Weekly Roundup, 26th March 2019

We begin today’s Weekly Roundup in the FT, with Paul Lewis, who was writing about workplace pension contributions.

Contents

Pension contributions

The headline contribution rate rises to 8% in April – 3% from the employer and 5% from the employee.

- But as Paul notes, the first £6K and anything above £50K doesn’t count as “qualifying earnings”.

So the true payment for someone on £12K is 4%, and the maximum is 7%.

- On minimum wage the rate is 4.9% and on median pay of £27.4K, it’s 6.2%.

These numbers are far too small, but some have warned that the increases will drive people to opt out.

- Paul says that they won’t, since the tax cuts for next year (a rise in the annual allowance) more than offset the increased contributions.

Paul notes that contributions to the MPs scheme are 24%, and those for the Bank of England are 29%.

- I don’t think we need to go that far, but perhaps 15% would be a good start.

Paul is not even that ambitious, asking only for 13% nominal (7% to 10% for most workers in practice).

Peer to peer lending

Kate Beioley and Nicholas Megaw had a double-page spread on peer to peer lending.

- I’m a fan of the idea – I joined Zopa when it launched almost 15 years ago – but not so much of how it works in practice.

The rates on offer are two low for the risks involved, and the only way to tax shelter the returns is to give my ISA allowance (which I think is better used elsewhere).

- It’s also difficult / expensive to diversify across the major platforms, and there is limited liquidity (the ability to sell loans in a secondary market).

P2P seems to appeal to cash savers frustrated by low returns from savings accounts.

- But while the accounts appear to operate in a similar way, in fact they are much riskier, with no guaranteed returns, risk of default and no FSCS insurance scheme.

Kate and Nicolas compare the 5-year gilt yield of 0.9% 10-year yield of 1.2% and a corporate bond fund rate of 2.6% pa with the 0% available for providing property bridging loans.

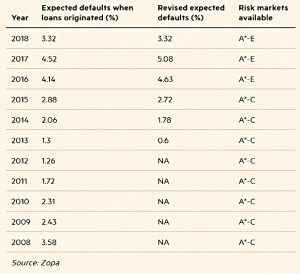

But defaults are on the rise, hitting more than 5% for Zopa loans originated in 2017.

- In 2018 Collateral went into administration, and there were problems with Lendy, a development finance firm.

The FCA is also sniffing around, worried by ads that promise “fixed” returns, and by research that shows over-commitment to the sector:

According to a survey of 4,500 investors by the Cambridge Centre for Alternative Finance, quoted in the FCA’s report, some 40 per cent had invested more than their total annual income in peer-to-peer investments and half of those had invested more than double their annual income.

In a second P2P article, Lindsay Cook looked behind the headline interest rates.

- She worries that since the introduction of the Innovative Finance ISA, the comparator for P2P has become cash ISA rates.

But of course, Cash ISAs qualify for the FSCS insurance scheme.

Mini bonds

Kate Beioley had a second article about the collapse of mini-bond firm London Capital and Finance (LC&F).

- This had been marketed as a “fixed-rate ISA” with interest of up to 8% pa.

In fact the bonds were not ISA-eligible, and any interest will be taxable.

- There are 11,500 investors affected and £236M is at risk.

- The administrators have said that as little as 20% might be returned.

Mini-bonds are unregulated, unprotected loans to small business that are not listed on a secondary market, so they have a lot in common with some flavours of P2P.

- Several other firms – particularly those offering renewable energy-related mini-bonds – have gone bust in recent years, but LC&F is much bigger.

One of the big issues here is that LC&F was a regulated firm, but it was selling unregulated products.

10 financial mistakes

This week’s advertorial in the FT came from Michael Martin, a relationship manager at 7IM.

- He’s been a financial adviser for 20 years, and offered a list of the 10 most common financial mistakes that he’s seen.

Here they are:

- Jumping on bandwagons – he cites dot-com and bitcoin.

- Catching a falling knife – perhaps UK retailers at present, or Northern Rock and RBS during the 2008 crisis.

- Being too safe – sticking with cash.

- Falling for a teaser interest rate.

- Ignoring pensions and the attendant tax relief.

- Avoiding life insurance.

- Trying too hard to avoid paying CGT.

- Checking valuations every day.

- Believing things that seem too good to be true, like 10% pa risk-free returns.

- Scrimping on advice.

Not a bad list. The only two I don’t like are:

- The plug for life insurance, which only some people will need.

- The ad for advice – most people don’t need it.

Book value

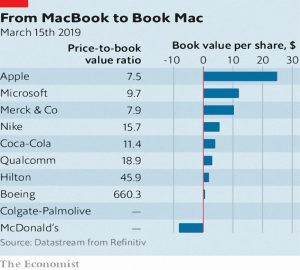

In the Economist, Buttonwood looked at why book value has lost its meaning as a measure of the intrinsic worth of a firm.

- McDonald’s now has a negative book value, and lots of other firms have a small book value relative their market cap.

- This makes them look expensive in price-to-book terms.

Value stocks have underperformed over the past decade, and Buttonwood wonders whether part of the explanation is that intangible assets are now both more important and harder to value properly.

- In contrast, tangible assets are worth what you paid for them, and this value is then discounted over the life of the asset.

The median price to book in the S&P 500 is only 3.0, but many big names have much higher ratios.

- McDonald’s is all about the brand, and has fully depreciated its property assets.

Mergers and acquisitions also distort things, with victorious firms being saddled with goodwill to reflect the premium they paid.

- Buy backs also push up the ratio (if it is above 1 to begin with), since they reduce book by more than price.

One suggestion is to adjust book value to reflect past R&D and advertising spend.

- But a better approach would be to use multiple measures of value.

Quick links

I have six for you this week:

- Alpha Architect explained why the size premium should persist.

- The Economist wrote about Masayoshi Son’s second $100 bn tech fund.

- But also felt that the Vision Fund needs more governance.

- The newspaper wrote that Big Tech should fear Europe.

- Because it faces competition and privacy concerns in Brussels.

- and David Stevenson wrote that dividends might soon be a problem for stock markets.

Until next time.