Weekly Roundup, 4th July 2017

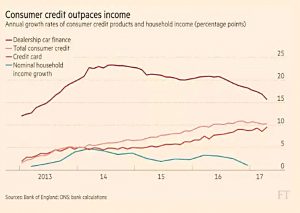

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about consumer credit.

Contents

Consumer Credit

Gemma Tetlow reported that growth in borrowing is outstripping wage growth.

- Total consumer credit grew by 10.3% in the year to May.

- Car financing remains the fastest-growing sector, though the growth rate is slowing.

Default rates on such loans have been low recently, but the Bank of England is worried that lenders have started to relax their lending criteria, increasing risk.

- Banks could be exposed by defaults, and a stress test had been brought forward to September.

Another possibility is that stretched households will repays their debts, but reduce other spending, hurting the wider economy.

Mortgage debt remains seven times larger than consumer credit, but losses on this form of borrowing have been ten times smaller over the past decade.

- Despite this, the Bank has introduced further affordability checks, which assume interest rates rising by 3% pa.

Overall debt remains lower than before the financial crisis, but the Bank worries that this is concentrated amongst a minority of households, with some having unsustainable levels of debt.

Trust reporting rules

Vanessa Houlder wrote that new rules would increase the reporting burden on family trusts, which are usually used to structure the inheritance of assets.

- I don’t know too much about trusts at the moment, but they are on my list of things to find out more about.

A new register will include the assets in the trust and the names of trustees and beneficiaries.

- The register will need to be updated each time the trust makes a tax return.

Here in the UK only law enforcement agencies and HMRC will have access to the information, but most EU states have plans to make them public, raising privacy concerns.

John Lee

John Lee has turned 75 and celebrated 60 years of investing.

- Last week, he gave another of his regular updates on his portfolio.

There were four transactions to report:

- He sold some of his large holding in Treatt, which has continued to go up in price

- He bought MP Evans, MS international and Tarsus.

MP Evans is a special situation, with John anticipating another bid from KLK of Malaysia.

Borrowers’ market

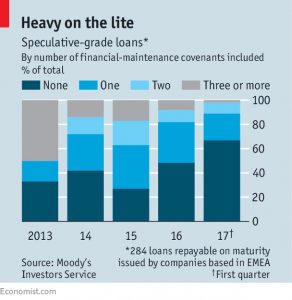

Over in the Economist, Buttonwood was worried about over-exuberance in corporate lending.

Before the financial crisis, loans were cheap and plentiful and had few covenants (restrictions) attached.

- The crisis changed all that, but now such loans are back.

- “Covenant-lite” loans are up to more than two thirds of the market, from 27% in 2015.

This is a sign that investors are desperate for yield.

- CLO (bundled loans) issuance in 2017 to date is double the amount in the same part of last year.

- And Argentina got a 100-year bond away last week (albeit at 7.9% pa).

Investors believe that the global economy is doing well, and the default rate on speculative bonds will continue to fall.

- But what will happen when the central banks start to raise interest rates and trim their balance sheets.

Minimum wage

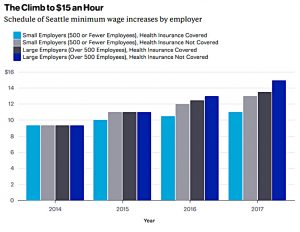

On Bloomberg, Noah Smith looked at the effect of the $15 / hour minimum wage in Seattle.

- The general consensus recently has been that high minimum wages have no effect on employment.

But an alternative negative effect might be that employers would cut a worker’s hours.

- And the University of Washington has just reported that hours worked by restaurant staff have fallen.

- And the fall was large enough to cancel out the effect of the minimum wage being increased.

It’s possible that workers moved into better-paid jobs – potentially as a result of the higher minimum wage – and had less need of low-paid work.

- So more research will be needed.

But the charge in the US towards a national $15 / hour minimum wage should at least be paused until this happens.

- I’m not holding my breath.

Elephant chart

Next, a quick plug for Branko Milanovic and his elephant chart, which was featured on PBS.

- As you might remember, the chart shows income growth during globalisation (broadly the last 30 years) against global income percentiles.

People below the 70th percentile (in developing countries, particularly China) have done well.

- Those in the 80th and 90th percentiles (poorer people in developed countries) have not done well.

This feeling of being caught by people in the developing world and left behind by the rich in their own countries is one of the reasons behind populism, Brexit and Trump.

Branko is giving a free lecture at the LSE tomorrow night, which I’m hoping to attend.

- Please don’t everyone go, or I might not get in.

Twitter pics

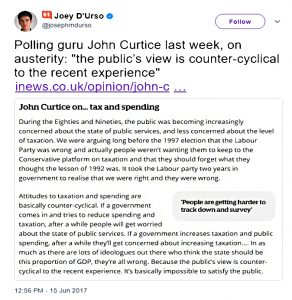

I have six pictures for you this week, the first of which makes me sad.

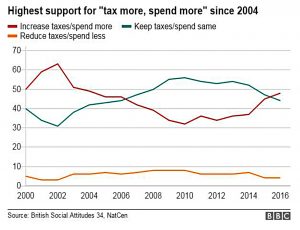

Support for tax and spend policies is increasing in the UK.

- Even worse, support for reducing taxes and spending less – my own preference – hasn’t breached 10% since the year 2000.

Joey D’Urso and John Curtice had some words of comfort for me:

- It seems that attitudes to taxation and spending are countercyclical – the people want the opposite of whatever they’ve had recently (making them impossible to satisfy).

The only problem with this is that the recent period of “austerity” has resulted in lower spending, taxation or borrowing.

- So we don’t have the usual low base from which to raise.

The FT reported that the household savings ratio has reached an all-time low of less than 2% of disposable income.

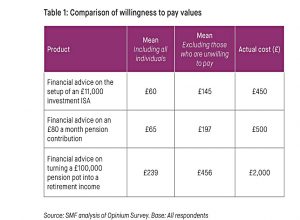

A survey found that most people don’t want to pay for financial advice, and those that do would like to pay around a third to a quarter of what the professionals actually charge.

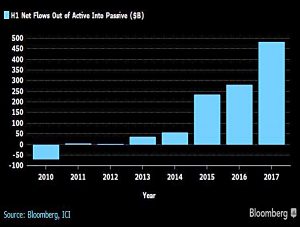

The flow of money from active funds to passive is accelerating. (( Note that this graph compares only the first half of each year, and has no data for the second half ))

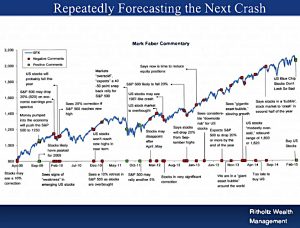

And Ritholtz poked fun at perpetual doomster Mark Faber.

- I included this not to run down Mark, but to illustrate how hard it is to predict what the market will do next.

Until next time.