Weekly Roundup, 3rd August 2020

We begin today’s Weekly Roundup with a look at the UK property market.

Contents

Property

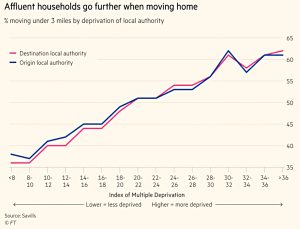

In the Chart That Tells A Story, James Pickford wrote that affluent households move further away when they change homes.

- In particular, those from more deprived areas are much more likely to move less than three miles away.

On average, 50% of renters and buyers stay within this distance, with Londoners least likely to do so.

- The study is by Savills, and uses 2017-19 data from Experian and the ONS.

The obvious explanations are work, schools and family and social networks.

- Retirement hotspots also play a part in later life.

Covid-19 might be expected to impact this pattern, as everyone flees the cities in search of more space to support greater home-working.

- But in practice, the more affluent will have more options when making this change and so are probably more likely to achieve it.

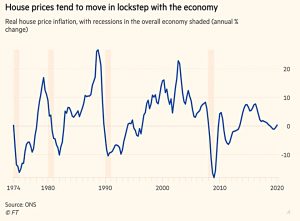

James’ second article looked at how the stamp duty holiday (on properties to £500K, until 31st March 2021) could provide a short-term boost to the property market.

- But in the longer-term, the looming recession is more likely to spoil the mood.

Rightmove, the property website, has seen inquiries to estate agents surge by 49 per cent in the week [after the announcement] for homes priced between £400,000 and £500,000.

- And Nationwide reintroduced the 90% LTV mortgages that it withdrew earlier in 2020, but said that they would be subject to “enhanced lending criteria”.

Of course, a temporary holiday is likely to bring forward transactions from the future but may lead to a slump later on.

- And those people who took advantage of mortgage treatment holidays may find it harder to finance a move.

When the stamp duty holiday ends, we will be five months past the end of furlough payments, and the economy could look very different.

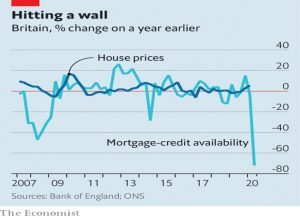

The Economist reported that although activity has bounced back, it’s getting harder to borrow.

According to Rightmove, the average asking price is now 2.4% above where it was when the lockdown began and buyer inquiries are up by 75% year on year.

But June transactions were still down by a third on 2019, and the OBR is forecasting price falls of 8%.

Rising unemployment, a possible no-deal Brexit and the end of the stamp-duty cut all suggest there will be a difficult start to the new year. The housing market’s immunity to covid-19 is unlikely to be permanent.

Mutual fund performance

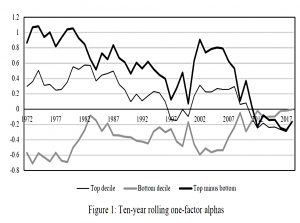

In his Bloomberg newsletter, John Authers reported that the enduring outperformance of mutual funds has disappeared.

- Whilst a previous study from 1997 showed some persistence of returns, a new study from James Choi of Yale finds none.

The outperformance disappears after the 2008 crisis, which leads me to believe this is another “ruler” phenomenon.

- When the best-performing assets are the largest stocks in the biggest market (US tech for the last decade) then no-on if going to outperform against the market-cap indices.

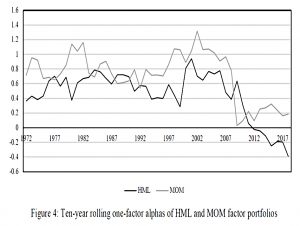

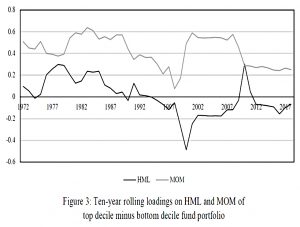

Value (HML) has turned negative and momentum (MOM) outperforms by much less than it used to do.

So the top-performing funds have lower loadings to these factors (particularly value).

John offers two reasons for the decline of active management:

- There are fewer amateurs (retail investors) to take advantage of, and

- Cheap computing has made factors easier to find, use and erode away.

The new economics

The Economist notes the “desperate scramble” by governments to pass legislation that would have seemed heretical a few months ago.

- But the extreme level of state intervention in economies and markets comes with risks well as opportunities.

There are four features of the new regime:

- Huge and seemingly limitless government borrowing

- 17% of GDP or $4.2 trn this year

- Money printing ($3.7 trn)

- This has been mostly used to buy government debt, keeping long-term interest rates low

- Buying of corporate bonds

- The Fed and the Treasury now own 11% of US business debt

- Low inflation, which means that interest rates can stay low (and government debt can stay high)

And if inflation never returns, the new regime will become the new normal, even after (if) the pandemic recedes.

The good news is it is now cheap to borrow in order to build infrastructure.

- But even with continued low inflation, lobbyists and unions will wrestle for control of the new machine.

With low interest rates making independent central banks impotent, the Economist thinks that either deeply negative rates, or the delegation of fiscal rules to technocrats will be needed.

- The newspaper has a lot more detail in a briefing paper.

Digital cash

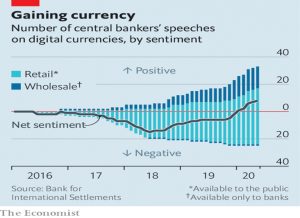

The Economist looked at the growing central bank interest in official digital currencies, which could be used to support negative interest rates.

- So-called central bank digital currencies (CBDCs) would never exist as coins or bills, but only as electrons.

Central bankers are discussing the concept more frequently, and they are more positive about it (see chart).

- This is partly familiarity, and partly the urgency of moving away from cash provided by the pandemic.

But central banks also worry about the failure of online payment systems, and about a private system (from say Facebook or Tencent) becoming dominant.

- CBDCs could also act as a bridge between rival private systems.

Retail CBDCs would also allow transactions to be more easily tracked by governments.

- And they would make helicopter money (including disaster support and targeted consumption rebates) straightforward.

Finally, replacing physical cash with digital would support negative interest rates (incredible shrinking money).

Getting rid of cash entirely won’t be easy, and people could still us a proxy asset (like gold) instead of cash.

- And too many flavours of money would impact its basic (and very attractive) fungibility.

Digital tax returns

Anyone who has run a small company will be aware that since 2013, even the smallest firms have had to use software to submit “real-time” actually monthly returns of PAYE and NICs.

- Luckily HMRC provided free software suitable for smaller firms.

Since 2019, all VAT-registered firms with a turnover above £85K pa (the lower limit for compulsory VAT registration) have had to do the same for quarterly VAT returns.

- This time the government didn’t provide free software.

Companies had to choose between hundreds of private offerings, most of which were chargeable.

- It was enough for me to scale down my activities through my company and deregister for VAT.

Last week the Treasury announced that from 2022, all VAT-registered firms will be covered, regardless of turnover.

- And from 2023, individuals and sole traders with an annual income of more than £10K from business or property will also have to join the regime.

FCA crypto regulation

The Treasury also announced that it would like the FCA to regulate cryptocurrency promotions.

- The wild volatility in crypto prices (particularly Bitcoin), including a massive bull market in early 2018, has less to a lot of scam schemes.

I’m generally not a fan of more regulation, but I’m fine with this.

- Wierd and wonderful schemes designed largely to enrich middle-men are are something we could do without.

These include “mini-bonds”, insurance bonds and property development loans as well as crypto.

- On the other hand, a cheap ETF to track the Bitcoin price (or a basket of crypto) would be very useful.

Paying for care

The Guardian ran a story suggesting that the over-40s will be required to pay more in tax or NICs as insurance against case costs in later life.

- Alternately they could insure privately (assuming that a competitive market for such insurance could be developed).

If people could choose a lifetime cap on their contributions (effectively a voluntary excess) then such a system might prove quite flexible.

- But I’m not convinced that these risks can be easily assessed and underwritten.

Boris has promised to “fix the crisis in social care once and for all”, and presumably such a scheme could claim to do so.

- Matt Hancock is apparently keen on the scheme, which is a variation on how Japan and Germany fund care.

In Japan only the over-40s pay, but in Germany, everybody pays, including pensioners.

- The German toll is 1.5% of salary, plus 1.5% from employers or pensions.

In Germany, the money forms a pot that can be used towards your own care in your home, or towards a care home for yourself, or even be used to care for relatives and friends.

- But the article suggests that a Japanese approach (pooled, over-40s only) is currently the favourite.

It’s not clear at this stage whether the payments during a calendar year will be used to fund care in the same year, or saved until those contributing require care.

- I would assume the former since otherwise, the issue will take a generation to be resolved.

Quick Links

I have just four for you this week, two each from the Economist and Alpha Architect:

- Alpha Architect looked at Relative Skewness as a new risk factor

- And wondered whether systematic value was dead

- The Economist said that the collapse of air travel will reshape a trillion-dollar industry

- But noted that airlines could emerge from the crisis both leaner and greener.

Until next time.