Weekly Roundup, 5th February 2019

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about farmland.

Contents

Farmland

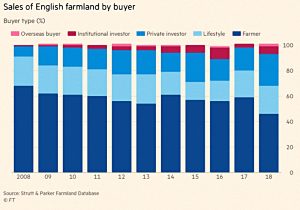

James Pickford noted that the share of farmland bought by actual farmers has fallen below 50% for the first time in a decade.

- The accompanying chart is a bit dodgy, as it doesn’t make clear whether farmers bought less or investors / lifestyle farmers / overseas buyers bought more.

- The chart shows sales of more than 100 acres, so I’m surprised that lifestyle farmers feature so heavily.

Investors buy land because it’s free from IHT (if actively farmed) and can be used to roll over capital gains.

Strutt and Parker, who carried out the research, say that the decline in the dominance of real farmers is mostly down to falling demand from them, due to Brexit uncertainty.

- The amount of farmland for sale in 2018 was up almost a third, at 190K acres – but that was driven by a few very large sales.

Despite this, prices rose 2% to £9.4K per acre, still down on the 1015 peak of £10.7K.

Better decisions

Jason Butler had a piece on how to make better financial decisions.

Here are a few highlights:

- He sits on the fence in the nature / nurture debate on financial decision-making.

- He thinks we have a short-term bias that comes from our distant and primitive past.

- Asking the right questions (how long will you live and how much of your life will be in good health, etc) is crucial to making the right decisions.

- Try to model potential future scenarios.

- Look at both the impact and likelihood of possible bad outcomes.

- More information might not help you to decide.

- The second-best choice is usually good enough.

- Regular reviews of your plan will maximise success.

The main problem with the article is that Jason comes out in favour of annuities as a safety net.

- Unfortunately, these are extremely expensive, and a poor use of your money.

2019 opportunities

John Lee felt that there were opportunities for stock investors in the wake of the correction in 2018.

John himself lost 12.6% last year.

- He even saw it coming, writing in March 2018 that he would be happy to end the year where he started.

But things could have been worse, as he sold 20% of his portfolio.

- James Fisher, UDG Healthcare, Quarto, and PZ Cussons were sold.

- And Gooch & Housego and Treatt were trimmed.

John hopes that the trend towards premium drinks noted by Fevertree (which he doesn’t hold) will spill over to his large remaining holding in Treatt.

John has been reinvesting in his favourites rather than seeking new investments.

- He’s bought more Daejan, Titon, Air Partner, Charles Taylor, Christie and Tarsus (in which he has now mad 37 purchases).

John is back down to 3% cash in his ISA.

Bad defaults

Merryn Somerset Webb warned against letting your money default to a bad deal.

Hargreaves Lansdown has just produced a report comparing the average returns from default pension funds to the average return from the top 10 most popular funds [chosen by the 19,000 investors who opted out].

The actively made choices outperformed the defaults by an average of 4.1% over the past five years.

HL worked out that a 22-year-old on £30K pa, saving 8% pa until age 68 would end up with £187K.

- This assumes charges of 0.75% pa and returns of 5% pa.

- Note that the 8% contribution rate will be the workplace minimum from April 2019.

If the return went up to 6%, the pot would end up at £243K – 30% more.

Merryn notes that default cash savings rates are also awful – so open a Marcus account (paying 1.5% pa) instead.

This is how capitalism works. If you shop around you get an OK deal. If you don’t, you don’t.

Less good is the 14% of revenue (£33M) that HL makes from not paying must interest on cash in your ISA or SIPP.

- Their “Active Saving” cash product is not available within the tax wrappers.

Cash is a perfectly valid asset class to hold and you are as entitled to receive returns on it as you are to the returns on any of your other assets.

Merryn suggests that we write to our providers (or tweet to them) to get the situation in ISAs and SIPPs remedies.

- Voting with our feet is not an option here, as there are no “good” providers to move to.

Fantasy dividends

Neil Collins looked at the UK firms that are paying out dividends that they can’t afford.

He focused on Vodafone, whose payout of 13.1p gives a yield above 9% pa, but identified five poor companies with the same issue:

- BT

- Glaxo SmithKline

- Centrica

- Standard Life Aberdeen, and

- SSE.

Fed pivot

Michael Mackenzie wrote about the Fed pivot.

- The Fed is no longer signalling future interest rate rises, and will consider slowing the rate at which its balance sheet shrinks.

Michael saw the U-turn as a necessary step as the global economy slows faster than expected, rather than a capitulation to Trump and the markets.

A decade after the financial crisis, debt levels have ballooned, particularly in EM and in the corporate world. China is enduring a credit crunch and trying to prevent a trade war with Washington.

At the same time, the UK jobs market remains strong, though inflationary pressures have eased a little.

- The housing market is starting to weaken and corporate earnings growth forecasts have been cut.

The risk premium on corporate bonds is also rising.

- Meanwhile rates on two- and five-year US bonds dipped below 2.5%

The bond market is suggesting that the central bank is at the very early stages of a pivot towards the next easing cycle.

A further decline in top-tier bond yields and inflation expectations would suggest the Fed has misjudged the cycle and already tightened policy too far.

Value investing

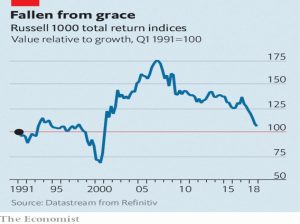

In the Economist, Buttonwood looked at value investing.

- It’s been a bad strategy for the past decade, as the graph shows.

Things have been slightly better over the last few months, but it’s probably not a new dawn.

- Low price to book sectors include carmakers, banks and energy firms.

Trade wars, emission scandals, electric vehicles, squeezed interest rate margins, and peak oil demand suggest that these might not be the best places to invest.

- Believers think this is part of the process – you buy problem stocks when they have problems.

Critics now suggest that book value is an overrated measure.

- It dealt well with firms based around machinery, but doesn’t cope with digital corporations.

Which means that value is increasingly a sector-based strategy.

Rent controls

Sadiq Khan is looking to get re-elected as London Mayor in 2020 on the back of rent controls.

- One in four Londoners rent privately, at an average cost of 40% of pre-tax income.

- And two-thirds of Londoners favour rent controls.

Luckily he would need legislation from central government, and the Tories are not keen.

MoneyWeek agrees with the Economist that rent controls are not the answer.

- They re-issued their article on the topic from 2015, saying that the arguments have not changed.

Britain had rent controls from 1915 to 1989.

- Between 1939 and 1957, some properties had their nominal rents frozen, leasing to a 60% decline in real terms.

- As you might expect, this meant few repairs and upgrades, and a smaller market.

National Labour policy is only to restrict increases within the life of a tenancy, not when a property comes back on to the market.

- This is the least damaging course that Khan could choose.

- But at the same time, there’s little evidence that landlords are gouging tenants on renewals.

The Mayor would be better advised to build more houses.

Hyperinflation

As the media peddles its “battle for Venezuela” line, the Economist suggested that the right kind of regime change could bring a quick end to hyperinflation.

- Venezuelan inflation was 100,000% in 2018, and is expected to reach 10,000,000% in 2019.

The causes of hyperinflation are usually budget deficits, high government borrowing and a weakening exchange rate which increases the cost of imports.

But most countries with high inflation (more than 100% pa) simply cut back borrowing and money growth (by limiting spending and raising taxes).

- Two thirds have avoided hyperinflation in the post-war period.

Tom Sargent, a Nobel prizewinner, argued that expectations of high inflation reflect candid assessments of government policy.

A credible policy shift can change expectations quickly and at little or no cost. Once a “regime change” occurs, hyperinflation ends in weeks.

Such a regime change usually involves a commitment to stop printing money, and an exchange rate peg.

- New political leadership also helps, as does money from outside (eg. the IMF).

Doctors pensions

Last week’s story on the impact of pension limits on doctors continued to run.

- The answer from the government appears to be a halving of doctors’ pension contributions.

Good luck with that one.

100% BoMaD mortgages

There’s been a bit of a row about Lloyds’ plan to offer 100% mortgages to youngsters who can arrange three years of underwriting from the Bank of Mum and Dad.

- They call it the “Lend A Hand” deal, and you can borrow up to £500K.

- Apparently Barclays has offered a similar “Family Springboard” deal.

Close relatives other than parents can also get involved, by locking away 10% of the property’s value into a Lloyds savings account for three years.

- It’s not clear what happens if the property is less worth than before at the end of the three years.

The hoo-hah is about the fact that those with rich parents will be able to afford more than those without.

- So basically the same as things were before this mortgage offer was released.

Frank Field MP has asked the Building Societies Association to respond by offering a deposit-free mortgage to those without parental backing.

- But surely such a product would involve a significantly higher interest rate, sapping the cash freed up by a move from renting to owning.

Both measures (one real, one imaginary) have the same effect as MIRAS used to have, and Help to Buy and LISAs do now – they help people to bid up house prices.

- At the risk of repeating myself, maybe we should build more houses.

And I mean houses – on streets, and not flats on “streets in the sky”.

Quick Links

I have ten for you this week:

- Flirting with Models said No Pain, No Premium.

- And looked at how to tighten the uncertain payout of trend-following.

- The FT reported on Mike Ashley’s “generational opportunity” on the high street.

- Alpha Architect defended Factor Investing.

- I was directed to an SSRN paper on Technicals vs Fundamentals.

- UK Value Investor talked about turnarounds, recoveries and transformations.

- And about excessive corporate debt.

- David Stevenson said that Cash is still King.

- And looked at some passive funds that live up to Bogle’s Big Idea.

- The Times lifted the lid on the £40M black hole at the heart of PatVal.

Until next time.