Weekly Roundup, 21st November 2022

We begin today’s Weekly Roundup with rate rises.

US rate rise

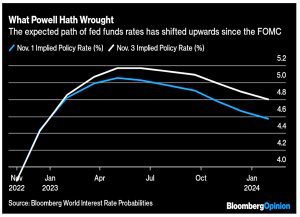

The Economist noted that the Fed delivered its fourth straight rise of 0.75% at the start of the month.

- Whether we get a fifth, or a slowdown to a 0.5% hike in December, will depend on the two inflation numbers before then.

This is now the most aggressive sequence of raises in 40 years (albeit late in starting).

- The peak is now expected to be at 5%, which leaves another 1.25% to go.

The neutral level is estimated to be around 2.5%, but with inflation at 8% and a hot labour market, that doesn’t matter.

- Markets expect a pivot in 2H23, but who knows?

John Authers noted that the statement accompanying the hike was quite dovish, stressing the smaller increments ahead.

- But after Jay Powell’s press conference, the S&P had given up a 1% gain and closed down 2.5%.

Powell said:

We still have some ways to go. The incoming data since our last meeting suggests that the ultimate level of interest rates will be higher than previously expected, and we will stay the course until the job is done.

The “dot plot” of future guidance was missing this time. (( It only comes out four times per year ))

To make such direct guidance about the likely future course of rates without a dot plot to back it up was very unusual, and signaled Powell’s determination to expunge any market belief in an imminent easing of rates.

Macro Alf (( Who is well worth following on Twitter and Substack )) called it “a pivot from hawkish to more hawkish”, quoting Powell:

It is VERY premature to think about a pause in our interest rate hiking cycle.

Alf had three takeaways:

- It’s very premature

- Higher for longer

- Over-tightening is better than doing too little

Prudent risk management suggests the risks of doing too little are much higher than doing too much. If we were to over-tighten, we could use our tools later on to support the economy. Instead, if we did too little we would risk inflation getting entrenched and that’s a much greater risk for our mandate.

Alf’s conclusion was “don’t fight the Fed”.

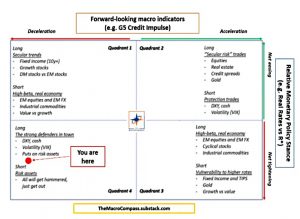

Alf uses an investing framework based around a quadrant that he calls the Macro Compass.

- The vertical dimension is monetary easing vs tightening.

- The horizontal dimension is credit deceleration v. acceleration.

We remain stuck in quadrant four, the worst quadrant.

Long USD cash, Long patience. Short almost any (risk) assets.

UK rate rise

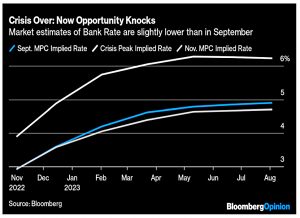

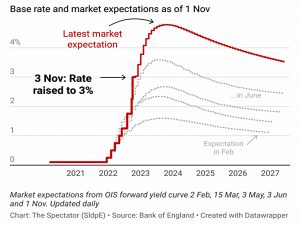

The UK also raised rates by 0.75% but tried to spin this as dovish. Andrew Bailey said:

We think (the) Bank Rate will have to go up less than what’s currently priced into

financial markets.

Rate expectations are back to where they were before the Truss/Kwarteng episode threatened looser fiscal policy.

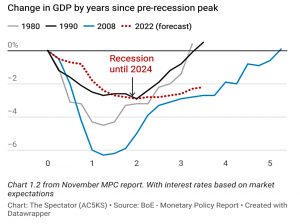

- The bad news is the BoE is now predicting a two-year recession (the longest since records began).

Combined with continued high inflation (driven by energy costs and other imports), demand could drop without UK rates getting too high.

- The beneficial consequence of that is that mortgage rates could peak soon, and there might not be too much damage to the housing market.

If this does happen, the BoE will have gotten away with things, since it consistently underestimated inflation until very recently.

In a Spectator newsletter, Kate Andrews notes that this predicted recession would leave people worse off in 2025 than before Covid.

Shaun Richards of Not A Yes Man’s Economics was harder on the Bank’s prediction of a lower peak rate.

It is not easy to express how stupid a statement that was. After all they had just made the largest interest-rate increase for many years and some decades. They could therefore have left the impression that they were going to defend the UK Pound as a way of helping to reduce inflation.

Arguing you have made the largest interest-rate increase for some time because you expect inflation to fall below target makes you look very unconvincing. We are expected to believe that we have had the largest interest-rate rise for 2 years because inflation is forecast to be on target and the economy will go into recession!

Shaun is scathing about the gap between interest rates (3%) and inflation (10.1% even for CPI) and on the logic of small rises (0.15%) followed by larger ones (0.75%).

Perpetuals

In the FT, George Soros recommended that Rishi Sunak issue some perpetual bonds.

Sometimes called “war bonds” or “consols”, perpetual bonds have a long history in the UK. They were first issued in 1752, and later used to consolidate the debt accumulated during the Napoleonic Wars.

George sees Covid as much worse than these wars.

The advantage of Consols to the government is clear – the principal never has to be repaid.

- The advantage to the purchaser is less clear.

It would also appear that the window to issue these has just closed – gilt yields have shot up over the past year and the bonds would be expensive.

- In fact, with no BoE buying to push down prices, perpetual might settle way above the current long end of the gilt yield curve.

George doesn’t see the high coupon as a problem:

The bonds can be redeemed (after a “non-call” period) and replaced with another perpetual bond with a lower coupon.

This could be harder than it sounds if interest rates haven’t fallen again, but if it was a feasible plan, then it sounds like another good reason for me not to buy a perpetual unless it had a very high starting yield.

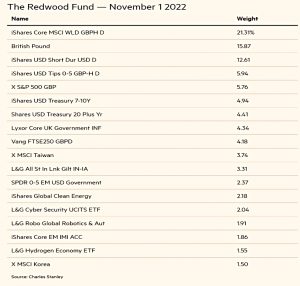

Redwood

In his regular FT column, John Redwood said that he was buying bonds rather than stocks.

- He thinks that the Fed is getting close to bringing inflation down.

Personally, I think that the current projected peak or around 5% won’t be enough and that we won’t see a pivot (rate cutting) until core inflation falls below the Fed rate (something that I hope will happen during 2023).

John admits there are risks:

The danger now is [the Fed] lifts rates too high for too long, which would turn

the coming downturn into a recession.

Things are worse in Europe (higher inflation, fewer rate hikes so far) but not quite so bad in the UK.

Bonds have fallen as rates have risen and now offer much better yields, so John is starting to buy US long bonds as diversification for his global stocks (a plan that wouldn’t have worked so far this year).

He has some regrets:

A Nasdaq ETF used to be the largest holding, which I cut back. It would have been better to have sold all the specialist digital as well.

He expects more earnings downgrades in the US and a drag on the global economy from Chinese lockdowns.

It is still not possible for markets to look forward to a shallow and short downturn followed by a good recovery. No advanced country central bank is yet ready to pause its actions to curb inflation and none will guide us to expect falling or even stable rates any time soon. Company margins have reached very high levels, and are likely to come down as the cost of living crunch makes consumers more cautious.

So he won’t be buying stocks for a while.

Two per cent

In FT Adviser, Miton fund manager Hugh Greives warned that we will never see two per cent inflation again.

He expects US inflation to fall relatively quickly:

Accumulated savings are now being spent and cash reserves are coming down. Supply chain disruptions have .improved as China emerges from lockdown. Fears of a wage-price spiral are misplaced: people are returning to the workforce and resuming training for roles in many sectors.

But he sees the 30 years of 2% inflation as an aberration driven by globalisation and Chinese growth.

- 3% to 4% will be the terminal rate, with implications for asset classes:

Interest-rate-sensitive long-duration assets are now far less appealing and investors’ attention will instead turn to shorter duration assets that are able to deliver income now.

Hugh also thinks that the US will avoid recession.

One major signifier of recession is defaults on mortgages and consumer credit arrangements. There is currently very little evidence of this.

The US has a lot of 30-year mortgages, so higher rates will only impact forced movers.

- The market might lock up, but it need not crash.

As a fund manager, Hugh has to be relatively optimistic, but I don’t – I think everything depends on how high the Fed goes.

- If they are prepared to drive up unemployment in order to kill inflation, then anything can break.

One thing that Hugh does worry about is the S&P 500:

The five largest stocks within the S&P 500 are all tech stocks, heavily reliant on international exports. The S&P 500 is not the US economy, and there is huge concentration risk within the S&P 500. This is not a safe place for investors to be, despite the continued health of the US economy.

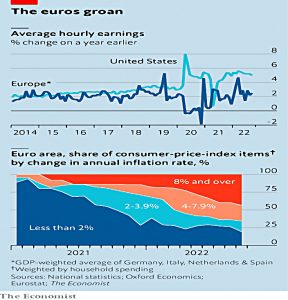

European inflation

The Economist worried that even a recession might not bring down European inflation.

- Inflation is at 10.7%, and we’ve had two 0.75% rate hikes so far.

The good news is no fiscal stimulus since Covid (unlike the US), though there has been energy price support.

- Lower energy prices will help, but slowly, since France has prices pencilled in for 2023 and Germany uses long-term smoothed prices (which will go up).

Prices for services and goods other than food and energy increased by an annualised 6% over the past three months.

It feels like inflation is spreading, as it did in the US a few months ago, and we might have wage rises to come.

The labour market remains tight because of production backlogs:

Manufacturing firms have on average more than five months of work on their order books.

And the workforce is ageing (and retiring).

- So if the looming recession is brief, inflation could remain, demanding the kind of interest rate rises seen in Germany in the 1970s.

Quick Links

I have just four for you this week, the first two from Alpha Architect:

- Alpha Architect looked at whether Active Managers are Subject to the Same Biases as Individual Investors

- And asked Is there a theoretical foundation behind industry and factor momentum?

- The Economist looked at The race to reinvent the car industry

- And Rob Carver said If you’re so smart, how come you’re not SBF? Kelly and bet sizing

Until next time.