Weekly Roundup, 29th June 2021

We begin today’s Weekly Roundup with a look at cash.

Cash

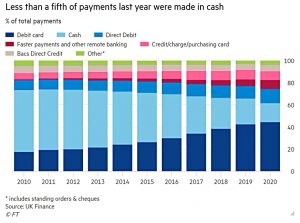

In the FT, Claer Barrett reported that the pandemic has accelerated the decline in the use of cash.

- The number of payments made using notes and coins went down by 35% in 2020.

- Online, contactless and wallet app payments all increased.

The use of cash has been decreasing by around 15% pa for the last few years, but fears over fomite contagion have lead to an acceleration in this decline.

- At the same time, the amount of cash in circulation – or perhaps more accurately, stored under the mattress – has never been higher, at £80 bn.

Apart from the fact that some people (especially poorer and older people) there are three issues with abandoning cash:

- Loss of anonymity – not everyone wants all of their transactions to be recorded

- Ease of spending – handing over cash is more difficult than tapping a card reader

- Loss of the lower bound – negative interest rates are hard to implement when people can just store cash under the mattress

Also in the FT, Tim Harford focused on the second point.

- An online and cashless society makes it easier to lose track of spending.

We’re warned to be careful of the small print, but on a mobile phone, all the print is small print.

He refers back to Thaler’s famous book Nudge:

Nudges can also be used to “make it easy” to do other things, too. The logical extreme is the endlessly renewable subscription. Our household subscriptions include online yoga, the Star Wars and Marvel movies, Patreon, wine, Amazon Prime, Microsoft Office, Adobe Photoshop, apps for mindfulness, language learning and productivity [and] two cloud storage services.

More importantly:

Not only are we paying for all this, we’re paying without a clear idea of when or how much the payments are, or even the method of payment we are using.

Tim quotes a study of gym users who could pay annually, monthly or via 10-day passes:

The monthly consumers stayed subscribed for longer, paid nearly twice as much per gym visit and typically took more than two months to cancel after their final gym appearance.

Tim suggests that instead of buying things (online) immediately, we should add them to a list and decide which purchases to make at the end of the month.

- An annual budget broken down by category would serve a similar purpose.

And maybe we shouldn’t be too ready to abandon cash.

Nutmeg

JP Morgan is buying robo-advisor Nutmeg for an undisclosed sum (thought to be around £700M) in advance of launching a digital bank in the UK later in 2021.

- The deal will need regulatory approval and but could close before the end of the year.

Goldman Sachs has a similar plan to JPM but has started from the other end – with a successful savings account under the Marcus brand.

Nutmeg has 140K clients and £3.5 bn of AUM (up 70% year on year) – I make that an average balance of £25K.

- But it is still loss-making (the latest accounts are for 2019 and show a loss of £22M), though revenue growth in the year to April was 66%.

- 1Q21 new clients were up 53% year on year, and inflows were up 230%.

Nutmeg CEO Neil Alexander said:

The products and services our customers currently enjoy from Nutmeg will be unaffected. [Our] customers can expect the same level of transparency, convenience and service that helped make us a leading digital wealth manager in the UK.

I am truly impressed with the digital experience that Chase is building for the UK, and this new chapter in our story will see Nutmeg’s customers benefit from a wider range of products and services in the future, and allow us to expand into new markets.

Sanoke Viswanathan, CEO of international consumer at JPM, said:

We are building Chase in the UK from scratch using the very latest technology and putting the customer’s experience at the heart of our offering, principles that Nutmeg shares with us. We look forward to positioning their award-winning products alongside our own and continuing to support their innovative work in retail wealth management.

It’s not clear if the Nutmeg name will survive. JPM is expected to launch under the downmarket Chase brand rather than the much classier JP Morgan name. The bank said:

Nutmeg is a great brand and enjoys strong consumer awareness in the UK We are also lucky to have two strong brands in JP Morgan and Chase. We will conduct detailed research and take a considered decision on brand choice over time.

Nutmeg has been around for a decade now, but neither it nor the other robos have figured out how to cheaply attract new customers, and in particular customers with large accounts.

- No amount of £25K accounts will fix this, and without scale, they can’t deliver on the obvious USP of a robo – a cheaper service than DIY.

Robos mostly charge between 0.5% and 1.% pa, whereas a diversified DIY portfolio of ETFs is likely to work out at somewhere in the 0.3% and 0.4% pa range.

- On a £1M account, 0.5% pa is £5K, and it’s hard to see how a robo can demonstrate that amount of value-add.

Zombies

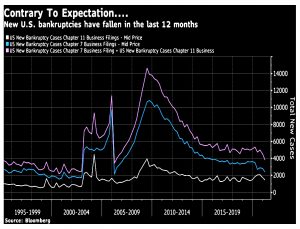

John Authers was worried that we have had too few bankruptcies, and would instead have a wave of zombie companies.

- Zombie companies are those who show little prospect of ever earning enough to repay their debts – they survive only because interest payments are low and their creditors don’t call in their debts.

John says:

I thought a solvency crisis was the biggest risk out there. With so many companies suddenly deprived of their revenue, it seemed only reasonable to fear that a wave of bankruptcies and defaults would choke the banking system, bring asset prices down, and present us with a secondary financial crisis.

This hasn’t happened in the US:

Company failures spiked and then dived around the adoption of a new and more restrictive bankruptcy code in the fall of 2005. Since then, the total number hasn’t been lower than it was in the last 12 months. The contrast to the credit crisis in 2007 and 2008 could scarcely be more stark.

In fact, other than after the 2005 law, last year’s fall in bankruptcies is the sharpest for decades.

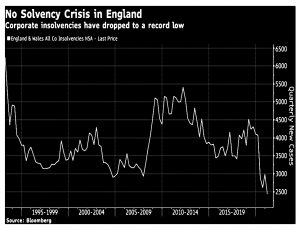

It’s a similar story in the UK.

Nor has the greater threat of bankruptcy ahead lead to an increase in the yield required by lenders to high-risk companies.

- The spread between “high-yield” debt and treasuries is at its lowest since 2007.

Investors in risky bonds are making a bet on a potent and enduring dose of financial repression, in which central banks keep propping up markets, and effectively force everyone to lend to the government, and to companies, at otherwise uneconomic rates.

This is what happened after World War II. John quotes Jim Reid of Deutsche Bank:

Over the last 20 years, the authorities have intervened to lower defaults. Implicitly via huge monetary stimulus lowering rates, and explicitly via larger and larger bailouts.

This has driven down funding costs relative to economic activity and made it much easier for companies to survive. We’ve moved away from creative destruction and towards an economy with a higher percentage of zombie companies.

This implies lower growth. Back to John:

Weak and unprofitable companies, free of the risk of going to the wall, tie up capital that could be used more productively.

It also leads to fewer jobs, lower productivity, higher prices and inflation.

Crypto

AJ Bell has published research that shows that more people in the UK (7% of adults) have bought crypto than have invested in a stocks and shares ISA (5%).

- 71% of the crypto investors claimed to be in profit, but 17% said they didn’t know.

- And a whopping 81% said they didn’t understand crypto.

- Most of the crypto buyers were under 35 (56%) and most were male (64%).

This is a shocking finding, but the real issue is that only 5% put money into a stock ISA.

- This should be a staple investment product for the majority of workers, alongside their workplace pension.

The FCA also released research that showed that holding crypto was more common and that attitudes towards such assets were changing.

- The number of crypto holders who see them as a gamble is down from 47% last year to 38% this year – most people now see them as a complement or alternative to mainstream investments.

- More people are happy with their purchase and plan to buy more (up from 41% last year to 53% this), and fewer have regrets (down from 15% last year to 11% this).

Awareness of crypto was up from 73% to 78%.

- Awareness of FCA warnings not to invest in crypto was much less at 10% – and only 43% of these people were actually discouraged from buying crypto.

Interestingly, the percentage who can identify the correct definition of a cryptocurrency fell (albeit only to 71%).

- Only 54% of crypto users were clear on the potential benefits of stablecoins.

Worryingly, 14% of holders had borrowed money to buy crypto.

- And 12% of crypto investors believed that their holdings were protected (which they are not).

The FCA estimates that the number of people holding crypto is now 2.3M (4.4% of adults), and that the average crypto holding is £300.

- Holders are mostly male, and of AB social grade, but the FCA believes that they are mostly over 35.

The FCA repeated its warnings on crypto. Executive director Sheldon Mills said:

The research highlights increased interest in cryptoassets among UK customers. The market has continued to grow, and some investors have benefitted as prices have risen.

However, it is important for customers to understand that because these products are largely unregulated that if something goes wrong they are unlikely to have access to the FSCS or the Financial Ombudsman Service. If consumers invest in these types of products, they should be prepared to lose all their money.

The third crypto story of the week came from a survey of 100 hedge fund CFOs carried out by fund administrator Intertrust.

- The hedge funds surveyed each held an average of $7.2 bn in assets.

Intertrust found that hedge funds expect to allocate 7.2% of their assets to crypto within the next five years.

- US funds expected to hold 10.6% in crypto whilst UK and European funds expected to hold 6.8% on average.

- All hedge funds in these three locations expected to hold at least 1% in crypto.

These results would indicate total hedge fund crypto assets for around $312 bn in five years time.

Quick links

I have ten for you this week, the first three from The Economist:

- The newspaper reported that record label Universal will IPO

- And said that Revolut wants to take over the world

- And described how Tiger Global is changing Silicon Valley

- The Irrelevant Investor said that investors should be prepared to be disappointed

- Alpha Architect confirmed that timing factors is difficult

- And asked whether there is anything special in private equity

- UK Value Investor looked at Qinetiq as a dividend growth stock

- Bloomberg wondered whether earning 6% in interest was worth the risk

- Pragmatic Capitalism asked whether a 100 Vol asset belongs in retirement accounts

- And Dual Momentum described a sensible approach to bitcoin.

Until next time.

Picky point, re “An online and cashless society makes it easier to lose track of spending.” I would argue it makes it easier to track spending as no longer need to hang onto all those pesky paper receipts, etc. You just need to consult the appropriate, and inevitably on line, statement. Having said that it may well be easier for some folks to lose control of their spending in an online and cashless society – this may be an opportunity for some smart folks to come up with an online equivalent of the cash envelopes system people have used for years. What do you reckon?

Also, the significance of the point “At the same time, the amount of cash in circulation – or perhaps more accurately, stored under the mattress – has never been higher, at £80 bn.” should not IMO be overlooked.

“Track” is not the ideal word. If you have a stack of notes, it’s easy to know when to stop spending. Online, using cards, you won’t get that cue and can more easily spend too much that month. And spending electronic money doesn’t hurt like handing over cash does.

Going back to last month to find out what you spend it on is easier with cards than with cash, but I suspect that most people don’t bother.