Weekly Roundup, 29th January 2019

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about UK household spending.

Contents

Spending

Nikou Asgari looked at the latest ONS data on UK household spending.

- Spending in 2017/18 was up to £29.8K per household, the highest since 2005 (adjusted for inflation).

Transport was the biggest cost, at 14% of the total.

- Housing, fuel and power came next, at 13%, along with “other”.

Nikou also mentioned separate data on savings and debt.

- The household savings ratio is the lowest since records began in 1963, and household debt has been rising over the past few years.

Persistent low interest rates are the most obvious explanation.

Nikou also looked at spending across age groups.

- Over 50s spent almost a quarter of their housing costs (no figure given) on improvements.

- Those under 30 spend £400 a year on takeaways.

Mortgage holders pay more than renters (£8.1K vs £5.6K).

- Bu they are richer, so mortgage payments account for 13% of their total spend, whereas rents make up 18% of renter’ payments.

Pension limits

Josephine Cumbo reported on the BMA’s complaint that the limits on pensions allowances are hitting doctors hard.

- We’ve discussed this before – the LTA cap of £1.03M on a pension has meant that more doctors are retiring in their early fifties. (( That’s effectively what happened to me ))

Now the BMA says that the annual limits are incentivising doctors to work fewer hours per week. and / or retire early.

I can’t see how this is good for the country, but tax cuts for those earning more than £100K – or those who have saved £1M – are never an easy sell.

- I think the LTA should be scrapped, but not just for doctors as a special case.

Financial date nights

Lindsay Cook recommended that we each take our partner on a financial date night.

- I have no intention of discussing finances on my date night, but I think we should all consider finding time to discuss Lindsay’s suggested agenda.

It’s not cheery stuff, mind – the central focus is your partner knowing what to do if you keel over.

- In most couples, one partner takes the financial lead, and they need to ensure that the other partner knows where the treasure is buried – in case you go first.

Here’s a quick checklist:

- Wills

- Lasting Power of Attorney

- List of locations of current funds (with account numbers and contact info)

- Dates when any actions need to be taken.

- Passwords (Lindsay uses Last Pass)

Lindsay also tipped me off to the Death Notification Service, which:

Has been created to allow you to notify of a person’s death to a number of banks and building societies (financial institutions) at the same time. Our aim is to make the process quick and easy for you to inform them at a time that suits you.

So that’s another thing for my list of 2019 financial resolutions.

Stocks will rebound

Ken Fisher was his usual optimistic self, reassuring investors that stocks will rebound from their losses in 2018.

Expect global stocks to rise 15 to 25 per cent or more this year, as a V-shaped rebound aligns with multiple positive factors. Don’t let the past blind you; 2019 will be great.

Ken notes that US stocks average 12.4% in the year after a down year.

- Consecutive negative years have only happened during wars and global recessions.

- December 2018 was the left-hand side of the V, and the right side should be along soon.

Ken also notes that 2019 is the third year of the Trump presidency, which is usually the best for stock markets.

- Returns have been positive in 91% of such years, averaging 17.8%.

- The last negative was 1939.

Ken puts the December slump down to the liquidation of 500 hedge funds.

- As usual, his advice is to stay fully invested.

Offshore loans

The FT seems to have decided that taxing contractors on the earnings they accessed via zero-interest loans from offshore companies is a “scandal”.

- Emma Agyemang reported on the thousands caught up in the “unfair” crackdown.

There’s not much new in the article, apart from a table breaking down the industries affected.

- 65% are the “business services” contractors with which I’m most familiar.

My position remains the same:

- Retrospective tax changes are always bad.

- Technically, the loan charge is not retrospective, since it relies on the loan still being in place for the tax year when the charge is incurred.

- But of course almost none of the loans will have been (nor were ever intended to be) repaid, so the impact is retrospective.

- The contractors I was familiar with at the time knew what they were doing.

- Essentially, they were trying to get around the then-new IR35 legislation.

QT

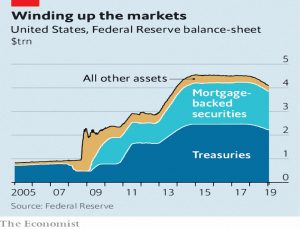

The Economist looked at the impact of the Fed’s unwinding of QE, a process known as quantitative tightening (QT).

- QT was intended to be dull, with a steadily increasing shrinking of the Fed’s balance sheet from October 2017.

When market turbulence hit a year later, many blamed QT.

QE reduced long-term bond yields, and encouraged investors to buy riskier assets (stocks) – so QT might eventually be expected to do the opposite.

- But the current plan for QT doesn’t get us back to where we started, and has not yet been fully implemented.

But perceptions matter, and if the Fed ignores the market’s interpretation, we can expect more turbulence.

- And anything he says about the pace of unwinding will ensure that minds remain focused on the size of the Fed’s balance sheet.

Bogle

Jack Bogle died last week, and there was a lot of coverage in the financial press, on the UK blogs – and even an obituary in The Times.

- Here are the links to the Economist article, and two from MoneyWeek (1 and 2).

Bogle founded Vanguard, and launched the first index-tracking fund in 1975, after reading a an article by Paul Samuelson.

- Index funds weren’t popular at first, but they are now, particularly with younger investors.

They are also usually very cheap, and have saved investors many billions since 1975.

- So there’s a lot to thank Bogle for.

Here are a few quotes from Jack:

In the fund industry, you get what you don’t pay for.

Nearly all those experts whom we identify as stars prove to be comets.

Don’t look for the needle in the haystack. Just buy the haystack!

I’m a fan of indexing – particularly as practised by ETFs (which Bogle didn’t like) – since it allows cheap access to a wide variety of assets and geographies as part of a core portfolio.

- But I’m not such a fan of the “set and forget”, one- two- and three fund portfolios that are popular with Vanguard fans.

They don’t offer enough diversification, have strange allocation schemes (to me at least), and are sub-optimal.

- On the other hand, they are easy to implement, especially for small portfolios.

I also take issue with market-cap weighting.

- It bakes in a “buy high, sell low” approach, and is outperformed by almost any other style of indexing.

Further, whilst the often quoted “active managers fail to beat index funds” is clearly true by definition, other rules that are clearly true (that factors like momentum, small size, value and low-volatility outperform, for example) are routinely ignored by the same investors,.

- Passive zealots claim that beating the index is not only impossible in aggregate, but also for the individual, despite much evidence to the contrary.

The criticism that index funds help to inflate bubbles (by buying more of what has gone up) is hard to sustain.

- An index fund of constant size would merely need to hand on to the stocks it holds.

- It’s new investors buying the fund that would force more purchases of the top stocks.

There is an argument that index funds make the market less efficient (since they don’t have a view on pricing) but this is countered by the idea that they displace “dumb money”, which could conceivably increase efficiency.

Bogle himself was concerned about the growth of Vanguard, Black Rock and State Street, who between them might:

Own 30% or more of the US market – effective control. I do not believe that… would serve the national interest.

More than 80% of the US market is now owned by firms managing more than $100M in assets.

- This is probably not good for competition.

Quick Links

I have dozens of articles for you this week, starting with Musings on Markets:

There are also three from the UK Value Investor:

- Reported earnings not adjusted earnings

- Capital employed growth not earnings growth

- Companies with thin profit margins make bad investments

There were lots of interesting pieces in the FT:

- Fullers is getting out of brewing beer

- Palladium is a catalyst for crime

- Investors have cooled on Metro’s business model

- Cyber breaches have exposed the limits of the insurance market

- Hedge funds are turning into family offices

- John McDonnell has been reassuring the City over capital controls

- Algorithms are an easy scapegoat for volatile markets

- How PatVal’s recipe turned sour

And a few in the Economist:

- The market for cyber insurance

- IKEA moves into the high street

- Can Mike Ashley save the high street?

And here are the rest:

- CFA Institute thinks that Popularity is the bridge between Classical and Behavioural finance

- Meb Faber looked at the Stay Rich Portfolio

- O’Shaughnessy Asset Management looked at how Negative Equity is eroding the Price to Book metric

- Two medical REITs are merging

- The rich are preparing to leave the UK if Corbyn becomes PM

- And James Dyson has already moved to Singapore for the same reason

- Goldman Sachs has bought an expensive stake in Nutmeg

- Flirting with Models looked at Drawdowns and Portfolio Longevity

Until next time.