Weekly Roundup, 24th May 2021

We begin today’s Weekly Roundup with a look at crypto.

Crypto

It was a dramatic week in crypto:

- Elon Musk said that Tesla won’t accept payment in bitcoin after all, ostensibly because he has just discovered that BTC has a large carbon footprint (( He hopes to re-engineer Dogecoin to be much more efficient ))

- Tether revealed that only 3% of the $58 bn of issued coins was back by cash, reviving claims that it is a Ponzi scheme.

- And China reiterated that crypto is not money and that Chinese financial firms should steer clear.

All of which meant that the price of BTC and ETH fell, to below $40K and to around $2,500 respectively at the time of writing.

- Which in turn lead to several institutions (including UBS, Pimco and T Rowe Price) expressing caution about crypto’s adoption.

John Authers wrote of his struggles when discussing bitcoin with its “ardent supporters”.

- They don’t mind that BTC doesn’t function as a currency.

- They don’t mind that transactions are difficult.

- Or that the price is volatile (as it has been in recent days).

They champion BTC as freedom from the “abuse of central banks and governments” and even from war.

- John notes that the governments that crypto fans want to escape are largely democratic and that the guiding emotion is anger.

The GameStop saga is very similar. Both are motivated by anger, and a genuine, righteous desire to right the wrongs of society — whether by toppling unscrupulous speculators, or a corrupt government imposition. Also, there is a painful generational angle.

The crypto believers are, in general, no fans of old people (“boomers”).

It’s disturbing that ageism [is] acceptable when just about every other form of identity-based abuse is now unacceptable.

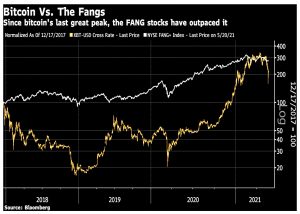

John concludes that if BTC isn’t a currency, it is a growth asset, comparable to the FANGs.

He notes three problems with this idea of BTC as a company with a promising but unproven technology:

- The technology doesn’t work well enough yet. (This week’s volatility puts that beyond argument.)

- The way to invest in the technology isn’t by buying the currency, but by buying stock in the companies that produce that technology.

- Stock in Apple or Amazon.com Inc. has the advantage that it is backed by the

companies’ assets and cash flows; bitcoin has no comparable backing.

Sticking with crypto, David Stevenson looked at NFTs (non-fungible tokens). As David explains:

An NFT is a certificate of authenticity held on the blockchain, a digital ledger of transactions that cannot be hacked. These tokens may refer both to an actual item, such as an artwork, as well as its authentication.

They are just a piece of code with a unique identifier. An NFT is thus a kind of digital securitisation, an asset of a kind that cannot be exchanged for or replaced by another identical one (hence nonfungible).

That sounds a bit rosy to me – the most common use for NFTs to date is to “prove” ownership of easily-copied digital assets (pictures, videos and music) via a blockchain that may or may not exist in the future.

- I can’t see most people trusting a system like this, though plenty of rich people already have.

This is the perennial problem for blockchain – decentralised sounds good, but only when a single unhackable decentralised system dominates the space.

- Bitcoin comes closest to this at the moment, with the enormous amounts of computational effort, electricity and carbon required to generate more.

But getting a new decentralised solution off the ground is like floating a better version of Amazon.

David sees NFTs as an accessible and easy to trade form of securitisation, but to me they feel as secure as buying “antiques” and “rarities” on eBay.

- Much better to buy through Christie’s or Sotheby’s and be reasonably sure what you are getting.

David has bought into Aquis-listed fund NFT Investments (AQSE:NFT), as well as DeFi firm Dispersion Holdings (AQSE:DEFI).

- He previously bought into KR1, a kind of blockchain venture capitalist.

He also mentions the VanEck Digital Assets ETF (DAGB).

Swensen

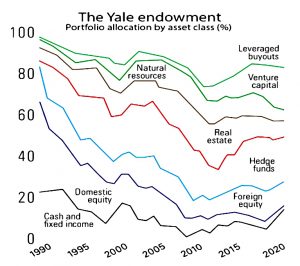

David Swensen, the Yale investment manager who revolutionised the university endowment model of asset allocation, has died aged 67.

- He worked at Salomon’s and Lehman’s before joining Yale in 1985.

At the time, university endowments held a lot of bonds and few international investments.

- Swenson diversified into riskier foreign stocks and real estate, as well as private equity, venture capital, hedge funds and forestry.

Bonds and US stocks now make up less than 10% of the fund.

- Hedge funds accounted for 24%, as did VC, and PE made up 18%.

He also advocated for a long-term view, in order to take advantage of illiquidity.

He was so successful – growing the fund from $1bn to $32 bn – that this approach became known as the Yale model (or sometimes the endowment or Swensen model).

- Yale’s endowment averaged 12.4% pa over 30 years and provided a third of the university’s total revenue last year.

Charles Ellis, the former chair of the Yale endowment, said:

The really great painters are the ones that change how other people paint, like Picasso. David Swensen changed how everyone who is serious about investing thinks about investing.

Ted Seides, the hedge fund manager famous for losing a bet with Warren Buffett (and who now has a decent podcast), worked for Swensen:

He was just an incredibly wise man. He was the greatest in the industry and he has been for many years.

John Authers said:

He stressed asset allocation rather than stock picking, or attempts to time the market — beyond the mechanical market timing that came with rebalancing (buying more of assets that had done badly and selling some of those that had done well).

Swensen deserved more credit for this huge shift in the investment landscape than any other single individual. With the sole exception of Warren Buffett, Swensen’s actions at Yale were more closely watched than any other investor’s.

John also notes that Swensen’s legacy is uncertain:

Allocations to deeply illiquid investments made life tough for the big endowments during the global financial crisis, and many of them (including Yale) were forced to borrow.

There have also been protests about fossil fuels holdings and the poor performance of hedge funds since interest rates fell have attracted criticism.

There are also issues for private investors in reproducing the Yale approach.

- Swensen got into hedge funds and PE early and was able to access the best managers, who tend to capture most of the available returns.

In MoneyWeek, Chris Sholto Heaton wrote that many investors learned the wrong lessons from Swensen.

- Yale’s own analysis of its returns found that whilst 40% of its outperformance came from asset allocation, 60% was from manager selection.

Yale has a skilled team and a rigorous process dedicated to finding the best managers – an edge that is much harder to duplicate. Yale’s clout and network gives it access to high-performing funds that aren’t available to many institutions, let alone individuals.

In his book, Unconventional Success, Swensen recommended just six core asset classes – domestic shares, international shares, emerging market shares, real estate investment trusts, government bonds and index-linked government bonds – implemented through cheap index funds.

- I think we can do better than that, though the basic point about the advantages of Yale remains.

Redwood

John Redwood was looking forward to a good year for profits as we emerge from lockdown.

The technology success stories of lockdown are now reporting huge gains in turnover and profits last year, justifying the way their share prices have rocketed. Sectors damaged by lockdown are now reporting some lift in sales and margins as they find ways to offer their goods and services in a socially-distanced world.

The banks are reporting better figures, as they made substantial loan loss provisions last year that are not currently needed. Oil and other commodities have bounced in price from the lows of last spring, helping the producers. Even hospitality and travel are seeing a few signs of improvement.

He doesn’t seem to have made any significant changes to the ETF fund he manages for the FT:

Fulcrum fees

In FT Adviser, Sally Hickey reported that Fidelity has scrapped its “fulcrum fees” due to lack of customer interest.

- Fidelity has decided that the VMF share classes are too small to manage cost-effectively.

These performance fees, also known as variable management fees (VMFs) were introduced on five actively-managed stock OEICs – Fidelity Special Situations, Fidelity European, Fidelity Asian Dividend, Fidelity Global Special Situations and Fidelity American – in July 2018.

- VMFs used three-year performance relative to a market index to flex the standard charge of 0.65% up or down by 0.20% pa.

I think that this amount of flex is too small to get people interested.

- I’d like to see funds with zero fees when they underperform the index, and a fixed percentage cut of any outperformance.

The only firm that I’m aware of with an approach like this is Orbis.

- They charge 1.1% pa plus 25% of index outperformance.

But if the fund underperforms, any accrued “sharing fees” are refunded at the same 25% rate.

Property funds

For Citywire, James Phillips warned that the Financial Conduct Authority (FCA) might ban retail investors from open-ended commercial property funds.

- The FCA is considering introducing withdrawal notice periods for such funds of up to six months but has decided to defer any decision until 3Q21.

The problem with such funds is a liquidity mismatch – the underlying assets are illiquid, but fund managers need to provide both daily pricing and daily redemptions of units.

- This requires a cash float, and when this is overwhelmed, the more liquid asset of the fund must be sold, concentrating the fund even further into illiquid assets.

This sort of spiral caused problems for Woodford’s equity income fund, which had too great an allocation to illiquid (unlisted assets).

- In contrast, shares in closed-end funds with illiquid assets can be freely traded on an exchange.

It’s not clear how notice periods would fix the mismatch since they still require assets to be sold according to a (slower) timetable.

- What they might do is make such funds ineligible for ISAs.

The FCA also plans to introduce a new kind of fund, the long-term asset fund (LTAF) first discussed by Chancellor Rishi Sunak in November 2020. The FCA said:

We think it unlikely to be desirable to permit an LTAF to be marketed directly to retail investors without any restrictions.

Hence the media talk of a “ban”.

- You might have to go via an IFA, take an online test, or self-declare as “sophisticated” – as per VCTs and EIS at the moment.

Moira O’Neill, of Interactive Investor, said:

Passing the buck onto sophisticated investors and advisers strikes the wrong chord. We would be interested to know how many people in frozen property funds were there because they took “advice”.

She would like to see investment trusts (ITs) take over in illiquid sectors:

ITs come with their own concerns, such as discount or premium issues. But they can be fully invested, and investors can buy or sell at the beat of their own drum, not someone else’s.

The FCA said that respondents to its consultation:

Did not think that Reits offered an appropriate substitute due to their price volatility’ and the fact investment companies can trade on premiums and discounts to net asset value (NAV).

The last thing we need is another kind of fund, and the second last thing is more many state investing regulations.

Quick Links

I have nine for you this week, the first five from The Economist.

- The Economist wondered whether we might be in a green bubble

- And said that sustainable finance is rife with greenwash

- The newspaper also looked at the Warner-Discovery deal and the future of streaming

- And explained why McDonald’s is supersizing its wages

- And how second-tier tech can thrive in the shadow of giants.

- Alpha Architect looked at the predictability of the value premium across asset classes

- And broke down ESG performance into E, S and G

- And wondered whether Ben Graham’s disciples are actually value and quality factor investors.

- UK Value Investor reported that the S&P 500 CAPE ratio is indicating an epic bubble.

Until next time.