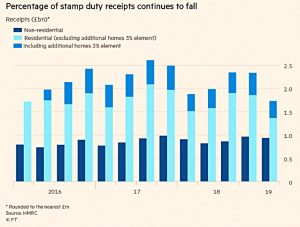

James Pickford reported that stamp duty receipts have fallen.

- Stamp duty receipts are down 19% in 1Q19 compared with 4Q18, or a more measures 8% compared to the same period last year.

+Sales of homes in the £1M to £2M bracket in particular have slowed. – transactions are down 14% on 1Q18.

- The FT puts this down to a “Brexit effect” but maybe its just he punitive rates of duty applied at those levels.

And the prospect of a communist Labour government is probably also a factor.

Only 65% of residential transactions were liable for stamp duty.

- First time buyer relief on purchases below £300K is largely responsible.

Equity release

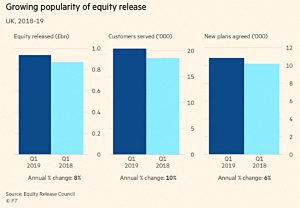

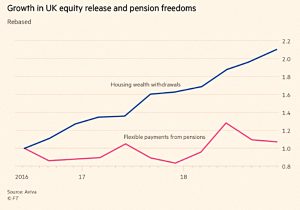

Lindsay Cook reported that record numbers of homeowners are accessing the value tied up in their homes to fund their retirement.

Last year, a record £3.94bn was raised by 83,000 homeowners over the age of 55. Yet the figure could surpass £5bn in 2019 after figures released this week by the Equity Release Council showed the strongest start to any year on record.

Homeowners can usually release from 19% to 50% of the value of a home worth more than £70K, depending on their age and health.

- The money can be taken as a lump sum, in slices via “drawdown” or as a steady income.

Interest rates are usually fixed at the start of the contract, and don’t float with the Bank of England rate.

- The average interest rate is currently 4.2% pa.

Many borrowers opt to roll the interest up until the last borrower dies or enters a care home.

- But no negative equity guarantees mean that the amount owed can never exceed the value of the home.

Some contracts are portable if the owners later decide to downsize, and other ring-fence a proportion of the property’s value to be passed on as a bequest.

I’m not a fan of debt, other than a mortgage on the house you live in.

- While equity release is another loan secured against the same asset, the fact that most people choose to roll up the interest until they die makes it a difficult product to support.

Men vs women

Isobel Owen looked at whether women are better investors than men.

- This is a difficult question, and perhaps one that is pointless to answer.

The first point is that each investment journey is different.

- We have personal goals, risk tolerances, cash flows and pot sizes, and we invest through different business and market cycles.

- You can’t just look at two outcomes and decide who is best.

Next, regular readers will know that I am not a fan of identity politics.

- I believe in group characteristics, but question their usefulness in telling us much about an individual who is a member of a group.

So even if we could prove women were better, how would that help when we next come across a female (or male) investor?

The next problem is the statistical one:

- It’s hard enough to prove whether you yourself are a good investor, or even whether an undisputed genius like Warren Buffett is a good investor.

We just need too much data to be sure one way or the other.

The third problem is self-selection.

- For whatever reason, fewer women than men are serious investors, so it’s quite possible that only the women who are good at it get involved, or stay the course.

And then there are data distribution issues.

- Many studies show that men exhibit greater variability of performance, with fatter tails than women (more Nobel prize winners, more criminals).

So even if the female mean was higher, the best investors could still be men.

So with those caveats, what has Isobel found?

Warwick Business School looked at 2,800 investors with the Barclays Smart Investor platform.

- The split between women and men is not provided, but it’s not a good start – despite the name, the Barclays platform is not the choice of smart investors.

Men beat the FTSE-100 by 0.14% pa, whereas women beat this dodgy benchmark by 1.94% pa.

- In a separate study, HL found that women beat men by 0.81% pa.

Which does make you wonder why so few women are active investors.

- 55% of UK women have never invested, compared to 37% of men.

In terms of behaviours, there were two main findings.

First, women are more risk averse.

- This can be a good thing – it means that women have no interest in the “lottery” stocks that some male investors are drawn to.

- But in practice it tends to also mean that women favour cash, which is a bad choice over the long run.

Second, women trade less frequently, which is usually a good thing.

We’ll leave it there for today.

- I think the jury is out, and should probably stay out.

Crypto

Gillian Tett wrote about crypto, and bitcoin in particular.

- She covered a recent study by multiple universities which concluded than cryptocurrency decentralised exchanges (DEXs) have become infested with bots.

Like high-frequency traders on Wall Street, these bots exploit inefficiencies in [DEXes], paying high transaction fees and optimizing network latency to front-run trades.

I’m not sure this is that big a deal:

- Although HFTs make a lot of money, they don’t massively impact the returns of long-term traders.

- Crypto remains far from mainstream, and if / when it does become so, we can expect better exchanges – with comparable levels of regulation to current stock exchanges – to emerge.

The Economist also had a crypto article – this time it was about Tether.

- This currency is the dominant “stablecoin” and is supposed to have dollar parity, but fell to 97 cents after allegations of misuse of customer money.

- The New York attorney-general claimed that $850M of the $2.8 bn currency had been lost by Bitfinix (the Tether exchange).

Tether is now back at a dollar, and Bitcoin has steadied at $5,400.

Tether is important to the crypto ecosystem, since banks don’t like to trade with crypto exchanges, which makes them permanently short of dollars.

- Tether acts as a substitute, providing liquidity to the other crypto markets.

The Economist notes that the Bitcoin price on Bitfinix is 6% higher than on other exchanges, which suggests that traders are trying to get out of Tether.

Corbyn watch

The newspaper also reported on efforts by the rich to protect their wealth from a potential Corbyn government.

- The odds of Labour taking power seem much lower to me than in 2017 or 2018, but with Brexit, anything could happen.

Apparently a lot of people have been buying property on Guernsey, which has a flat 20% income tax rate.

- That doesn’t feel safe enough to me – Corbyn could change the rules for the Channel Islands.

It’s not really the super-rich who need to worry.

- They can move most of their money abroad, wait for the UK economy to crash, and then come back and buy assets on the cheap.

With the rich gone, it’s the middle class who would pick up the tab for socialism.

- Apart from increases in income tax, CGT and IHT, we also have a financial transaction tax to look forward to, and perhaps even a wealth tax.

- Capital controls are also likely, though Labour denies this.

Countermeasures include passing on property to children, lining up a second passport, and vesting tax-free cash from pensions.

Stocking with Labour, The Times reported that Corbyn plans to nationalise the water utilities on the cheap.

- The firms have a market cap of £44bn, and a value of £90bn if debt is included.

- OfWat values the industry’s assets at £73 bn.

According to a leaked Labour briefing paper:

Shareholder investment on the books of UK water and sewerage companies is less than £20bn.

We think this is a better place to start than market values because it reflects how much shareholders have actually put into a company, and doesn’t incorporate future expected profits, which will not exist under public ownership.

You have been warned.

Competitive edge

Buttonwood looked at how to find companies with a moat.

A company with a lasting competitive edge [is] the philosopher’s stone of business strategists and stockpickers. Its profits are secure because other companies cannot easily replicate what it does.

This is the Buffett approach, and comes in two flavours:

- Niche monopolies like newspapers (in the 1970s) and railways.

- Brands and customer relationships (Amex, Coke, Gillette, Wells Fargo and now Apple).

The second type is getting harder to find – Buffett went wrong recently with Tesco, Heinz and Kraft.

- Facebook, Amazon and Google seem to fit the bill, but Buffett is wary of tech and the threat of government regulation hangs over these firms.

As with most investing, buying firms with moats is “simple, but not easy”.

If it were easy, everybody could do it.

Pension vs property

Each week the Sunday Times carries an interview with a “celebrity” about their relationship with money.

- One of the questions is always “What’s better for retirement – property or pension?”

Almost everyone answers property, though this is clearly the wrong answer.

- Most weeks Merryn Somerset Webb tweets about this, but last week she went one better and wrote about it in her MoneyWeek blog.

The unfortunate victim was Michael Fabricant MP, who said:

Property. I’ve made a bit of money on my London flat.

Merryn points out that his 26 years as an MP gives him an inflation-linked pension of around £50K.

- This would cost £2M to buy on the open market, but handily comes in under the £1.05M LTA because of the generous 20-to-1 scale up for DB pensions.

Quick links

I have six for you this week:

- Flirting With Models looked at Tactical Portable Beta.

- The Economist thought that the resignation of the UK’s shale-gas tsar was a big setback.

- And looked at Tech’s raid on the banks.

- The FT said that markets have been becalmed for too long.

- Alpha Architect took a Deep Dive into the Value Factor, and

- Financial Planning said that Boring is good investing.

Until next time.