Weekly Roundup, 1st August 2022

We begin today’s Weekly Roundup with the Fed Hike.

Fed hike

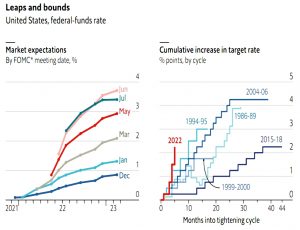

The Fed hiked again, up another 0.75% to 2.25%, and The Economist wrote about it.

The Fed has adopted the fastest pace of monetary tightening in decades. In the past three months alone it has raised its benchmark federal-funds rate by two percentage points.

Futures markets now expect a peak rate of 3.4% at the end of the year.

The day after the latest raise, GDP data indicated that the US had fallen into a recession. (( The Fed uses a wider definition than 6 months of shrinking GDP, but most people don’t ))

Normal the Fed raises in baby steps:

Between 1994, when the Fed began publicly announcing changes to its monetary policy, and 2018 it raised the federal-funds rate 40 times. All but five of them were quarter-point increases.

In theory, small hikes are easier for markets to absorb, and give the Fed more time to respond to economic data.

- But in this case, they started so far behind the curve that they had no option but to try to catch up.

It may be too little too late, but after the hike, Fed Chairman Jerome Powell said that future rises would likely be smaller and would be data-driven.

- These comments were widely regarded as dovish and were well-received by the markets, but bad data over the next couple of months could still mean another big hike in September. (( The Fed doesn’t meet in August, though we will get a speech from Powell at the Jackson Hole summit next month ))

Recession watch

The Economist felt it was too early to say whether the global economy was in recession, though the fear of one is entirely reasonable:

Since 1955 there have been three periods when rates in America rose as much as they are expected to this year: in 1973, 1979 and 1981. In each case a recession followed within six months.

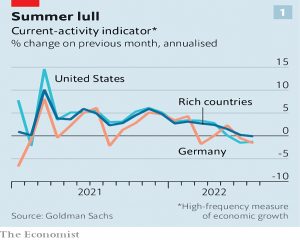

The chart above shows the Goldman Sachs “current activity indicator”, which uses a number of inputs to gauge economic health.

- The number has been falling in recent weeks.

The Economist has its own set of recession indicators, and most of them are still showing green.

- It’s a similar approach to that used by the National Bureau of Economic Research (NBER) in the US, which announced last week that the US is not in recession.

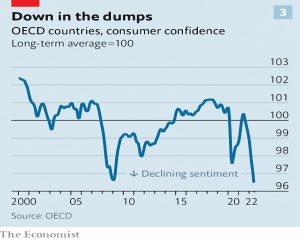

On the other hand, consumer confidence is low.

The public is even gloomier about the economy than it was during the depths of both the global financial crisis and the pandemic.

Households have around $3 trn of excess savings from the pandemic, and stimulus continues (including handouts to the poorest here in the UK).

- But people’s confidence in their own finances does not extend to the wider economy.

On the other hand, the job market remains tight, which is something not usually seen in recessions.

- And business investment has been strong until recently, and projected declines are not as steep as in previous recessions.

Newsflow is a problem since anything can be read as bad news:

Weak figures confirm that a downturn is approaching. Strong data, including wage rises, suggest central banks are not succeeding in slowing things down, requiring further tightening, which in turn stands to provoke a recession.

What we need is the inflation number to come down.

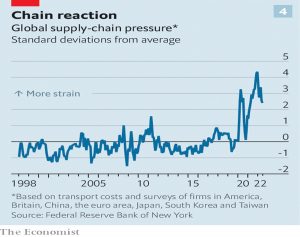

There is hope, from the easing of supply-chain pressures.

- But inflation is unlikely to fall quickly.

Past increases in the price of food and energy have not yet fully filtered into headline inflation rates; rich-world inflation will peak at 8% in the third quarter of 2022. Growth in wages shows little sign of easing. Companies still talk about how best to pass on higher costs to their customers.

Silver lining

The Economist also felt that there would be silver linings should a recession turn up – specifically lower inflation and greener energy.

Regardless of whether economies are already shrinking, it is hard to see how they can avoid a recession over the next year as monetary tightening bites and Europe heads into a bleak winter.

The newspaper sees the buffers in poor households’ bank balances and the switch from dollar- to local currency-denominated debt in emerging markets as protections from the worst effects of a recession.

And bizarrely, they think that the Fed has caught inflation early:

The last time the Fed tightened monetary policy so dramatically, in the early 1980s, prices had more than doubled over the previous decade. Today the figure is just 29%, because inflation only took off last year.

The data is correct, but plenty of us thought that the tightening could have started more than a year earlier than it did.

The Economist thinks the situation is similar to the end of WW2, which was ended by a mild recession.

It’s true that most commodity prices have fallen back, but we still have an energy crisis – particularly in Europe – as we hed into winter.

If rationing becomes necessary, industrial production and hence GDP will fall, perhaps steeply in exposed economies like Germany. Even as output shrinks, inflation will rise further.

It’s true that the war in Ukraine has raised awareness of Europes dependence on external energy supply, but a smooth and rapid transition to clean energy looks imporssible to me.

Stealing a living

Investors Chronicle economist Chris Dillow recently retired, and on his Stumbling and Mumbling blog, he admitted that he had been stealing a living.

The general financial advice any retail investor needs is actually very simple:

- Minimize taxes and charges. Avoid expensive fund manager fees. Don’t trade very much. Make full use of Isa and Sipp allowances.

- Make the power of compounding work for you. Start investing as early as you can. And remember that fund managers’ fees compound horribly over time.

- Diversify sensibly. Hold equities for growth, and non-equity assets to spread risk.

- Invest regularly, via monthly direct debits.

Pretty good advice.

- Chris also mentions some market timing techniques and factors (low vol and momentum in particular).

He says that he was not alone in stealing a living, and names some other guilty parties:

- Equity analysts

- Economic forecasters

- Fund managers

Many people in finance are simply quacks, snake oil salesmen. The market does not always weed out charlatans.

They use product differentiation (such as the launch of new funds); exploit wishful thinking and the public’s ignorance or distrust of experts; and they rely upon people not distinguishing between skill and luck.

Like me, Chris would like to see different financial products made available – ones that protect individuals from their major economic risks.

If we could trade securities which were claims on GDP or occupational earnings, people worried about or exposed to downturns could protect themselves by going short.

The problem is that these things wouldn’t be as profitable as ICOs and NFTs.

- You have to remember as a DIY investor that the system is not out to help you – its designed to fleece the people who can’t be bothered to be DIY investors.

[The] financial system is superbly well-equipped for purpose – to funnel wealth from clients (and wider society) to itself.

The company behind the Shares app, which is backed by billionaire Peter Thiel, has raised another £33M in funding, bringing the total to date to £75M.

Shares have a declared mission to attract women and young people into stock market investing.

- The app has 150K users and more than 90% of them are aged 41 or younger (millennials and zoomers).

- 40% are women, compared to just 7% of retail investors in total.

Shares trades on its social media features (seeing what other investors are up to).

- I’m a fan of social trading in principle (( I opened an eToro account for this feature )) but no one has yet managed to implement it in a particularly useful way.

Like all social media, (( And blogging )) there’s no correlation between how loud someone is shouting and the quality of their content.

We looked at Shares back in April 2022 and decided it was too expensive – FX charges were 0.4% in each direction, with no option to hold the account in dollars.

The good news is that as of last week, this charge has been scrapped.

- The bad news is that it has been replaced by/subsumed into a transaction fee which didn’t previously exist.

This fee is a ludicrous 0.79% on each trade, which is £79 on a £10K deal, and £7.90 on a £1K deal.

- So the Shares app is now of even less interest than it was in April.

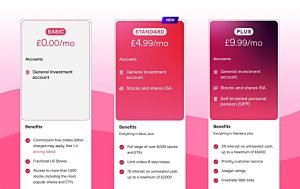

Freetrade

Freetrade is also changing its prices, but again not for the better.

- Currently, the free tier includes a GIA with a restricted stock list, and 2-way FX charges (no dollar account).

So I don’t use the Freetrade GIA.

You can also pay extra (£36 pa) for an ISA, and even more (£120 pa) for a “Plus” Tier which includes more stocks.

- A SIPP also costs £120 pa, or £84 pa if you have the Plus tier.

That is more expensive than Trading 212 (free ISA) and the same as AJ Bell for a SIPP, but with fewer investment options.

- There’s also the issue of whether you want to risk more than £85K with a small new broker – and SIPPs and ISAs tend to be bigger than £85K.

So I don’t use the Freetrade ISA or SIPP, either.

The new structure adds a third tier (“Standard”) for the ISA, at the same time increasing its price to £60 pa.

- It’s simpler but more expensive for a restricted-stocks ISA.

- A full range SIPP is now cheaper (£120 pa rather than £204)

The new tiers achieve the strange double-whammy of making Freetrade less attractive to me (more expensive ISA) and also running the risk of reducing income from its target audience.

- Millennials with a low-value but full-range ISA (who largely won’t want a SIPP) will now pay £5 a month instead of £10.

- And those with a SIPP will pay £10 rather than £17.

Quick Links

I have six for you this week, the first five from The Economist:

- The Economist said that recession fears are weighing on commercial property

- And that the Bank of England must weather high inflation and meddling politicians

- And that the era of big tech exceptionalism may be over

- And that the Fed put has morphed into Fed call

- And that the yen looks cheap as chips.

- Alpha Architect looked at the expected returns to ESG-excluded stocks.

Until next time.