Weekly Roundup, 1st October 2019

We begin today’s Weekly Roundup in the FT with Merryn Somerset Webb, who was talking about the cost of death.

Contents

Death

It was another quiet week in the financial press.

Merryn began by pointing out that the IHT take is increasing.

- 28K estates (4.6% of the total) paid an average of £179K in tax

She also recommended that we sort out our wills during Free Wills Month (October).

- Without one, even spouses get only £250K plus 50% of the rest – the remainder goes to children or other relatives.

- I’m not married, so my situation is even worse.

She also talked about our online legacies.

- In the US there are firms that will clean things up for you, but they haven’t made it here yet.

Financial advisers

Amy Austin reported that seven out of ten financial advisors think they are responsible for making sure that their client’s investments are suitable (rather than the product providers or the clients themselves).

- That might sound caring, but it’s actually a bit sinister.

Nearly two-thirds also thought that clients should not be able to open a Sipp without taking advice first.

- Or to put it another way, without paying them a fee first.

Eight in ten also called for a list of prohibited Sipp investments.

- Caveat Emptor works fine for me, thanks.

Lemons

The Economist revisited an old paper on the economics of used car sales – The Market for Lemons by George Akerlof (1970).

- In such a market, the sellers know more than the buyers (whether the car is a lemon with defects, rather than a reliable peach).

The uncertainty makes buyers give lower offers, which reduces the number of sellers.

- So the market can dry up, or it can become impossible to sell a peach for what it is worth.

The resale of tech goods is much the same, and insurance and education are also similar markets.

Now Richard Blundell from UCL has looked at the car market in Denmark.

- The lemons penalty in year 1 is 18%, falling to between 2% and 5% after three years.

By year nine, there is no lemons penalty, perhaps because defects are obvious by then.

100-year bonds

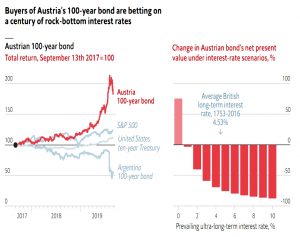

The newspaper also looked at the Austrian 100-year bond, which has delivered stunning returns (75% since 2017 from a 2.1% coupon).

- If interest rates rise, the price will crash, but the Economist reckons that most buyers won’t live long enough to regret it.

In the last two years, German 10-year bund yields have dropped from 0.4% to -0.6%, driving buyers to the Austrian bond (which currently yields 0.9%).

- Another 1.1% drop in long-term yields and the Austrian bond would double in price from here.

It’s worth noting however that 100-years before the bond was issued, Austria still had an empire.

- And a similar 100-year bond from Argentina is down 55% over the past two years.

Corbyn watch

Even Tim Harford is worried about a Corbyn government and in particular, the plan to offer private tenants a right to buy at a discount.

Who would be a landlord, if the act of letting out a house incurred the obligation to sell it? The entire private rental market would collapse.

Just because the idea would hurt landlords does not mean it would help tenants.

Long term returns

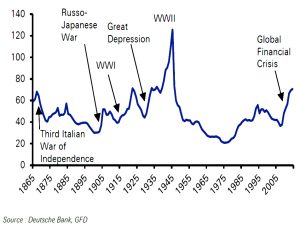

In his Bloomberg column, John Authers looked at the annual Long-Term Asset Return Study from Deutsche Bank (DB).

- He expects financial repression, helicopter money and poor returns from bonds.

Debt to GDP (12 developed countries) usually runs at half of GDP, unless there is a war to fund.

- The 2008 crisis changed that, with a bigger impact than anything other than WW2.

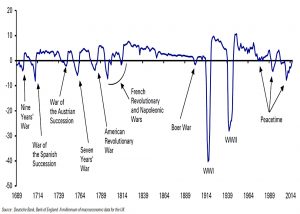

UK deficits tell a similar story.

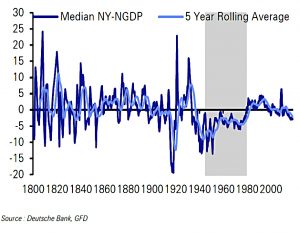

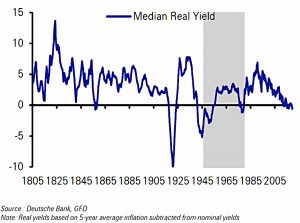

Nominal yields tend to match nominal GDP growth (15-country median).

- Less than this means lending at a loss or financial repression.

John expects another seven years of negative rates, again worse than anything other than WW2.

Negative real yields are also usually the result of war, and their effects are eased by inflation.

- But there’s not much sign of inflation at the moment.

DB predicts that a lot of long-term government debt will be issued – perhaps even “zero-coupon perpetuals”.

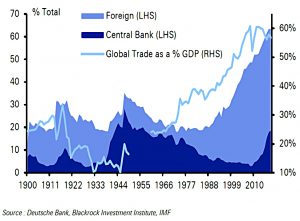

John also worries that a reversal of globalisation will mean there are no more foreign buyers of these bonds, which could put prices into reverse

- He suggests that the long-term case for commodities is strengthening.

DB themselves warn about government spending and higher inflation and yields:

Infrastructure (tech -ed) and green investment may give even the most prudent of countries the political cover to spend. So higher debt, higher inflation, higher nominal GDP, higher yields, and higher central bank balance sheets.

Overvalued stocks

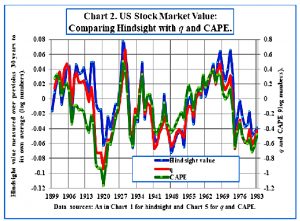

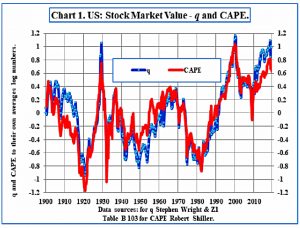

In a second column, John looked at stock valuations.

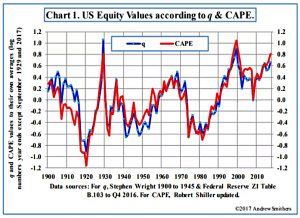

- Tobin’s q and the Shiller CAPE are both good long-term (10 years plus – they are no use for short-term timing) predictors of stock returns.

They are both based on fundamentals (growth, earnings, assets and so on).

- So what happens when the definitions used in the fundamentals change?

- And does the rise of intangibles (brands and tech IP) invalidate this approach?

The National Income and Product Account (NIPA) numbers in q’s denominator have been revised recently.

- This means that non-financial US companies have a net worth that is lower by 58%.

Which means in turn that q now shows US stocks to be more overvalued than does the CAPE.

- q now shows non-financial stocks to be overvalued by 167%

Here’s the chart from before the revisions, for comparison.

Cynics (or bulls) would argue that the fact that such substantial revisions are possible means that the measure is not very useful.

- But its historical track-record would suggest otherwise.

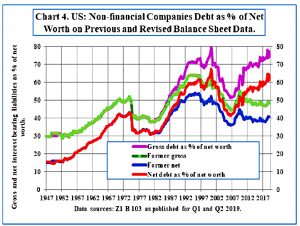

The NIPA revisions also mean that US corporates have more debt than previously thought.

- Levels are now close to the post-war high of the dot-com boom.

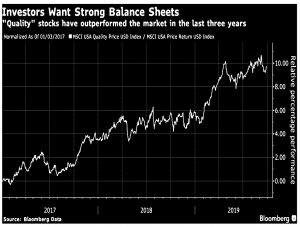

This is reflected in fund manager surveys showing a preference that cash-flows be used to clean up balance sheets, and in the strong recent outperformance of quality stocks (with less debt).

Emerging markets are gold are the suggested safe havens against a bear market and credit underperformance.

Quick links

I have just five for you this week:

- The FT looked at Shell’s search for a purpose beyond oil

- The Economist looked at the headwinds facing Netflix and HBO

- Alpha Architect wrote about the Short Duration premium

- ERN gave his thoughts on the “upcoming recession”, and

- Flirting with Models looked at Trend Following Active Returns.

Until next time.