Weekly Roundup, 22nd November 2021

We begin today’s Weekly Roundup with inflation.

Contents

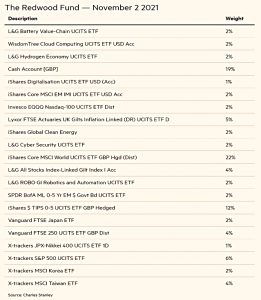

Redwood

John Redwood wrote that one thing that was not in short supply was inflation.

In Germany, it has hit 4.5 per cent, Spain 5.5 per cent, the US 5.4 per cent and in Brazil more than 10 per cent.

The culprits are disrupted supply chains and chip and energy shortages, plus a hot jobs market after months of stimulus cheques.

There are three questions:

- how high will it get?

- how long will it last?

- and what – if anything – will central banks do about it?

As a disbeliever in the central bank forecasts, I cut out the longer dated bonds in the portfolio and replaced them with short-dated inflation linked Treasury bonds and more cash. I feared inflation might prove livelier than the central bankers

estimated.

There are signs that some central banks are refocusing on inflation rather than recovery, but only the peripheral ones:

We have seen interest rate rises in South Korea, New Zealand and Norway of 0.25

per cent on their low levels; and increases to 7.75 per cent in Brazil, 1.8 per cent in

Hungary, 4.75 per cent in Mexico and 7.5 per cent in Russia.

The Fed, ECB and BoE are all holding firm for now – but they are making conciliatory noises.

- So John is not making any changes to his portfolio.

Moderate inflation is not too damaging to shares. Trying to stop inflation too rapidly would cause harm and would require protective action.

Pricing power

The Economist noted that the stock market likes companies that can pass on costs to their customers – those firms with pricing power.

Warren Buffett has described it as “the single most important decision in evaluating a business”. When hit with an unexpected expense, firms without pricing power are forced to cut costs, boost productivity or simply absorb the costs through lower profit margins.

There seem to be plenty of companies with the power about at the moment – the article cites McDonald’s, PepsiCo, Procter & Gamble, Hilton, Chipotle, Starbucks, Levi Strauss, GlaxoSmithKline and Estée Lauder.

Of the S&P 500 companies that have reported third-quarter results, over three-quarters beat projections. Mentions of “price” or “pricing” in American earnings calls increased by 79% in the third quarter from a year earlier.

Another indicator is the purchasing-managers index.

A gap between input and output price inflation is typically interpreted as a sign that firms are struggling to raise prices and that margins are being squeezed. That isn’t happening yet.

Investors can spot pricing power by looking for fat and steady profit margins.

- Such companies also tend to be bigger and have greater market share.

A “pricing-power score” for companies in the s&p 1500 compiled by UBS is based on four indicators: mark-up, market share, and the volatility and skew of profit margins.

Not surprisingly, sectors vary a lot.

Firms providing consumer staples, communication services and it have the most pricing power and that energy, financial and materials companies have the least.

Companies with pricing power have better profit growth (since 2010) and better returns, particularly when inflation is high.

- They have lagged over the past year, possibly because margins remain generally hgih.

When they shrink, firms with pricing power should do better.

Cash

Buttonwood looked at the attractions of cash.

Cash is a safe asset, but a wasting one. The real returns on risky assets have been much greater.

On the other hand, cash offers optionality – in particular, you can buy stocks when they are cheap (after a market crash).

- But it rarely offers a return above inflation, and it certainly doesn’t at present.

More and more capital is tied up in investments where much of the payoff lies in the distant future. You see this in the tech companies in America and in the money flooding into private-equity and venture-capital funds. Investors have to wait ever longer to get their money back.

The further away a return is, the less it is worth today.

- And this shrinkage effect increases with higher interest rates (discount rates).

Buttonwood approaches this through the concept of duration, borrowed from bonds.

Duration takes into account that some of what is due to bondholders—the annual interest, or “coupon”— is paid out sooner than the principal, which is handed over when the bond matures. The longer you have to wait for coupon and principal payments, the longer the duration.

And the longer the duration, the greater the sensitivity to interest rates.

- For stocks, PE acts as a crude measure of duration – it’s an indicator of how many years it will take the company to earn back the money you paid for it.

And as we all know, the Schiller CAPE has only been higher during the dot com boom of 2000.

- Similarly, real long-term interest rates are as low as they have ever been.

So long-duration assets are vulnerable, and this includes stocks and property (which is highly valued relative to future rents).

The only problem, as we said at the start, is that cash is a low-return asset that will drag down portfolio returns.

So be it. Missing out on some returns is the price you pay for mitigating duration risk.

Over 50s don’t like robos

A survey of 1,000 UK adults aged over 50 (by fintech Visible Capital, but which I saw on the Financial Planning Today website) has found that 82% would not take financial advice from a robo-advisor.

- 88% would not be prepared to give the robo details of their finances.

38% of respondents were able to access financial advice from a human (an IFA or accountant), though it’s not clear what proportion was actively doing so.

- Previous surveys have found that very few people use IFAs (usually less than 10% from memory).

This survey found that 15% used online services for advice (though advice is not easy to define).

Some other results from the study were:

- 60% that they had relied more on technology during the pandemic

- 20% trusted technology less coming out of the pandemic

- 60% were comfortable with technology

- 84% were using online services for general banking

- 52% for insurance

- 44% for savings and investments

- 64% for payments and transfers

- 55% manage credit cards digitally

So it’s advice rather than technology that the oldsters are shunning.

Ross Laurie, CEO of Visible Capital, said:

A large proportion of respondents are happy using digital resources for managing their savings and ISAs, yet when it comes to financial advice they were less keen to use a robo-adviser. Trust is a major factor here.

There is an opportunity now for financial advice firms to steal a march on the market by taking the trusted face-to-face advice format and combining it with technology

to deliver a hybrid service.

I’m not convinced of that myself.

Crypto nudge

HMRC is sending out nudge letters to UK individuals that it believes have held crypto-assets (and might therefore owe some CGT).

- If your records are in order and you only have crypto gains from 2020/21, these letters are nothing to worry about – you just need to repor6t your gains on your annual return – in the same way that you would account for gains in a taxable stock account.

If you have gains from previous tax years, you could start with the HMRC voluntary disclosure facility.

- The letters are not – at this stage – the start of investigations/enquiries into the tax affairs of individuals, but if HMRC thinks that you have crypto gains and you don’t report any, you might reasonably expect another letter next year (volumes permitting).

I haven’t received a letter myself, though I did come across a draft of the format on reddit. The letter begins:

We have information that indicates you hold, or have held, investments in cryptoassets (also known as cryptocurrency). If you dispose of cryptoassets, you may have to pay Capital Gains Tax (CGT).

You make a disposal of cryptoassets whenever you:

- Sell cryptoassets for fiat currency (eg; USD, or GBP). Gains from these transactions are taxable, even if the money you make is not ‘withdrawn’ from the cryptoasset exchange.

- Exchange one cryptoasset for another, for example Bitcoin to Ether. You must pay CGT on these gains, even if you haven’t converted your cryptoassets back to fiat currency.

- Use cryptoassets to buy goods or services.

You must pay CGT if your total gains arising from all disposals in a tax year are over the annual exempt amount. For the tax year 2020 to 2021, this was £12,300. This allowance is not exclusive to cryptoassets, it also covers any disposal of other assets, such as shares, or property.

Pension age

The government seems to be making a mess of its plans to increase the normal minimum pension age (NMPA) from 55 to 57.

- This is the age at which you can access a private pension, and the long-standing intention of the government has been to keep this age set at 10 years below the state pension age (SPA).

So when the SPA moved up from 65 to 67, we waited for a corresponding move in the NMPA, which has now arrived.

- The plan is to increase the NMPA to 57 in 2028.

The problem is that some existing schemes have a “protected pension age” of 55 written into them.

- For such schemes, an increase in the NMPA would make no difference.

Even worse, a transfer window allowed people to move non-protected pensions into protected schemes until April 2023.

- After warnings that such transfers would leave people vulnerable to scammers, the government has now closed the transfer window with zero notice (though transfers already in progress will be allowed to complete).

Anyone with an unprotected pension is now locked out from accessing it at 55 and is perhaps unhappy about this.

- Some savers will have multiple pots, some of which can be accessed from age 55 and others that can’t be touched until age 57.

In a separate announcement, the Department for Work and Pensions has said that from December, trustees will be able to pause/block pension transfers if they suspect fraud.

- They can also raise an “amber flag” which required the member to prove that they have taken scam guidance from the Money and Pensions Service.

A High Court case in 2016 had ruled that members could transfer pensions against the wishes of the current scheme.

Transfers to master trusts, CDC schemes and funded public sector schemes will be exempt from the new rules as ‘safe destinations’.

Musk’s tweets

Elon Musk has been troll-tweeting once more.

- He ran a Twitter poll to decide whether he should sell 10% of his Tesla holdings so that he would be forced to pay capital gains tax (he takes the minimum wage as salary).

The Democrats have floated the ludicrous idea that unrealised capital gains are a form of tax avoidance, and he claimed to be responding to this.

The poll was in favour of selling, the stock price tanked and he did in fact sell, but that’s not the whole story:

- He had options due to vest, so he would have had to pay billions in tax next year in any case

- He has previously said that he thinks that tax rates could rise

- The Tesla stock price is very high

- If he had sold quietly, the subsequent announcement could easily have tanked the stock price even more

- He had already filed to sell $5 bn of the roughly $7 bn he’s sold recently

Some Dems responded that billionaires tax bills should not be set by Twitter polls. When Bernie Sanders tweeted:

We must demand that the extremely wealthy pay their fair share. Period.

Musk responded:

I keep forgetting that you’re still alive. Want me to sell more stock,

Bernie? Just say the word.

He also asked what tax rate they thought he should pay and whether 53% was enough.

interactive investor

Another week, another (potential) takeover by Abrdn.

- They are in talks to buy interactive investor (ii) for £1.5 bn

After an acquisition spree that has made them the second-biggest investor platform in the UK (not sure if this is by assets or number of clients), ii had planned to float in 2022, joining HL and AJ Bell as UK-listed platforms (brokers X-O are also listed as Jarvis, but are much smaller).

- ii has 450K clients and manages £56 bn in assets, and is currently majority-owned by private equity group JC Flowers.

Quick Links

I have five for you this week, the first three from The Economist:

- The newspaper warned us not to mock the metaverse

- And told us that the video-game industry has metaverse ambitions, too

- And said that Walmart has got its bite back.

- UK Dividend Stocks wrote about selling SThree

- And Alpha Architect said that chasing low beta loses alpha.

Until next time.