Weekly Roundup, 30th March 2020

Today’s Weekly Roundup is once again mostly about the coronavirus and its impact on the markets.

Contents

Market outlook

There’s not much change since last week: everything is shut, the virus numbers are still getting worse and there’s not much in the shops.

- We had a market bounce this week, but it might not stick.

My best guess is that encouraging news from the UK is a week or two away (when we might be past the steepest point of the S-curve.

- We shall see.

In terms of investment, I still believe that the priority for most people should be making sure they have enough cash to last through the next six to eighteen months.

- Only then should you start thinking about coronavirus bargains – my initial watch list is here.

Calling the bottom

Bill Ackman, who runs listed hedge fund Persing Square Holdings (PSH) has called the bottom of the market.

- PSH closed its shorts last week, making $2.1 bn from the $27M in hedges it placed at the start of March.

In a letter to fund investors, Ackman described the hedges as “credit protection on various global investment grade and high yield credit indices.”

- This has been interpreted as bets that sovereign bonds would be bought and corporate bonds sold, widening the spread between the two sets of yields.

Ackman wrote:

Because we were able to purchase these instruments at near-all-time tight levels of

credit spreads, the risk of loss from this investment was minimal at the time of

purchase.

After the announcement, the fund is close to flat for the year, and up around 25% over three years.

First they came for the old

John Authers looked at the somewhat offensive trade-off between restarting the economy and more deaths, particularly of old people.

- He notes that recessions themselves lead to more deaths and shorter lives, quoting a paper from Philip Thomas of Bristol University.

This uses the “J-curve” technique developed for the nuclear power industry.

- A twelve-month lockdown would be needed to minimise deaths (it should be noted that the present lockdown is primarily designed to flatten the curve and delay deaths so that a ramped-up NHS can better cope with the peak level of serious infections).

But even those saved lives would be outweighed by the impact of a fall in GDP of 6.4% or more (which seems likely even with our shorter current lockdown).

- For reference, the 2008-09 recession led to a fall of 6% in GDP.

I can’t question the maths, but this is a slippery slope.

- I don’t (quite) fall into the at-risk group for this pandemic, but I might for the next one.

We are all in this together.

Stock Index Weights

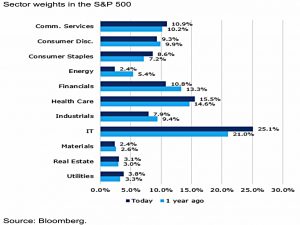

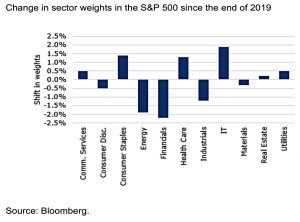

Joachim Klement has noticed that the crash has shifted index weights around.

The IT sector now makes up more than 25% of the S&P 500.

- Materials (mining) and Energy are now less than 5% between them.

Since the turn of the year, Financials, Energy and Industrials have shrunk.

- Health Care and Consumer Staples have been the big winners.

Over in the UK, Energy has dropped from 17% to 10% in a year, and Health Care is up from 9.4% to 13.5%.

Feedback

In the Economist, Bartleby looked at how not to give employee feedback.

- Woike and Hafenbradl looked at the impact of performance ranking using a “public goods” game in which participants can invest in projects, either individually or collectively.

Collaboration improved overall returns, but in one version of the game, investing individually led to an improvement in the relative ranking of the investor (though returns were lower).

- In one version of the game, feedback focused on individual performance relative to the group, and in the other, overall group performance, relative to a maximum score.

Information on individual performance relative to fellow group members led players to favour moving up the pecking order. They were willing to forgo guaranteed financial gains; achieving “status” was more important.

No surprise there. The authors note:

Ranking feedback prompts people to perceive even situations with co-operative outcome structures as competitive.

Which, of course, they are (in almost all organisations).

It’s clear that internal cooperation is beneficial to the organisation, but it’s not clear how to translate this into benefits to the employee.

- When “optimal” career development cannot be provided to everyone, how can workers be incentivised not to care about “losing out”?

Targeting low risk

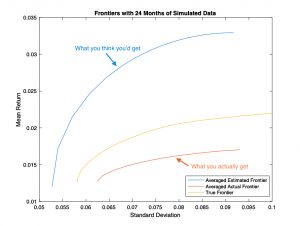

On Medium, Ewe Zi Yi explained why portfolio management should target low risk rather than maximum return.

- He starts by looking at Markowitz’s efficient frontier, which assumes that we have perfect information on asset returns.

In reality, what we have is some historical data (which Yi simulates using estimated parameters for the underlying model).

He calculates three frontiers:

- The true frontier — represents the actual portfolio return and standard deviation based on optimal portfolios determined using perfect model parameters

- The average estimated frontier — represents the estimated portfolio return and standard deviation based on optimal portfolios determined using estimated model parameters

- The average actual frontier — represents the actual portfolio return and standard deviation based on optimal portfolios determined using estimated model parameters

Here average means 1000 runs (Monte Carlo) for each month in his two months of simulated data.

- As the top chart shows, the estimated frontier is above the true frontier and the actual frontier is below it.

In other words, you think you will do better than the true frontier, and you actually do worse.

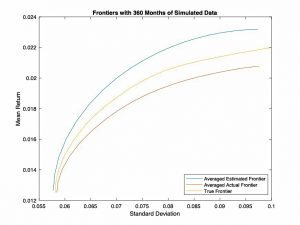

With more data (30 years) the curves move closer together.

- And in both cases, they are closer together where the standard deviation (risk, and hence also returns) are low.

The estimation errors encountered by aiming for a high mean return are much larger than those seen when we aim for a low standard deviation.

With imperfrect information, it is preferable to prioritise minimising risk to maximising returns with only imperfect information, so as to not overestimate the performance of your investment portfolios.

I think its a bit more complicated than that since few people will be satisfied with minimum returns.

- But it’s food for thought.

Quick Links

I have eight for you this week:

- Flirting with Models looked at the performance of trend equity strategies through the recent market rout

- Musings on Markets had part four in the Viral Market Meltdown series, this time looking at investing for a post-virus economy

- Klement on Investing asked Is value dead?

- The Economist explained how Visa became the top dog in global finance

- UK Value Investor warned us to brace for dividend cuts

- Alpha Architect looked at ESG and stock returns

- And also at whether the Value Premium is broken

- Finally, Flirting with Models provided One Hedge to Rule Them All.

Until next time.