Weekly Roundup, 17th May 2021

We begin today’s Weekly Roundup with a look at capital taxes.

Capital taxes

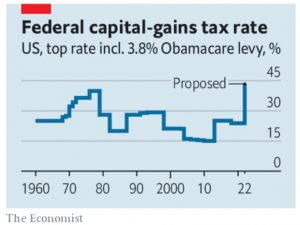

The Economist looked at the potential impact of Joe Biden’s proposed taxes on capital.

- His plan is to increase the top rate on capital gains and dividends to 39.6%, twice the average top rate in Europe (and significantly higher than in the UK).

- Corporate taxes would increase from 21% to 28%.

Comparisons are tricky, however:

The OECD does not publicly track members’ capital-gains-tax rates because exemptions and carveouts make them so hard to compare.

Biden’s new rate, for example, would only apply to the top 0.3% of taxpayers who earn more than $1M pa.

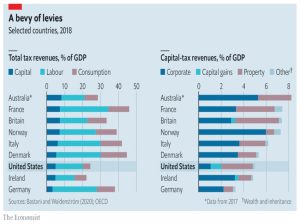

So instead, researchers look at the percentage of GDP raised by a tax.

- US capital taxes raised 5% of GDP in 2018, compared with an OECD average of 5.8%.

The US is unusual in having high property taxes and low corporate taxes.

- It has low taxes overall but within that, capital taxes already make up a relatively high proportion.

It’s hard to work out what effect the Biden changes would have:

Assessing how saving and investment respond to capital taxes is one of the most hotly debated topics in economics. Investors can choose when to sell assets, and therefore when to pay capital-gains tax.

In fact, closing an inheritance “loophole” (no CGT on death) might bring forward the crystallisation of gains.

Despite this, the newspaper projects a total increase in taxation of 0.4% of GDP over the next ten years, with 90% of this from corporate rather than capital taxes.

Lets’s move on to the moral argument:

Taxing savings and investment income can seem like unfair and inefficient double

taxation. Those who earn today to spend today must pay only income and consumption taxes; why should someone who prefers to gain by deferring their gratification face extra levies?

And the practical one:

Discouraging saving and investment hurts the economy in the long run. [An OECD] review ranked corporate taxes as the most harmful of four common taxes to economic growth. Economic models predict that Mr Biden’s business-tax plans would cut the size of America’s economy by around 1% by 2050.

The counter-argument is that without CGT, wages will be disguised as gains.

- The Economist quotes the private equity “carried interest” loophole, but I’ve never come across a way for UK individuals to pull off this trick. (( I’ve actually only used my CGT allowance once – during my divorce – though I expect to use it for my GIA in the coming tax year ))

Even the Economist calls for moderation:

Taxes on capital stack up. Before they can return their profits to investors in the form of dividends and capital gains, firms pay corporate taxes. Mr Biden should ensure that taxes on capital do not rise above taxes on labour.

They also recommend allowances for (re-)investment and exemptions for the normal rate of return, whatever that is – a beefed-up form of inflation indexation.

- But they are in favour of repealing the “no CGT on death” rule.

I’m not a fan of capital taxes.

- I started with nothing, and everything I’ve saved has already been taxed (or will be, in the case of pensions).

So the prospect of CGT deters me from any activity at all.

- But I’m not American, so Biden’s taxes won’t affect me directly, and only last week Rishi Sunak was making conciliatory noises about not necessarily having to raise UK CGT.

Let’s hope so.

Property

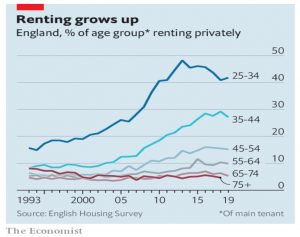

The Economist worried that people who never buy houses will become expensive problems.

There have been three been shifts in the UK housing market:

- After World War II, lots of council houses were built and the private rented sector (PRS) declined

- In the 1980s, Thatcher started a sell-off of council houses to their occupiers, at a discount; mortgages also became easier to obtain, so homeownership rose

- By the late 2000s, house prices (particular in the south) were so high that people were unable to leave the PRS for ownership at the end of their twenties

Private renters are more numerous once more, and older.

- The worry is that mid-career renters will become retired ones, whereas right now less than 5% of over-65s are private renters.

The issue here is that most retirement advice assumes homeownership, and hence lower outgoings in retirement (as a mortgage is paid off).

- Royal London calculates the difference in required pension pot at £185K, a bargain compared to the average UK property price of £249K.

And most people will miss the lower target (of £260K) in any case.

With too few council (and housing association) properties to go around, taxpayers will be subsidising these retirees through housing benefit.

It’s also the case that renters vote Labour, so the Tories need to convert more people to homeownership.

- To encourage this, they have introduced a state guarantee on 95% mortgages.

The Treasury is now offering to insure new mortgages with LTV ratios between 91% and 95% that are used to buy homes worth less than £600,000. (( The insurance only runs to the first 20% loss by the lender ))

This scheme has the happy by-product of keeping house prices rising, which is another factor in persuading homeowners to vote Conservative.

- The average first-time buyer needs to save 70% of their income to reach a 10% deposit, so the guarantee will help those unable to lean on the Bank of Mum and Dad (BoMaD).

However:

A flurry of 95% LTV mortgages is unlikely. There is no clamour for them from would-be borrowers.

The Help-to-Buy scheme has supported 95% mortgages since 2013, but almost half of its users choose to have a larger deposit.

- And some building societies have complained about the new scheme’s securitisation restrictions.

The other problem is that lenders can only allocate 15% of lending to mortgages over 4.5 times salary (the average multiple in London is 5.4). (( I find these numbers scary – back in the 1980s it was impossible to borrow more than 3 times my salary, but I would have done if I could have ))

- So there will be more take up of the new scheme outside London, and even then the lenders have another cap on loans above 85% LTV.

And borrowers need to pass a repayment stress test where interest rates rise by 3%.

- So perhaps the new scheme will be a flop.

And perhaps that is good news – Joachim Klement said that guaranteeing mortgages is not a great idea.

- Joachim is from Germany, where lots of people rent, and he finds the British obsession with property ownership baffling.

He says that 95% mortgages are not offered for a good reason – they are toxic.

People who cannot afford a 20% down payment on a house shouldn’t buy one in the first place.

A study of the US market found that default rates and delinquencies are remarkably stable.

It wasn’t that the housing crisis of 2006 to 2008 triggered a massively higher delinquency rate. There just were more subprime mortgages outstanding where homeowners defaulted.

I’ve been saying this for a long time, but most people don’t believe it.

A 10 percentage point reduction in the down payment led to a 22.7% increase in the delinquency rate. For the 15 percentage point reduction the UK government will introduce we can thus expect something like a 34% increase in delinquency.

This looks even worse when you discover that a 1% increase in the interest rate only increases delinquency by 1%.

Nanny state

This weeks instalment in the story of the creeping financial nanny state is the news that investors over the age of 55 who want to access their pension cash might have to sit through a compulsory 45-minute guidance session from Pension Wise.

- Josephine Cumbo wrote about it in the FT.

At the moment, pension providers tell you about Pension Wise as part of the “warm-up” process before you access your money.

- But only one in five of the 430K people who access their pensions take up their free appointment.

Richard Parkin, a non-executive board member of the Financial Services Compensation Scheme, said:

Requiring people to have taken guidance or actively opted out of doing so, before accessing retirement savings, has always made sense to me. Putting people through a process of having to consider guidance would provide another opportunity to highlight the prevalence of scams.

Investment scams are included in the risk factors which providers need to raise with clients accessing their retirement savings but, in my experience, these risk warnings often don’t actively engage consumers and are seen as a hurdle to get over in order to access benefits.

As would a compulsory Pension Wise appointment.

There are obviously a lot of pension scams around, and many people would benefit from free guidance.

- But compulsion is not the way.

I’ve written many times before about how difficult it is to get hold of your own money from a pension.

- Please don’t make it even harder.

The Department for Work and Pensions seems happy with the status quo, which is that providers must offer to book a Pension Wise appointment for customers, who may then opt-out.

- This was only introduced last year.

At the moment, this idea is just a thought bubble from a member of the FSCS board.

- Let’s hope the FT is overreacting.

Car crowd

The latest asset class to receive the crowdfunding treatment is classic cars.

- The Car Crowd lets you buy shares in classic cars, which are then listed in a directory “to unlock work in TV shows, Films, Press and Corporate Events”.

They also seem to organise visits to see “your car” at shows and track events.

- Owners can vote on when to sell a particular car, and there’s a matched bargain secondary market if you want to get out (no guarantees).

I couldn’t find any info on fees, and some of the (very few) cars listed on the side were pretty ordinary.

The setup reminds me of Masterpiece, the art marketplace that we looked at last week.

- Risky, unproven, and probably for aficionados only.

Quick Links

I have just three for you this week:

- On Medium, Stephen Foerster looked at Bitcoin’s Risk and Return in Charts

- Pragmatic Capitalism wondered whether the dollar might lose reserve currency status (as Stanley Druckenmiller has suggested)

- And Musings on Markets looked at investor taxes and stock prices.

Until next time.