Irregular Roundup, 25th March 2024

We begin today’s Irregular Roundup with the British ISA.

British ISA

The Economist gave its take on the British ISA. Question not the need:

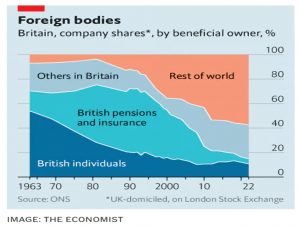

Sticking money in domestically listed equities over the past decade has meant total shareholder returns two-thirds lower than investing in a global index that strips out Britain. It should be no great surprise, then, that British investors exhibit less “home bias”, an over-allocation to domestic equities, than most rich-world peers.

But the newspaper doesn’t think the BRISA will work:

Cajoling domestic investors to buy British is not the remedy for underperforming markets, however. British households invest only 11% of their financial assets in stocks, compared with 23% in France and 36% in America. Such habits won’t change without sustained strong returns, and insufficient capital is not to blame.

In particular, the FTSE-350 is not starved of capital.

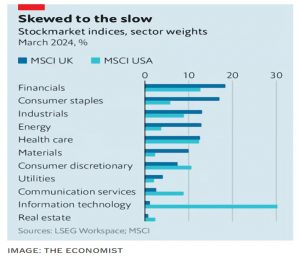

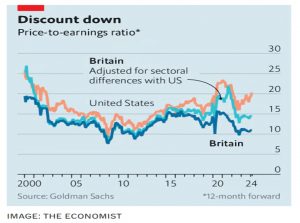

[Its] weakness partly reflects industry mix: only 1% of large-cap British equities are in technology compared with 30% in America. Differences in sectoral composition explain half of the valuation gap between British and American stockmarkets.

The rest is because the UK firms are older and grow more slowly.

What we need are market reforms:

Abolishing stamp duty would help. The tax depresses share prices by 4%.

And more scale-up capital for mid-stage funds (rather than the early-stage venture capital which is available (and tax-advantaged).

Most of it comes from abroad; highly fragmented British pension funds generally lack the scale or sophistication to invest in unlisted assets. Plans to consolidate local-government pension schemes are a good start.

Takeovers

For the FT, John Lee characterised 2024 as a year of takeovers.

Direct Line, Spirent, Mattioli Woods,Wincanton and others have either been sold or are “in play” in 2024, with big jumps in their share prices. Who would have thought that transport group Wincanton would achieve a 100 per cent premium on pre-bid levels?

Of course, all this activity was predictable given the low valuations of UK stocks.

Ah yes, valuations. We’ve discussed how “cheap” the UK is before – the problem is that there is no obvious catalyst to change things.

- I think the UK market is in long-term decline, and neither flavour of government seems motivated to make the radical changes needed to save it.

John’s not happy, either:

The government’s response to low valuations has been somewhat unconvincing — telling pension funds to be more transparent as to where they are invested and introducing a £5,000 additional allowance British Isa. This damp squib has been slated by many commentators, looks administratively complex, will only benefit the really well-off, and unsurprisingly has hardly delivered a flicker of reaction in markets.

£5K pa for an extra that will only be used by a minority is just a rounding error.

John wants a cultural change instead:

Greater financial education in schools, arowing back of financial regulation which in my view excessively protects the consumer, inhibiting, say, television broadcasters from covering the stock market or investment opportunities.

Not to mention the restrictions on financial bloggers.

We should all be worried and ashamed that more young people speculate in cryptocurrencies than invest in a stocks and shares Isa.

I’ve never had much luck with takeovers, but John’s experience is the opposite:

Over the years I have been on the receiving end of 60 takeovers or take privates —approximately one a year for my investing life. All delivered appreciated premiums and cash for reinvestment, but I would rather have seen many remain independent,continuing to grow.

That’s the problem – losing an under-appreciated gem means spare capital to reinvest, and for dedicated stockpickers like John, that means having to unearth a new prospect.

John is expecting more takeovers:

When I look at my own portfolio, and the depressed level of so many stocks, virtually all appear vulnerable to a bid.

The standout opportunities for John are Christie Group and PZ Cussons, with Cerillion, Lok’nStore and Vianet the runners-up.

Finfluencers

Joachim Klement wrote that finfluencers (financial influencers) are a waste of time and money.

- A recent study looked at short-term stock tips on StockTwits from 2013 to 2017 (there were an amazing thirty thousand users of the site making recommendations).

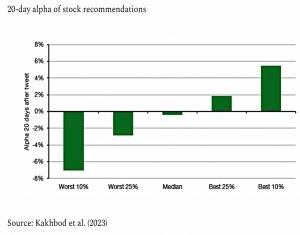

On average, investors underperformed the market by 0.35% per month (4.1% annualised) if they followed the advice of these finfluencers. Yet, there is a minority of finfluencers that add value.

The top 25% by performance managed to outperform the market by some 1.9% per month or 25% annualised. However, the distribution is skewed towards underperformance with the bottom 25% of finfluencers underperforming the market by 29% annualised.

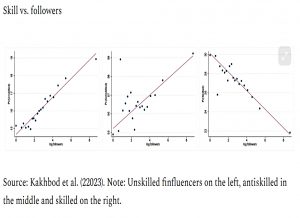

The authors of the study classed 28% of influencers as skilled, 16% as unskilled (with random predictions) and a whopping 56% as “anti-skilled” (their tips have a statistically significant negative alpha).

- So following a StockTwits influencer at random would lose you money.

You might hope that users of the platform could identify the wheat from the chaff and follow only those with skill.

- But you would be wrong.

Users like the worst of the worst:

The unskilled and antiskilled finfluencers with the most followers are far more likely to be unskilled or antiskilled (i.e. their recommendations are more likely to destroy performance) than finfluencers with fewer followers.

And they also like the worst of the best:

Skilled influencers with more followers are less likely to have truly positive alpha than finfluencers with fewer followers. The worse their recommendations are, the more followers finfluencers tend to have.

Joachim explains:

Users tend to follow influencers that ride return and social sentiment momentum, i.e. they egg users on to act on their emotions and their pre-existing beliefs and act as amplifiers rather than serious advisers.

This is true throughout life – people like people who tell them what they want to hear, and they tend to shoot the messenger.

- There are obvious implications for internet popularity:

Finfluencers most easily increase their influence and follower count by actively encouraging users to do what they already wanted to do. Finfluencers create an echo chamber that removes competition and insulates them from questioning performance or the validity of their beliefs.

This has been my experience with financial forums.

- If you join an established group and try to steer them towards best practice, you will be shouted down and/or ostracised.

If you start your own space and stick to the truth about investing, it will remain a niche flavour. Joachim is reassuring:

Markets don’t care about a person’s belief, which is why finfluencers are so destructive and a waste of time and money.

But that doesn’t stop them from making money.

Hipgnosis

The latest episode in the Keystone Cops saga of the Hipgnosis Songs Fund (SONG – in which I have a small and getting smaller position) was a row – and possible legal action – between the fund and its managers (HSM) over a write-down in the fund’s NAV and possible over-charging of fees.

- The NAV is being written down by another 7.6% (after being cut by a third a few weeks ago following an independent valuation) to reflect double-counting of accrued income.

The problem arises from an accounting error regarding delayed income from radio, streaming and live performances.

Chair Robert Naylor said:

The investment adviser has now notified the board that they agree with the board’s view, contrary to previous advice. The error relates to the adjustment made to the IFRS NAV to produce the operative NAV, which is prepared by the investment adviser, and does not relate to the valuation methodology used by the company’s valuer [Shot Tower].

Since NAV is a key input to the market cap of the firm, Naylor belies that:

[SONG] has almost certainly been overcharged investment advisory fees by the investment adviser. The board has reserved all the company’s rights against the investment adviser.

The board is already suing HSM for indemnity against possible litigation costs involving founder Merck Mercuriaidis.

HSM claimed that “operative NAV” had been used since the fund’s float five years ago and was originally calculated by the company’s administrator before HSM took over the responsibility. A spokesman said:

It is understandable that the company’s board wish to improve its reporting and APMs and HSM is fully supportive of this. However, it is disappointing that the board has sought to incorrectly place blame in the process. We continue to believe that it is in the interest of the company’s shareholders for the company and the investment adviser to work constructively together.

That doesn’t look very likely based on the last few months’ events.

Dogs

Two popular “star” fund managers have appeared on the regular BestInvest list of “dog” funds for the first time.

- Lindsell Train (Nick Train) and Fundsmith (Terry Smith) are the two funds in question.

It was a bad year for the dogs (defined as funds that have consistently underperformed over the past three years), with their ranks increasing by 170% over the last six months to 151 funds managing £95 bn between them (up 106% from £46 bn).

- Global and sustainable funds did particularly badly, but anything underweight the Mag 7 and the energy sector would struggle.

UK funds also increased from five (managing £3.4 bn) to 34 (managing £12 bn).

It’s usually a matter of time before a star manager ends up at the wrong end of the performance tables.

- They usually stick to their advertised methods (Neil Woodford being a notable exception) and since no single style works all of the time, they must eventually come unstuck.

BestInvest MD Jason Hollands said that investors need to monitor their holdings.

Funds can endure [bad] periods for a variety of reasons,including a style bias or process that has been out-of-favour with recent market trends, but which may prove temporary. Others may be serial underachievers, with little reason to continue holding them.

The call to action if an investor owns a fund on the list is really to delve a bit deeper, evaluate why the fund has lagged and only then decide whether to stick with it or potentially move.

Quick Links

I have ten for you this week:

- Mauldin Economics looked at Powering the AI

- The FT reported on Isas: the nation’s tax-free favourite turns 25

- And also on The mutual fund at 100: is it becoming obsolete?

- And said that JPMorgan blames JPMorgan for suppressed volatility

- And that Index providers are massively dull

- Discipline Funds’ Q&A had a Fed Rate Cut Edition

- The Economist noticed that Japan ended the world’s greatest monetary-policy experiment

- And asked Just how rich are businesses getting in the AI gold rush?

- CapX said that The Bank of England has committed its latest misstep

- And Morningstar listed the Top 10 Things to Know About Building a Diversified Portfolio

Until next time.

What are your current thoughts on a UK investor maintaining a home bias in asset allocation, given the structural issues you have covered?

I think there are a number of points to consider:

1 – The UK market is less attractive than it used to be

2 – Trading foreign stocks (particularly US stocks) is much easier and cheaper than it used to be, removing one of the reasons for a UK overweight

3 – Some people will want to hold AIM stocks for IHT reasons (I used to do this)

4 – Since the 2008 crash, holding US tech stocks has been a simple winning strategy

5 – Holding too much in US stock is also a danger, as it makes up 61% of the global index and US stocks are expensive

The data used to show that a moderate home overweight (say 20% to 40%) had little impact on long-term returns and delivered cost advantages, but that has changed recently and might not be the case going forward.

I used to hold around 20% in UK stocks, but I’ve been slowly reducing over the last decade and I’m down to 9.2% at the moment. I also cap my US exposure at around 15%, but I’m much more consciously diversified than most people (and I only have 40% in stocks).

Everyone has to come up with an allocation that lets them sleep at night.