Weekly Roundup, 22nd May 2018

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about renting.

Renting

It’s another quiet week I’m afraid, and so it’s another short Roundup.

James Pickford reported that the average length of a tenancy had risen to 4.3 years in 2015/16, up from 3.5 years in 2010/11.

- The initial agreement usually still covers six months or a year, though.

Labour has promised to make three-year tenancies the norm (not to mention introducing rent caps, which will reduce supply).

- The Tories have said that they support 3-year tenancies on new-build rentals.

The idea is to make renting more suitable for families tied to schools and jobs.

- But if the average tenancy is already longer than that, will these proposals make much difference?

Pensions cash-in

Josephine Cumbo reported that the amount of money transferred out of final salary pension schemes more than doubled last year, to £21 bn.

- In 2016, “only” £8 bn was removed.

- The number of transfers went up from 61K to 92K.

This increase doesn’t surprise me, as I looked at my own potential transfer only last week.

- Spoiler alert – I plan to take the transfer money.

Transfer values are high at the moment because of low interest rates, and you can usually get your hands on the money sooner.

- The average transfer value for £10,000 of income transferred at age 64 is currently £232K.

The trade off is that you lose longevity insurance – if you live to a great age you need to make sure that you can provide yourself with an income.

- But problems like that are far off in the future and won’t concern most people.

Hedging

Kate Beioley reported that currency-hedged funds underperform non-hedged funds.

- This is another not-so-surprising result – FX is a zero-sum game, and hedging introduces an additional cost to the fund.

In the short-term of course, the movement of sterling against the currency in question will be key.

I’ve never been a fan of hedging, as I assume the effect of FX will be neutral in the long-run.

- And in the short-run, it’s usually too unpredictable to worry about (central bank actions like QE or QT can sometimes make things more predictable).

Matching your assets to your liabilities is a better strategy.

- See Some Home Bias is Okay for more detail.

The argument against hedging extends to insurance products in general.

Indexing

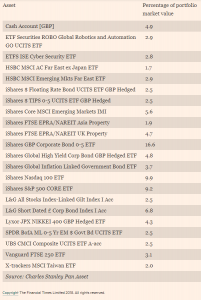

John Redwood gave another update on the portfolio he runs for the FT.

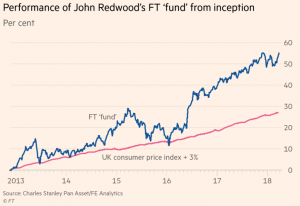

This time he included a performance chart as well as the list of funds.

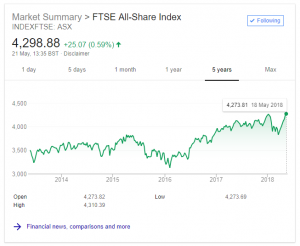

Annoyingly the chart only shows the benchmark of CPI + 3% pa, so here’s the FTSE All Share for comparison.

The ASX is up around 20% over five years, but probably more like 40% if dividends are reinvested.

- Which means it’s neck and neck with the Redwood fund.

John wrote about index funds in general.

- He likes their simplicity, and sees them as a momentum play, investing in success and automatically dropping losers.

This is a subject I will return to in a future post.

John also wrote about the Nasdaq.

- He’s sticking with tech stocks for now.

Corbyn watch

The Economist had an article about how a Corbyn government would change Britain.

- They think that proposals to “democratise” the economy are more radical than its fiscal and monetary ideas.

They appear to have dropped their plan for “people’s QE” (printing money to fund government investment).

- And their proposal to add an unemployment target to the Bank of England’s mandate is reasonable.

- Though with unemployment so low already, it would have little impact at the moment.

But their tax plans (increases in corporation tax and income tax above £70K pa) will be counter-productive, as will the rent controls we mentioned above.

- They also plan to increase spending by £45 bn a year, just as the deficit has been eradicated.

The biggest plan of all is to reverse the move made by Thatcher towards individualism and self-reliance.

- McDonnell has described individualism as offering only “the illusion of control”.

Labour want to bring back collectivism, using the work of Karl Polanyi (a “moral” economist) as a model.

- Polanyi believed that capitalism leads to spiritual and moral decline – that greed corrupts.

Market exchange and self-interest need to be replaced by reciprocity, honour and loyalty.

- In practice this means more power for workers (unions) and less for finance, without regard to the impact on GDP, living standards or unemployment.

It also means a lot of nationalisation – water, electricity, gas and railways.

- But the newly nationalised industries would be run on a local level, rather than nationally.

And worker-controlled firms (co-ops) would be promoted by offers of finance from central government.

- Co-ops find it hard to raise money as they can’t issue shares and normal banks are wary of them.

Workers would also have first refusal on any company that was sold.

The Economist might be sympathetic, but it all sounds like a return to the 1970s to me.

- And I hope we never have to live through that decade again.

Once again, I have no Twitter pics.

- My fondness for the platform seems to have disappeared.

Until next time.