Irregular Roundup, 27th June 2023

We begin today’s Weekly Roundup with inflation.

Contents

UK inflation

The headline UK inflation rate stayed at 8.7% pa for the year to the end of May, and even worse, core inflation (which excludes the volatile elements of energy, food, alcohol and tobacco) went up from 6.8% to 7.1%.

- Headline inflation had been expected to fall back to 8.4%, and this is the highest core reading since March 1992.

The main risers were air travel, recreational and culture and second-hand cars.

- The main fallers were energy, food and non-alcoholic drinks.

The move from food and energy inflation into services is particularly concerning, suggesting that a wage-price spiral could become a reality.

- Fixing that could mean higher rates for longer, which in turn could lead to a recession in the UK.

After the announcement, there was speculation that the Bank of England might raise UK interest rates by 0.5% this month, rather than the previously expected 0.25%.

- And so it proved.

Markets are pricing in rates of 6% by year-end (up from 4.5% on the day of the inflation figures).

Chancellor Jeremy Hunt said:

Today’s figures strengthen the case for the Government to stick to its guns. We won’t be pushed off course, because we need to squeeze every last drop of high inflation out of the economy.

If you look at what’s happening in other countries, you can see that rises in interest rates do bring down inflation over time. That will happen here but we need to be patient, we need to stick to the course and then we’ll get to the other side.

Inflation and markets

The Economist looked at the impact of inflation on financial markets.

In the real economy, inflation corrodes trust by continually and arbitrarily redistributing wealth. In the financial one this corrosive dynamic is less obvious, but just as real.

Whether we will ever get back to the official target of 2% inflation is one matter.

- Lots of people think that a new (implicit) target of 3% to 4% is more likely.

Unfavourable demographics, fragile supply chains and increases spending on defence, climate change and welfare (including healthcare) mean that getting to 2% would require interest rates so high that the damage to the economy would not be acceptable.

Look back at the past century and you will struggle to find an instance of inflation rising as far as it did in 2022, then immediately coming back under control. The trade-offs required to get it there look nightmarish.

So what would the extra 2% mean?

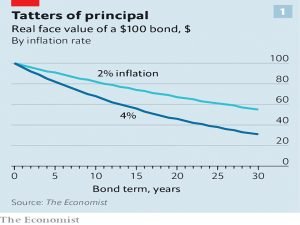

Buy a ten-year government bond when inflation is 2%, and the principal that is eventually returned will be worth 82% of its original value. When inflation is 4%, that figure falls to 68%. The principal on a 30-year bond will, when returned, be worth 55% of its original value if inflation averages 2% over that time. With 4% inflation, it will be worth 31%.

In addition, higher inflation means higher future bond yields in anticipation of higher interest rates, which means lower bond prices.

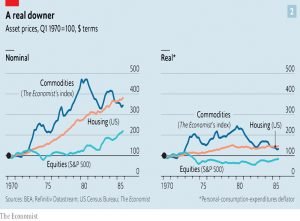

Stocks do better with higher inflation, in the long run.

- But higher inflation rates tend to be more volatile, which is hard for businesses to handle.

Between 1900 and 2022, in years in which inflation rose above around 7.5%, the average real return on equities flipped from positive to negative.

Real assets (property, infrastructure and commodities) do better.

Property and infrastructure generate income streams, in the form of rents and usage charges, that can often be raised in line with inflation. In years of above-average inflation, the excess real return of a diversified portfolio of commodity futures over cash has averaged 11.4%.

But these are smaller markets than bonds and stocks, and more difficult to invest in.

The real winners from prolonged higher inflation are governments, who will see the value of their enormous debts eroded.

- But as bond returns drop, institutional investors will scrutinise government fiscal policy.

Emerging-market countries are used to this treatment, but for the rich world, the adjustment would be painful. Governments that lose the trust of lenders are in for a rough ride.

Chat GPT forecasting

Joachim Klement looked at AI forecasting.

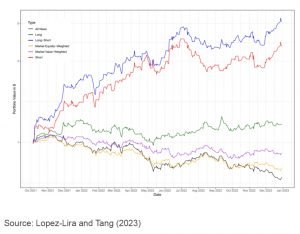

Alejandro Lopez-Lira and Yuehua Tang asked chatGPT to pretend it is a financial analyst and rate if a given news item about a stock is positive, negative or uncertain.

They then built long portfolios of stocks with good scores and short portfolios of those with bad scores and held them for a day.

- GPT-1 and GPT-2 could not outperform the market, but GPT-3 and GPT-4 did.

In the chart, the black line is an equal-weight portfolio (a version of market returns).

- The green line is the long portfolio and the red line is the short portfolio.

Best of all is the blue line – the long-short portfolio. But:

The chart shows returns for a daily strategy without transaction costs. I presume transaction costs will be so large as to kill any outperformance.

The real takeaway is that GPT-4 is a lot better than GPT-1.

- By the time GPT-8 rolls around, we might have outperformance that survives transaction costs.

David Stevenson reported on an HMRC investigation into the use of fractional shares in ISAs.

- I don’t use fractional shares myself, but a lot of investors with smaller accounts on platforms like Freetrade and Trading 212 use them to access US shares which are particularly expensive (for example, BRK and GOOG until recently).

There are also some UK ETFs and ITs with similar issues.

A Freetrade spokesman said:

We are of the view that the current Isa rules do not prohibit fractional shares from being held in an Isa. We have engaged with the Government on this and welcome an open dialogue with HMRC.

More established UK platforms like HL and AJ Bell don’t offer fractional shares because they think that the trust structure used by the low-cost platforms isn’t supported by the 1998 ISA regulations.

Tom Selby, of AJ Bell said:

Existing legislation prevents Isa investors holding fractional shares. While there is an argument for amending these rules, as things stand anyone holding fractional shares within their Isa is at risk of being hit with a penalty from HMRC.

It now appears that HMRC takes the same view. A report in the Telegraph quotes an HMRC spokesman:

It is HMRC’s view that “shares” as referred to in those regulations, relates only to whole shares and not parts thereof, therefore fractional shares cannot be held in an ISA.

If they enforce this view, then gains on these fractional shares would potentially be taxable.

- There’s also a read-across to robo-advisors like Nutmeg which use fractional ETFs in their portfolios.

David is not impressed with HMRC:

‘By the letter of the law’ would mean that ordinary private investors looking to buy into US shares would be severely disadvantaged. The cynic in me wonders whether this is all part of some cunning ruse to make Brits buymore British shares and thus make the London stock market seem more successful.

But he concedes that as with most things, stupidity is a more likely explanation than conspiracy.

There is already a default assumption at the FCA that there needs to be a paternalistic steer on investing, that private investors are vulnerable and need constant protection. I slightly struggle to understand why we still don’t have any London-listed trackers for [crypto] markets.

He thinks that the regulators want to herd private investors into “mainstream funds run by established asset managers the regulators can carefully manage and supervise”.

- I tend to agree.

Premium bonds

NS&I is raising the Premium Bond prize fund to 3.7% from July – the sixth hike in just over a year.

- This is the highest rate in 15 years and equates to an extra £39M in prizes.

Dax Harkins, NS&I CEO, said:

We’re expecting to pay out more than £374 million to winners in July with more higher-value prizes, meaning that, each month, more lives will be changed by Premium Bonds.

The overall odds of winning for each bond remain slim (at 1 in 24,000) since the increase will be achieved by converting £25 prizes into wind between £50 and £100K.

- The odds of winning £1M won’t change, either.

VCTs

The economic secretary Andrew Griffiths refused to commit to extending the sunset clause for VCTs (and EIS/SEIS) whilst giving evidence to the Treasury committee earlier this month.

- The schemes are currently due to expire in 2025, which unfortunately coincides with the next general election.

The sunset clause was created as a sop to EU rules on state aid and has no reason to exist post-Brexit.

Griffith said:

It is the nature of parliament that we do not bind our successors any more than we absolutely need to to give people that certainty [that the schemes will continue until April 5th 2025]. I am happy to reaffirm today my belief that these schemes work well for the British economy, they work well for taxpayer fairness.

It might be a good idea to buy as many VCTs as practical over the next two tax years.

IHT

IHT receipts for the first two months of the new tax year reached £1.2bn, up by £100M on the same period last year.

- As fiscal drag pulls more people into the IHT net, the Office of Budget Responsibility forecasts that IHT receipts will hit £8.4 bn in 2027/28.

The government will come under pressure to reduce or abolish IHT in the run-up to the next election, but at the same time, it’s turning into a nice little earner.

Quick Links

I have eleven for you this week:

- The Economist warned that Britain’s economy may grow by more than expected, but inflation is stickier

- And that Blocking the Microsoft-Activision deal would harm consumers

- And explained How Britain can become an AI superpower

- And How to make Britain’s AI dreams a reality

- And Why self-storage is turning into hot property

- Mauldin Economics said that the Fed had done A Skip, Not a Stop

- The Investors Chronicle asked Is Andrew Bailey the biggest obstacle to lower inflation?

- Alpha Architect said that in Long-Only Value Investing: Size Doesn’t Matter

- And looked at Intangible Value: Modernizing the Factor Portfolio

- And Fundamentals and the Attenuation of Anomalies

- And Improving Performance by Avoiding Negatives of Index Replication

Until next time.