Weekly Roundup, 29th June 2020

We begin today’s Weekly Roundup with the sad story of the Robinhood suicide.

Contents

Robinhood

A 20-year-old Robinhood trader (Alex Kearns) committed suicide after being shown a spurious $730K negative balance in his account (related to the asynchronous settlement of matched option trades – probably a bull put spread).

- It’s impossible to know what is in the mind of someone who kills themselves, but the case still raises important questions.

The knee-jerk reaction is to blame leverage.

- I’m not one for banning things, but it would probably be desirable to limit available leverage in proportion to net worth.

The problem is in how to implement this (how to establish net worth, for example).

And in this particular case, absolute leverage wasn’t the main issue.

- Kearns didn’t really owe $730K, he just had “negative buying power” on the platform until the other side of his trade was closed.

This was essentially a (tragic) user-interface error.

Robinhood hasn’t launched in the UK yet, and the free trading platforms that do exist (Freetrade and Trading212 are the two that I use) don’t support options trading.

- Nor will Robinhood when it launches here.

Most UK private investors access options through spread betting.

- Since MIFID II, retail investors can’t lose more money than they stake, whatever leverage they use on an individual trade.

So let’s not think about banning free trading platforms, which – used correctly – could be a great help to private investors.

Robinhood said that it is looking at making adjustments around multi-leg option exercise and assignment.

- The user interface is also likely to change, with the “buying power” number shown to Kearns de-emphasised.

The company also said it would donate $250K to the American Foundation for Suicide Prevention.

Wirecard

The Economist (amongst others) looked at the Wirecard scandal.

- Their main point was that it showed the benefits of allowing short-selling.

The firm has admitted a €1.9 bn hole in its accounts and has begun an insolvency process.

- It’s CEO first quit and then was arrested and charged with false accounting and market manipulation.

The share price is down more than 80% over the past few days, and with deserting customers and no real franchise or cashflow, equity holders will probably end up with nothing.

Short sellers detected the bad smell around the firm some years ago, but regulators and investors bought the growth story.

- The German regulator even specifically banned short-selling of only Wirecard stock at one point and began a criminal case against journalists.

Meanwhile, sell-side analysts maintained buy recommendations right up to Markus Braun’s resignation.

- And Ernst and Young (EY) – the firm’s auditor – now face significant reputational damage.

On a personal note, the withdrawal of Wirecard’s permissions on Friday 26th June meant that the Curve card I use most days stopped working.

- But it was back in action by Monday 29th June.

I find Curve very useful, but the moral with all things financial is to always have more than one way of achieving your goal.

Commercial property

The Economist also looked at whether Covid-19 might mark the end of the investment world’s love affair with commercial property.

- Lots of rental payments are being withheld, and the split of future pain between landlords and tenants remains unresolved.

Landlords themselves don’t attract much public sympathy, but a lot of commercial property investing is done by pension funds and insurance companies.

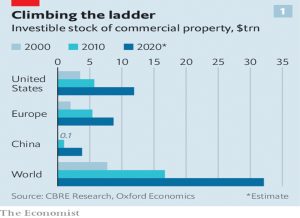

- The global commercial property stock has quadrupled since 2000 (to $23 trn), and one-third of this is held by institutional investors.

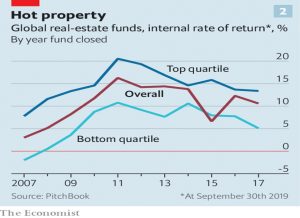

Allocations to real estate have increased over the last decade.

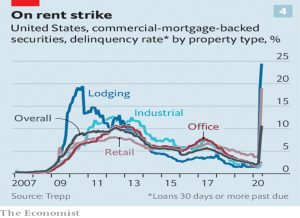

And with rents being withheld, delinquency rates on commercial-mortgage-backed securities (CMBSs) have now passed the levels from the 2008 crisis.

The future looks uncertain – the move to online shopping means that department stores and malls, in particular, could be in trouble.

- But things look far from rosy for restaurants and hotels, too.

Office space is probably the big question mark – some people like working from home, others miss the social side of the office.

- Data centres and storage and distribution (logistics) facilities probably have the rosiest futures.

The good news is that banks look better placed than in 2008 to weather the downturn.

- The bad news is that a lot of property-backed debt will need refinancing over the next five years.

Private equity firms are likely to be the big winners, at the expense of pension funds and insurers.

Dot com

Buttonwood wondered whether the dot com boom and bust (now 20 years in the past) is behind the moral authority assumed by value investing.

- On that occasion, value (low price to assets/profits) proved a better guide than “eyeballs”, page views and “engagement”.

But since 2007 – and low interest rates and tech dominance – value has suffered.

Buttonwood speculates that without dot com, more small tech firms would have reached IPO rather than sell out to a tech giant.

- But the real question is whether – or if – the current incumbents will ever have their network effects and scale economies overturned.

Economies and Stock Markets

Joachim Klement looked at the differences between stock markets and economies.

- This is good timing since stock markets have almost recovered from the March crash, whereas the prospects for developed economies look pretty bad in the immediate future.

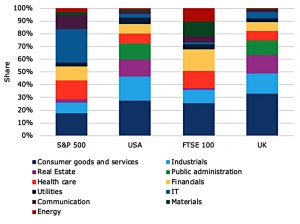

One good reason for the difference is sector composition.

IT, financials, and health care are massively overrepresented in the stock markets. On the other end of the spectrum is the property market. Industrials and consumer goods and services are also massively underrepresented.

The GDP of the United States and the UK look remarkably similar, but the two stock markets don’t.

So propping up the stock market need not boost the economy, and vice versa.

- Infrastructure spending can boost the economy. but government spending on welfare and health probably won’t.

Joachim characterises this as a left/right split between those who want to help the most people and those who want to help the overall economy.

- He examines this further by comparing wage and consumer inflation.

Within the economy, a given industry will represent one weight in the employment (wages) figures, and another in the consumption (inflation) numbers.

Over the last couple of years the industries that contributed very little to consumer baskets experienced large wage increases and the industries that contributed a lot experienced low wage inflation.

As a result, wage inflation rose, but wage inflation with consumer price weights declined.

First impressions

Over on Disciplined Systematic Global Macro Views, Mark Rzepczynski wrote about First Impression Bias.

Analysts who have a positive (negative) first impression will have optimistic (pessimistic) future forecasts. Firms that have higher positive first impressions will have higher target prices and more likely “buy” recommendations.

There is a U-shaped relationship with events. There is emphasis on first impressions and then an emphasis on more recent events. Negative impressions last longer than positive impressions.

Mark suspects that this bias also applied to investors looking at fund managers.

- And I would suggest that it applies to companies too (as a kind of precursor to the endowment effect).

Triple lock

Amidst renewed calls to end the triple-lock on the UK’s State Pension, Katherine Denham reminded us in the Times that it remains the lowest state pension in the OECD.

- We payout 28% of the average wage, compared to an OECD average of 59%, and an EU average of 64%.

The UK also spends a smaller proportion of GDP on pensioner benefits.

- We spend 5%, but Greece, France, Italy, Portugal, Austria and Finland all spend more than 10%.

So the triple lock should stay for now, because it hasn’t done its job of bringing the UK State Pension up to a level where people can rely on it in retirement.

Quick Links

I have seven for you this week, the first four from The Economist:

- The newspaper claimed that live-streaming will change rock’n’roll for the better

- And that Covid-19 is good for Bordeaux wines

- They also reported that the advertising business is becoming less cyclical and more concentrated

- And that the pandemic has accelerated the growth of e-sports

- Alpha Architect looked at whether statistics can be used to determine whether managers have no skill

- UK Value Investor showed how to find quality companies producing consistent and sustainable growth

- And Flirting with Models looked at Option-Based Trend Following.

Until next time.