Weekly Roundup, 30th January 2023

We begin today’s Weekly Roundup with equal weighting.

Contents

Equal weighting

Joachim Klement looked at why equally weighted portfolios work so well. There are several possible explanations:

- Joachim believes that our inability to forecast future returns makes them the safest bet

- But they might provide systematic exposure to outperformance factors such as the size effect

- Equal-weight portfolios have a small-cap bias relative to market-weighted portfolios; they also have a value bias.

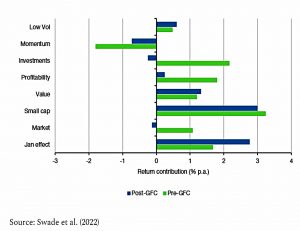

A new paper (from the UK) looks at the factor exposure of equal-0weiughted portfolios in more detail.

- The biggest contributor is the size effect, followed by the January effect, and then value, investment and profitability.

The only consistently negative (relative) contribution is momentum, which a market-weighted portfolio contains more of.

There are also differences since the 2008 crisis when interest rates and growth became lower.

- Depending on whether think higher rates are here to stay, or low rates will return, you might prefer one set of exposures to the other.

Small-cap and value should work in either case.

Stockpickers

Buttonwood reported that 2022 was a (rare) good year for active investors – 62% of active fund managers investing in US large caps beat the S&P 500.

This is not the usual result:

Every year from 2010 to 2021, more than half of active managers who benchmarked their performance against the S&P500 failed to beat it.

This poor performance explains the drift to passive investing – passive funds now account for 43% of AUM for US investment firms.

- More of the US market is now owned by passive funds than by active funds.

The explanation is simple – investing is a zero-sum game (for one investor to beat the index, another must lose out) so the higher fees of active funds represent an insurmountable hurdle for these funds (in aggregate).

- More specifically for 2022, the easy bet was to avoid big tech.

At the start of 2022, Alphabet, Amazon, Apple, Microsoft and Tesla accounted for nearly a quarter of the total market capitalisation of the S&P500. Their collective value dropped by 38% over the year; that of the rest of the index dropped by just 15%.

There was also a more general switch from growth to value as the era of cheap money came to an end.

- And in a volatile year for the markets, hedge funds and trend-following also outperformed.

UK stock market

In The Telegraph, Matt Oliver (( I couldn’t find a picture )) reported that the UK stock market is no longer seen as a must-own asset after a “breathtaking” fall from grace over the last 25 years.

- The judgement comes from The Investor Forum which includes fund managers like Blackrock, Aviva, UBS and the Norway sovereign fund.

They said that UK regulators need to do more to attract investment. Executive Director Andy Griffiths said:

It is crucial that the focus of any reform recognises the global nature of financing and seeks to create an environment in which UK listed companies can once again thrive.

We cannot simply hope for a better outcome – practical steps are needed from companies, investors and regulators if we are to create a vibrant marketplace which can attract international capital.

Institutional investors were accused of “box-ticking” and “grandstanding” over topics like the environment and executive pay.

Hipgnosis

In the Investors Chronicle, Bearbull looked at the Hipgnosis Songs Fund (SONG), which owns the publishing rights to more than 65K songs.

- The share price has fallen from a peak of 126p in early 2021 to 87p – a fall of 30% and a huge 48% discount to the net asset value (NAV).

One explanation for the discount is the gap between the fund’s estimate of NAV and a standard accounting approach.

The IFRS treatment writes off the cost of Hipgnosis’s catalogue over 20 years whereas Hipgnosis doesn’t write it off. In the year to March 2022,that meant an amortisation charge of $106mn (about £88mn), leading to cumulative amortisation of $200mn.

There is some logic to a long write-off period these days – the Beatle’s early albums are now 60 years old, and SONG just paid $150M for Neil Young’s catalogue (he is 77).

- SONG also adds a $457M credit to revalue the catalogue to “fair value”, which SONG wraps up as “operative NAV”.

Another factor driving down the share price is the recent rise in interest rates.

- The song royalties are a future income stream and the higher discount rate means a lower present value.

SONG’s valuer has not changed their discount rate from 8.5%, which is admittedly much higher than the 3.5% rate on 10-year Treasuries.

One telling point made by Bearbull concerns the low level of streaming platform royalties.

- Depending on the platform, it would take between 12 and 86 years for the catalogue to earn back the current share price.

On this version of PE, the fund looks expensive even after recent falls.

- But of course, the streaming market could grow.

Corporate tax

In the FT, Stuart Kirk argued that the only logical corporate tax rate is zero.

Wages and thus income tax receipts would adjust upward. So too money flowing into government coffers from bigger dividends and capital gains. People would spend more with consumption taxes yielding higher revenues.

Since the current government is committed to raising corporation tax, I can’t see this happening here in the UK, but luckily, Stuart says that investors needn’t worry.

When governments raise the burden on firms, what happens? Either the return to investors is reduced in the form of lower dividends or capital appreciation. Or a company can increase the prices customers pay for its goods or services. Or it pays less to suppliers — merely shifting the pain on to their employees, investors and suppliers. Or wages can be cut or employees laid off.

None of these sound good, but:

BMO Capital Markets have looked at the past five tax hikes in the US, going back to 1945. The average return of the S&P 500 in the calendar year of each raise was 13 per cent, with no negative readings. By contrast, on the seven occasions corporate taxes were lowered, the average return was 5 per cent.

Long-term effects are similar – returns from periods where corporate tax was below 35% are the same as from those when it was above 50%.

- This is partly because companies share the pain with employees and customers, but also because other things have a bigger effect.

Economic growth, competition, technological change, strategy, input prices and so on simply matter more.

Big Mac

The Economist looked at the impact of inflation on its Big Max index of fair value FX rates.

In America, the median price of a Big Mac has risen by more than 6% to an

average of $5.36 in the past two years. Big Mac prices have risen by 14% over the past two years in the euro area and by 15% in Britain.

These differentials reflect the 9% increase in the trade-weighted exchange rate for the dollar.

- But it’s not the same story everywhere.

Two years ago, the Big Mac was 26% cheaper in Japan than America. In principle, this suggests the yen was undervalued and should have risen against the dollar. In fact, the opposite occurred. A Big Mac is now more than 40% cheaper in Japan.

A contrasting “win” for the index is Argentina, where the currency has fallen and the Big Mac price has risen (compared with neighbouring Brazil, for example).

Exodus

In the Spectator, Martin Vander Weyer noted an exodus of millionaires from the UK – 12,000 have left since 2017.

It’s pretty obvious why. If tax is your top concern, a tightening of non-dom rules and the near-certain prospect of a Keir Starmer government abolishing non-dom status altogether would loom large.

I wonder if all of them were foreigners, though.

In the FT, Martin Sandbu reported on a similar migration of Norwegian billionaires, in response to an increase in the annual wealth tax, from 0.85% to 1.1%.

- There’s a derisory €150K tax-free allowance that won’t make much difference to the rich.

Pension transfer values

In FT Advisor, Amy Austin told us that pension transfer values fell by a third in 2022.

- Rises in gilt yields pushed the index down 36%.

And of course, lower valuations led to fewer transfers – 44 per 10,000 vs 62 per 10,000 in 2021.

Mark Barlow from XPS Pensions (who compile the index) said:

Transfer values have plummeted over the last year, which will be a cause of concern for many members. It makes access to high quality support and advice more important than ever before members make potentially irreversible decisions that could impact their retirement. However, it’s reassuring that, as yet, we have not seen a sustained trend of more members transferring due to cost-of-living pressures.

XPS also reported more transfers being tagged as potential scams:

- 87% of transfers had at least one red flag, up from 52% in 2021.

The rules have been tightened, with all overseas investments now raising a flag.

Premium bonds

Premium bond rates have gone up again, to 3.15% from February.

- This is the highest rate for more than 14 years, and the total monthly prize pot (made up of close to 5M prizes) now comes to £314M.

The prize rate has now more than doubled in just four months.

The odds of winning a prize remain the same (1 in 24K) since the increase comes from more prizes between £50 and £100K, rather than more prizes in total.

- The number of £50 and £100 prizes is going up by 10%

- And prizes between £500 and £100K will increase by around 5%

But there are still only two jackpot prizes of £1M each month.

Quick Links

I have four for you this week, the first three from The Economist:

- The newspaper explained How the world economy could avoid a recession

- And asked How will Satya Nadella handle Microsoft’s ChatGPT moment?

- And wondered Can Amazon deliver again?

- Flirting With Models looked at Rebalance Timing Luck in options.

Until next time.