Weekly Roundup, 23rd January 2023

We begin today’s Weekly Roundup with inflation.

Inflation

The Economist wondered whether Europe would end up with worse inflation than America.

Since October, core inflation in the euro zone has been higher than in America. Post-pandemic supply disruptions, fiscal splurges, an energy shock and labour shortages have created a near-perfect storm causing prices to soar. How fast inflation comes down may therefore depend not only on what central banks do.

Covid has also impacted lifestyles, and there have been massive government commitments to green tech and net zero.

- Moving workers around will generally inflate salaries, and even more in recessions, (( Or times when people fear a recession )) when people don’t want to move.

During Covid, Europe used furlough schemes whereas the US mailed out stimulus cheques, leading to a durable goods boom.

- Running the economy hot should have helped with the reallocation of workers and capital, and therefore inflation might come down faster.

Europe has also had more in the way of supply crunches (particularly energy).

- But these impacts should subside, helping Europe more than the US.

The issue is whether inflation is entrenched:

Inflation gets baked into economies when workers and firms come to believe that prices will keep rising. In the worst-case scenario, this creates a wage-price spiral, with workers and firms unable to agree on a division of the economic pie.

The US has an advantage here, with more flexible labour markets and less union input to wage-bargaining.

- US wage growth is already coming down.

Sixty per cent of European workers have collective pay bargaining and deals lasting more than a year mean that wages take time to adjust.

- This slower pace of change was good when inflation got started, but it’s a problem now.

Geometric returns

On his substack, Joachim Klement stressed the importance of geometric returns.

He illustrates this by comparing two assets:

Investment A might have a return of 10% in the first year and 10% in the second year. Investment B has a return of -50% in the first year and 70% in the second year. The average annual return is still 10%.

But A returns $121 after two years whilst B returns only $85.

Investment B has volatile returns and that costs you money over time because you have to dig yourself out of a hole (aka a bear market) from time to time.

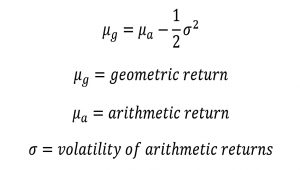

This issue is known as volatility drag. (( And it’s why leveraged ETFs don’t track their benchmarks very well )) Here’s the maths:

The higher the volatility of an investment, the more it acts as a drag on the geometric return. This is why diversification is so powerful.

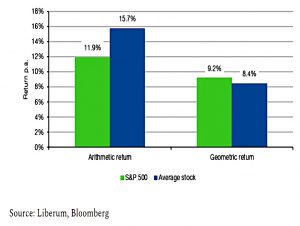

Joachim calculated the arithmetic and geometric returns for each stock in the S&P 500 index, and for the index itself, over the last five years.

If you had randomly picked one stock in the S&P 500 your average annual return would have been 15.7% compared to 11.9% for the S&P 500. Your compound return over five years would have been 8.4% compared to 9.2% for the S&P 500. The reason is that the volatility of the S&P 500 was 24% vs. 37% for the average stock.

Joachim takes particular aim at Cathie Wood’s ARKK Innovation fund:

The Fund over the last five years had a volatility that was roughly twice as high as the volatility of the S&P 500. That means that the fund needed to achieve returns that are roughly 1.5x as high to have the same compound return (some 18.4% to be precise).

Unfortunately, the average annual arithmetic return of the ARKK fund was 8.3% – even investors who have been with the fund through good and bad times are now worse off than with a boring S&P 500 fund.

Bitcoin is even worse, with 3.8x the volatility of the S&P 500.

The average annual return of Bitcoin needs to be about 30% per year to make it break even with the S&P 500.

Geometric returns are what matter, so slow and steady (low volatility) is the way to go.

China

In Ruffer’s Green Line newsletter, Jamie Dannhauser looked at the likely impact of China’s reopening.

- The consensus view is for short-term disruption followed by a mini-boom in 2Q23.

Jamie thinks there could be more disruption than expected.

For most of the past three years, China’s goods economy has been shielded from covid by continued lockdowns and restrictions. But in the coming weeks, lots of people won’t make their factory shifts. China’s reopening will fan the inflationary

flames, just as we saw in the West.

And even if the subsequent rebound drives a risk-on environment, central banks are likely to respond.

Until inflation pressures subside dramatically, good news on the economy will probably be bad news for risk assets.

And even if inflation comes down, will central banks start to cut, or will they just hold steady in the hope of getting closer to their 2% targets?

eToro

On his Adventurous Investor substack, David Stevenson reported that eToro has launched a value investors basket.

- I have a small eToro account, which I opened for crypto access and for social trading functions.

These revolve around copy trading – you call follow the trades of other investors or sign up for baskets of investors, known as copy portfolios or smart portfolios.

These consist of baskets of shares based on copying the trades of successful investors, be they on the platform [or] off the platform.

The new one is called Value Gurus, which eToro describes as:

A portfolio offering retail investors long-term exposure to the companies cherry picked by influential financial personalities who choose value investing.

This boils down to analysing 13F filings. For eToro, Dani Brinker said:

13F filings provide additional transparency on the stocks chosen by the leading mutual and hedge funds. We used 13F data to create a fully managed portfolio that provides them exposure to what the best in finance are buying.

The portfolio has 10 stocks to start with and will be rebalanced every quarter according to systematic rules (it’s not a discretionary fund).

I agree with David that this is an interesting idea.

- There are a few ETFs with this philosophy, but platforms should have more flexibility to innovate.

Premium bonds

We reported a few weeks ago on the increase in the Premium Bond prize pool to an average of 3% pa.

- But a new analysis (( Sent to me by Hargreaves Lansdown but under licence from The Telegraph and actually commissioned by the Family Building Society )) shows that the odds of winning a prize remain the same as when the rate was 2.2%, at 24,000 to one (per bond, per month).

There are 24M holders of Premium Bonds, but 60% of them will win annual prizes lower than the headline 3% rate.

- The odds are even worse for those holding the maximum £50K in bonds – their odds of hitting 3% in prizes are just 36%.

And the chances of winning the £1M jackpot are lower than when the prize rate was 1.4% during 2022, since there are still only two jackpots per month, and the number of accounts has increased since then.

- Someone with the maximum holding would wait an average of 69,000 years to win the jackpot.

It would take 12 years to win a £1K prize and 248 years to win a £10K bonus.

- 25% of prizes are for £25, with another 58% made up of £50 and £100 wins.

Crypto

Fresh from his “rehabilitation tour” of newspaper interviews, TV shows and investment conferences, SBF has beaten me to starting a substack.

Amongst his claims (( Hat-tip to Milk Road and CoinMarketCap here )) are:

- FTX could have repaid its customers if he had been allowed to accept new funding rather than being pressured into bankruptcy by lawyers.

- He also said that his personal Robinhood stock (sized by the Feds) should be used to “make customers whole”.

- He didn’t steal any money (“I certainly didn’t stash away billions”.

- He hadn’t been involved in running Alameda for a few years.

- But he did own 90% of Alameda and used its accounts to “prove” his billionaire status to Forbes magazine.

- The US part of FTX is solvent, as it was kept separate from the international division.

- He claims he handed over $350M in cash to the new (bankruptcy specialist) CEO.

- And he implied that the new CEO should have repaid customers of FTX US by now.

- He blames Changpeng Zhao from Binance for bringing down FTX.

He also asked for financial support for his new blog at a modest $8/month (presumably for legal fees).

- I’m not clear which of his former customers would be minded to do that.

And I’m not clear how his allowed to do this PR work in advance of his trial.

Quick Links

I have five for you this week, the first three from The Economist:

- The newspaper looked Disney at 100 – its business is on a rollercoaster ride

- And said that Disney’s troubles show how technology has changed the business of culture

- The Economist also looked at Venture capital’s $300bn question

- Alpha Architect wrote about Mitigating Risks with Factor Strategies

- And UK Dividend Stocks provided their FTSE 250 CAPE Valuation and Forecast for 2023.

Until next time.