Weekly Roundup, 10th July 2018

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about people leaving London.

Contents

Leaving London

Lucy Warwick-Ching reported that more people are leaving London that at any time since 2011 (when records began).

- Apparently people are leaving because of house prices (though I don’t think that anybody asked them.

Of course, the population of London is still increasing because of immigration and births.

- There are 8.8M people here now, up from 8.1M in 2001.

From a personal perspective, there are around 50% more people in the city than when I arrived, way back in 1986.

- This has good sides and bad sides, or course.

I’m afraid it’s another ropey chart from the FT.

- One year of data and Scotland listed alongside English cities and towns.

I sometimes wonder whether the weekend FT has anything to do with the daily paper.

- Also, look at the places that people are moving to.

The only group of UK movers with net positive migration to London are those in their twenties.

- Which is kind of how it’s always been.

Everyone I knew at college moved to London.

- Those who didn’t make it then moved out in their late twenties / early thirties.

Come on FT, let’s have some more interesting charts.

Taxing robots

Tim Harford’s column was about taxing robots.

- Last week he wrote about the pros and cons of a universal basic income versus a jobs guarantee.

In response, he got a lot of suggestions that such measures could be funded by taxing the robots taking the jobs.

- On reflection, Tim regrets using the words robots and jobs.

That isn’t how automation happens.

- Rather, individual tasks are automated.

Tim talks about the invention of the spreadsheet (at a time when I was already old enough to vote, remarkably).

- A lot of low-level accounting jobs disappeared fairly quickly, but even more jobs for more sophisticated types of accounting replaced them.

As accounting became more efficient, productivity increased and accountancy services became cheaper.

- Hence demand for them increased.

So the first problem is identifying the robot, and the second is identifying the job that it has replaced.

- Tim notes that he has never needed a secretary / assistant, since he can use email, internet search and a mobile phone for himself.

Should I have to pay the never-employed secretary’s tax bill, because I own a smartphone?

Which is the third problem.

- If you tax the productivity gains, you’ll get less of them.

Tax them to a level of the notional jobs displaced, and you get none at all.

- You bring us back to we started, and progress comes to a stop.

Basic income

Sticking with the territory, The Economist gave Guy Standing (( Sitting down in the picture, it’s an old internet joke )) space to push the idea of basic income.

- For Guy, it’s not about robots stealing jobs, it’s a moral issue.

Guy is one of those chaps who believes that wealth was created by all our forefathers and therefore belongs to us all.

There are two big problems with this:

- It wasn’t created equally by all of our forefathers, and untangling who did what might prove tricky.

- If only there were some way to make sure that the money was passed to the right people, like say inheritance.

- Giving people money for nothing (and especially, taking money from the most productive in order to fund this), will remove incentives.

- Incentives are my second favourite thing (after property rights), so that’s obviously not a good idea.

Guy disagrees explicitly on incentives, but then his idea of what constitutes work is rather broader than mine.

I think that it’s something you’d rather not do, where someone else calls the shots, but you do it anyway because you need the cash.

- Who cleans the toilets and collects the rubbish in a world of basic income?

Guy also believes that a basic income is affordable, but it isn’t.

There’s are other words for what Guy calls “social justice” – communism, or perhaps theft.

You need a plan

Back in the FT, Jason Butler thinks that you need a plan so that you don’t run out of money in the future.

- I agree – see here for more details.

Prospectuses

Andy Bounds reported that the threshold above which you need a prospectus to target retail investors for funds is rising to €8M (£7.1M).

- The current limit is €5M and the increase is driven by the EU.

- Five years ago the EU agreed to a €20M threshold, but further talks have watered this down.

A prospectus can cost £500K to produce, so this is a useful boost for crowd-funders and IPOs in the €5 to €8M range (still a little small for my taste).

- Apparently the average crowdfunding deal now raises £4.9M.

Indexing

Back in the Economist, Buttonwood looked at whether index funds have made markets less efficient.

- Index funds were only invented in 1975, so they’ve made remarkable progress.

I’m not a signed up member of the cult, but I do think that they (especially in the form of ETFs) are useful products.

- They are a safe and cheap way for inexperienced investors to do pretty well without much effort (or indeed thought).

Unfortunately, the theory behind indexing is based on the efficient markets hypothesis, which I reject.

- I don’t think it’s that hard to beat the index (particularly in your home market) using factor investing, trend-following and good portfolio management.

The real question is whether you think that it’s worth the effort given than indexing should be good enough for most investors.

The article looks at the idea that if everyone just buys the index, mispricing opportunities – that stockpickers can take advantage of – should increase.

- I think this is true in a factor sense, rather than a stock-picking sense.

Rob Arnott has shown that the market cap basis of index construction leads to companies being bought when they are overpriced and sold when they are underpriced.

- Alternately-weighted indices outperform by 2% pa.

The Economist sees things differently – by displacing the worst (losing) stock-pickers, index funds will have mad markets more efficient.

- Of course, since markets are zero sum, taking away the worst stock-pickers merely creates net loser from others who might previously have been profitable.

The article points out that in a static market, index funds have no need to chase winners, since they already hold them.

- But Arnott’s point about the mechanics of index construction holds.

And the increasing popularity of index funds means that there is always new money to chase the likely overpriced stocks higher.

- Of course, in the absence of index funds, this money might chase hot active managers, to similar effect.

So the risk of bubbles has probably not increased, and could even have fallen.

I think that if passive investing ever reached 80% or 90% of assets, we might see some strange market gyrations.

- But we aren’t there yet.

Pensions tax

To the FT once more, where Josephine Cumbo reported that HMRC won’t be changing the way that they tax people like me.

- I take an annual lump sum from my pension using UFPLS.

HMRC assume that I will be taking the same amount (close to £60K in my case) every month, and apply emergency tax.

- I reclaim this at the end of the tax year through self-assessment (though I think there is a process for getting the money back more quickly).

HMRC have concluded that any changes:

Would not significantly improve the tax position for the majority of recipients.

The existing PAYE treatment of flexible pension drawdowns remains the most effective method of deducting tax in these cases, and it reduces the risk of underpayments of tax arising.

I find this comment baffling – even switching to regular taxation (assuming a basic personal allowance) would be a massive step forward.

- HMRC seem to be going out of their way to penalise users of UFPLS.

They seem to think that we all have lots of other income sources, and that we won’t be filling in a self-assessment.

Pensions tax relief

In the Times, Philip Aldrick reported that a flat-rate income-tax relief rate for pension contributions was back on the cards.

- A 25% rate would raise £4bn a year towards new funding commitments for the NHS.

At one point, a 30% rate was mooted, but recent calculations suggest that 28% is the break-even point for the government.

I’m not against this move, since I think poorer people need more encouragement to save for the future.

- It would discourage higher rate taxpayers, but so long as relief is higher than basic rate, the incentive to put money aside for a lower-tax retirement remains.

Of course, this is easy for me to say, since I’ve already made my pension contributions.

Pensioner taxes

On to some more pension tax proposals, this time slightly more bonkers.

- In the Guardian, Philip Inman wants to squeeze rich pensioners.

He has three proposals:

- Make working pensioners pay NI.

- Charge pensioners more in tax, by subjecting them to different tax bands.

- Philip wants the 40% rate to start at £20K (less than the country’s average wage) and the 45% band to start at £40K.

- A new property tax regime.

(He’s not against a care tax, either, but he doesn’t specify that this should be paid by pensioners alone).

Philip is (wrongly) angry about occupational (DB) pensions and property wealth, and his scheme is just crazy talk.

First, it’s too vague:

- What’s a pensioner?

- Someone past state pension age (SPA), someone with a DB pension, or someone drawing from their SIPP, like me?

- People without DB pensions have already been punished by falling interest rates and falling annuity rates – their pension pots will buy less than half the income they expected 25 years ago.

- And I already pay NI on my earnings, since I’m nine years short of my SPA.

- What is income?

- Money taken from ISAs (which was taxed already on the way in), 25% of money from SIPPs and cash from VCTs and EIS schemes are specifically protected from income tax.

- Does Philip plan to repeal all these regulations?

- What’s the new property tax?

- There are no details at all here.

Second, it’s immoral.

- Pensioners have contributed to NI for decades (I already have more than forty years of contributions, but not enough for a full state pension) in good faith.

- I think NI contributions should end when you have enough for a full pension, not at the SPA.

- And I can’t pass up the opportunity to remind us all that the UK state pension is extremely mean – at around one third of average earnings.

- The same principle applies to income tax and property taxes.

- I’ve paid so much tax already (largely under tougher tax regimes than exist today) that’s it’s just not possible for me to end up as a net taker from the system (though NHS treatment and the state pension, for example).

- The real problem is the large increase in the number of people who rarely contribute, thanks to the massive extension of welfare (largely under Gordon Brown).

- You can’t just change the rules of a game halfway through to penalise the people who are winning.

- Age-based tax rules are discriminatory, plain and simple.

- Why not tax men more, or white people, since both groups tend to have more money.

Third, it won’t work.

- People like me would immediately be off to somewhere where our spending power is better appreciated.

- Others would delay retirement (and the onset of higher tax rates) by working part-time “bullshit jobs”.

A comfortable retirement after decades of work should be seen as a reasonable and admirable aspiration.

- The minority of rich pensioners have nothing to be ashamed of.

Wealth in retirement primarily reflects deferred consumption, something which we should encourage more people to pursue.

- It’s very hard these days for me to understand why I read the Guardian every day for forty-five years.

Three facts

Let’s try to end on a cheerier note.

Bill Gates asked Max Roser from Our World in Data (based at Oxford University) to give him three facts that were worth committing to memory.

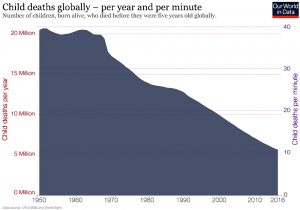

Up first was the dramatic fall in child deaths:

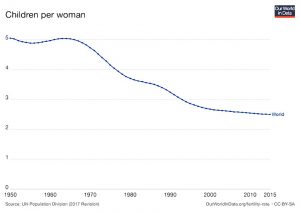

Next was the fall in fertility rates to manageable levels:

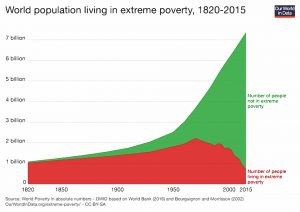

Third was the fall in extreme poverty:

Not stuff you would pick up from watching the nightly news.

Quick links

I don’t have so many this week.

- Over on the Collaborative Fund website, Morgan Housel gave us his Little Money Rules.

- UK Value Investor valued the UK Stock Market, and gave a forecast of its future level.

- Alpha Architect looked at the Beta Anomaly (what I call the Low Vol Premium).

- And NewFound Thinking looked at The New Glide Path.

- They have incorporated trend following into traditional stock / bond solutions to sequencing risk.

Until next time.