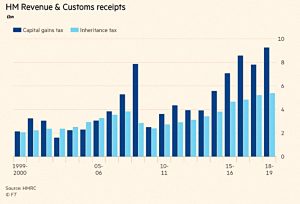

- CGT raised £9.2 bn in 2018/19, compared to £2.1bn in 1999 / 2000 (( I’m not clear how HMRC can know the tax take for a year that has just closed – I doubt many people have completed their returns yet ))

- IHT is up to £5.4 bn for 2018/19, up by £164 M on the year

Rising property prices and changes in the taxation of buy-to-let properties are behind the rise in CGT.

- Rising property prices also explain the increase in IHT (from larger estates).

The stock market has also done well over the past decade, which will have contributed to the CGT numbers in particular.

- You can see a similar peak in the run up to the 2008 crash.

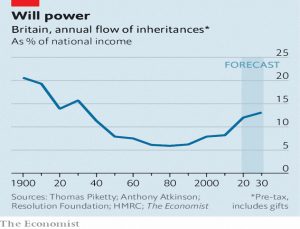

The Economist also looked at the return of inheritances, which are back to their pre-war levels in the UK.

For every £100 that they earn in wages, Britons receive £17 in gifts and bequests.

More significantly, one in twenty people now receives an inheritance worth more than ten years of net earnings.

Those whose income from employment means they might be classified as members of the lucky “few” increasingly feel as if they belong to the excluded “many”.

The liberalisation of mortgage lending in the 1970s – and the resultant bidding-up of house prices – is largely responsible.

Lawyers have also noticed Britain’s inheritance boom. The High Court considered around 150 inheritance disputes in 2017, three times more than it examined a decade earlier.

The Economist worries about the emergence of a “turbocharged elite” – brainy people in good jobs with inheritances who marry each other.

- That doesn’t sound so bad to me, or so different from what we already have.

Property yields

James Pickford reported that rising rents are boosting buy-to-let property yields.

- Falling house prices are part of the picture, too – London prices are down by 3.8% over the past year, though nationally prices were up by 0.6%.

Average gross yields across the country are now 5.9%, with London up to 4.6%.

- This seems high to me – we pay just over 3% for my mother-in-law’s flat.

The highest yields were in the areas with the lowest prices – the north east and north west.

Melt-up

In MoneyWeek, Merryn Somerset Webb picked up the Larry Fink reference to a market melt-up that we mentioned last week.

In China the state-controlled banking system has been increasing the flow of credit; in the UK we know that rates won’t rise at least until Brexit is semi-sorted; and this week the Bank of Canada left its interest rate unchanged at 1.75% for the fourth time in a row and – crucially – dropped a reference to future rate rises that had been in every statement since late 2017.

Finally, possibly most importantly, in February, the US Federal Reserve made it clear that it was soon to end QT.

But she warned that after the melt-up would come the melt-down.

P2P funds

For CityWire Investment Trust Adviser, Michelle McGagh contrasted the fortunes of a couple of P2P trusts.

- I was originally attracted to these funds as a liquid and tax-efficient way of accessing what seemed to potentially be a new asset class.

But as a group they haven’t performed well.

- Michelle described P2P Global (P2P) in particular as “jam tomorrow”.

But Honeycomb (HONY) has done well.

Buying and selling

Buttonwood looked at why investors are careful buyers but careless sellers.

He noted the lessons from the Market Wizards books:

It is striking how little emphasis the wizards put on getting into a position—finding the right trade at the right entry price—compared with when to get out of it.

You need to Cut Your Losses and Let Your Winners Run.

A recent paper looked at nearly 4M buys and sells from fund managers:

Buying decisions, they found, were good: the addition of a stock generally improved a portfolio. But selling decisions were bad—so bad that a fund manager would have been much better off choosing a stock to sell at random.

When they are stressed because their portfolio has recently done badly, instead of deliberating, they use a mental shortcut. Stocks that have done either really well or really badly, and so stick in the mind, are far more likely to be sold.

It seems that fund managers treat sales as a way to raise cash for the next purchase, whereas buying is treated as ain investment decision.

- Fund managers are often asked for buy tips, but rarely speak about which stocks should be told.

I have no direct experience of observing fund managers, but that’s certainly the way that a lot of “serious” private investors seem to behave.

- It’s easy enough to fix by using some kind of momentum filter on both buys and sells.

But as we know:

Individual investors show a strong preference for selling winners over losers. They may be impatient to experience the burst of pride that comes from selling a winner.

And they hold on to losers for too long in the hope of avoiding feelings of regret.

Don’t be like them.

Quick links

I have just four for you this week:

- The Economist asked Can Uber ever make money?

- The Reformed Broker explained Why Telsa is a better short at lower prices.

- UK Value Investor wondered whether it is Time to ditch Rolls-Royce.

- And Towards Data Science asked Which is a better investment – Real Estate or Stocks? (spoiler alert – it’s stocks)

Until next time.