond social media

- And that real Treasury yields are plumbing the depths.

- Alpha Architect looked at the benefits of sin stocks.

Until next time.

The Bloomberg summary article about Authers’ Indicators makes interesting reading. Maybe it is just me, but using 35 metrics to track one number seems a bit OTT! Furthermore, the US CPI is in many ways really a bit of a mongrel measure.