Weekly Roundup, 2nd April 2019

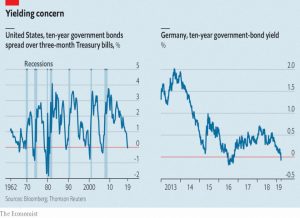

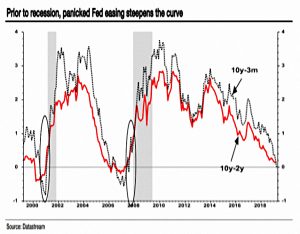

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about the yield curve and recessions.

Contents

Yield curve

Claer Barrett looked at why investors are worried about the yield curve.

- Of course the reason is that yield curve inversion (where the 10-year yield dips below the 3-month yield) tend to signal future recessions.

The inversion two weeks ago was the first since 2007.

- The lead time between inversion and recession average 18 months.

On top of the US inversion, an auction of German 10-year Bunds sold at a negative yield for the first time since 2016.

The Economist looked at the same issue and concluded that the message from Europe was more serious.

- The worst German manufacturing survey in seven years led to investors buying bods and pushing the 10-year yield below zero.

In the US, since rate rises have stopped, unemployment is low and inflation is close to target, a recession is probably not imminent.

- In the eurozone, they never got to raise rates.

Inflation and growth are low, and QT has been postponed.

- Italy is already in recession.

A recovery in trade with China is much more important than it is to the US.

- This is more likely than Germany coming to the rescue with a budgetary loosening.

NHS pensions

Josephine Cumbo looked at the problems being created by the annual and lifetime pension contribution allowance limits.

- These limits have been on the way down for almost a decade now, but the press is finally interested because a sympathetic group (NHS doctors) is now being impacted.

Senior staff are turning down extra shifts to avoid big tax bills for breaching the limits.

- It’s a version of the Laffer curve in action – tighter tax rules lead to no more tax being collected as taxpayers choose less work over bigger tax bills.

The biggest culprit is the annual allowance taper for high earners.

- The lifetime allowance of £1.05M is also an issue for some.

For those on incomes of £150K to £210K, the annual allowance drops to £10K.

- Most people deal with this by simply contributing less to their pensions, but like most public sector workers, doctors still have access to a DB pension scheme.

So their contributions are fixed, even if they don’t have to fund them themselves.

- Carry forward (of unused contributions from previous tax years) can help for a while, but is only a temporary fix.

It’s an unfortunate situation, but I don’t think that a specific exemption for the NHS is the way to fix it.

- Either taper kicks in at too low a salary, doctors are paid too much, or their pension schemes are too generous.

Tax rules that vary by profession is a slippery slope.

Gold

Lucy Warwick-Ching looked at whether gold really is a safe haven with enduring value.

- Or at least that was the article’s subheading – I couldn’t see much of a conclusion myself.

Personally I view gold as a useful diversifier with low but uncorrelated returns (compared to stocks).

- Not many investors will need more than a 5% allocation through cheap physical ETFs.

You can find out more here and here.

Nutmeg crowdfunding

David Stevenson looked at robo-advisor Nutmeg’s crowdfunding raise

Many start-up businesses have failed and there has been a constant running debate about how well the UK’s biggest online crowdfunding platforms vet businesses seeking equity investments.

Data from Beauhurst show that the number of early stage financing deals was down by 18% on 2018 compared to 2017, with the amount of money raised down by 9%.

- And the number of investments that reached seed stage was the lowest since 2013.

On the plus side, the average size of deal has doubled over the last two years.

- There’s also a new bias to fintech.

Nutmeg is number 27 on a 2018 list of the UK’s top 100 growth firms.

- It also claims to be the eighth largest wealth manager in the UK.

It’s funding came from VCs, Schroders and Goldman Sachs, but now it plans to raise £10M via crowdfunding.

David expects a valuation north of £500M, but Nutmeg is not yet profitable.

- In 2017 it lost £12.4M on turnover of £4.5M.

The problem for all the robo-advisers and fintechs is customer acquisition.

- It costs between £100 and £500 of marketing spend per customer to attract new business.

Nutmeg has fees of between 0.35% and 0.75% (plus extra charges within the underlying funds themselves).

- It has 65K customers with assets of £1.5bn, or £23K per person.

- So average annual income per client is of the order of £115 pa.

David points out that the more successful platforms trade on very high multiples:

So perhaps the Nutmeg raise will go very well, and act as free marketing into the bargain.

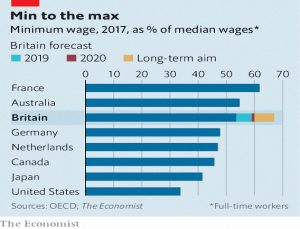

Minimum wage

The Economist looked at the minimum wage (MW), 20 years after its introduction.

- How much higher can it safely rise?

The worry is that at some point it must affect employment, as regulation forces firms to pay workers more than the value they can add.

Already there are signs that companies in labour-intensive industries, such as hairdressing and hospitality, have responded by raising their prices. Other firms have accepted lower profit margins, or have tried to get around the rules by treating their workers as self-employed.

The target in the UK appears to be two-thirds of median earnings.

- This would make it the highest minimum wage in the world.

Not bad for a country that had never had one until 1999.

- And Labour is promising a £10 minimum, which would be even higher.

Seven percent of worker are paid the minimum wage, but around 20% are paid below the government’s target rate.

The Economist prefers tax-credits to further MW rises, but at least 25% of that benefit goes to employers rather that workers.

- It’s a trade-off that will need to be evaluated in the near future.

Crypto

The newspaper also looked a crypto, and concluded that flaws in Bitcoin make a lasting revival unlikely.

- The price has fallen from $20K early in 2018 to $4k today.

The cryptocurrency fiasco has exposed three deep and related problems: the extent of genuine activity is hugely exaggerated; the technology does not scale well; and fraud may be endemic.

Bitcoin turnover in 2018 was $812bn, more than PayPal.

- But some went on Dark Web purchases, some more on gambling, and most of the rest on price speculation.

Not much Bitcoin is used to buy actual things.

- And 95% of the trading activity is artificial.

Other problems include:

- A maximum transaction capacity of seven per second (the add-on Lightning Network is an attempt to get around this).

- The deflationary nature of a currency where the maximum number of coins is limited to 21M.

- The amount of electricity consume to mine (produce) coins.

- Fraud – irreversible transactions, Ponzi schemes, and collapsing and insecure exchanges.

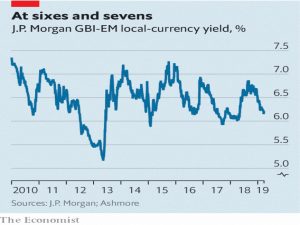

Diversification

Buttonwood looked at the use of emerging-market local-currency bonds for diversification.

They are not stocks, they are not denominated in dollars and they are not widely owned by foreigners.

GDP growth is generally faster, as there is greater scope to benefit from existing know-how than in rich economies. The business cycle is different, too.

They also have higher yields, which provides a buffer against FX risk.

- You can find them in The Perfect Portfolio, though admittedly only at a 2.6% weighting.

Ageing

The Economist also looked at the effect of ageing populations on growth.

For the first time in history, the Earth has more people over the age of 65 than under the age of five. In another two decades the ratio will be two-to-one.

The world’s greying is inevitable. But its negative effects on growth are not. If older societies grow more slowly, that may be because they prefer familiarity to dynamism.

A higher share of older workers appears to impact productivity, though not because the individual workers are significantly less productive (at least to age 60).

- It seems to be the influence they have on those around them, for all workers at firms with lots of oldsters are paid less.

Speculation around the causes includes a reluctance by such firms to introduce new technology, perhaps because the returns from expensive re-training would last for less time.

- Or it could just be that older bosses don’t like new tech.

The newspaper suggests measures to make firms more competitive with one another, which would force them to embrace change,

- Portable benefits would help.

And of course, it being the Economist, they want more immigration.

But given the choice between a dynamic but unfamiliar society and a static but familiar one, older countries tend to opt for the second.

What a shock.

- Perhaps the introduction of more automation – robots – will solve the problem.

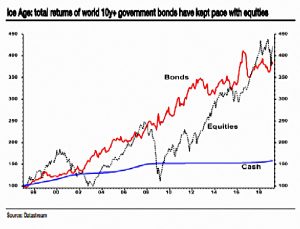

Uber bear

In his Bloomberg newsletter, John Authers profiled Societe Generale perma-bear Albert Edwards, who has been recommending an underweight position in equities since 1996.

- As the chart shows, this strategy worked pretty well until recently.

This worries John:

That is more than a little unnerving because Edwards thinks we are in a Japan-style “Ice Age” in which bond yields drop ever lower and stocks eventually sink.

Edwards sees the recent fall in expectations of Fed rate rises as confirmation:

If the market is right and the next move in rates is indeed down, this is exactly what normally occurs just ahead of a recession as the Fed realises it has over-tightened and crunches the interest rate gears into reverse, prompting curve steepening.

Let’s hope that he is wrong.

Quick links

I have nine for you this week, and a lot of them are from The Times for some reason:

- Citywire wrote about Woodford listing unquoted stakes offshore.

- The Economist looked at the looming media wars.

- UK Value Investor wondered what went wrong at Interserve?

- David Stevenson asked whether energy stocks are the new tobacco.

- The Times warned readers to be suspicious of high interest rates.

- And asked Terry Smith to come clean about his fund holdings.

- Not once, but twice.

- And reported on the first wobble for peer-to-peer lenders.

- And said that Britain shouldn’t be too glad to be grey.

Until next time.