Weekly Roundup, 29th October 2019

We begin today’s Weekly Roundup in the FT, with the Chart That Tells A Story. This week it was about current account switching.

Contents

Current accounts

I once read somewhere that people are more likely to divorce than to move their current account from one bank to another.

- Despite this, Katharine Gemmell (( still no picture )) reported that the Current Account Switching Service (Cass) have moved more than 1M accounts over the past 12 months (and 6M since it’s launch in 2013).

And I know from personal experience that they can’t help with every move, so the total number of moves must be more than that.

Nationwide was the big winner in 2Q19, but they’ve since dropped the high interest rate on their current account.

- Other winners include HSBC and NatWest (which I believe offered transfer incentives) and the FinTechs Monzo and Starling.

Losers are Halifax (part of Lloyds), Barclays and RBS.

- TSB has a much publicised IT failure and I think Tesco cut their interest rate.

I’ve never quite understood why some people pay so much attention to current account interest rates.

- My average balance is a fraction of a fraction of 1% of my net worth, and the highest-paying accounts always limit your balance to a few grand.

I stick my extra cash in Premium Bonds and a Marcus account until it is needed.

As for the FinTechs, I use three:

- Tandem for a cashback credit card that’s also good abroad,

- Starling for free company banking and a backup personal card for abroad, and

- Curve, so that any of my other cards can be in two places at once.

I can’t see the attraction of Monzo over Starling, but the kids love it, so the app must presumably be nicer – or it’s cooler in some other way.

My current account remains with the same high street bank that it’s been with for 40 years. (( And indeed, during that time I have been married and divorced ))

More Woodford

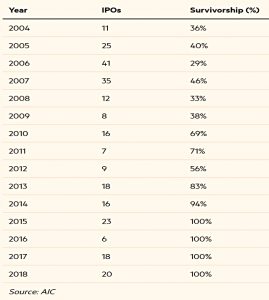

Emma Agyemang reported that the problems with Woodford Patient Capital (taken over this week by Schroders) have highlighted more general issues with big investment trust launches.

- Data from the AIC shows that not many pre-2008 launches are still around.

This does present something of a dilemma.

- For many of the asset classes and strategies where ITs have a good offer, the best funds will be well-seasoned.

But what about emerging themes (say, robotics or renewables)?

- Perhaps it would be better to dip a toe with ETFs here and wait for the ITs to prove themselves.

This can also be seen as a sub-set of the general IPO problem, of which more later.

Merryn Somerset Webb was also writing about Woodford.

- She used him – along with Adam Neumann of WeWork – as an example of “the modern bezzle”.

In both cases the disaster can be seen as a direct result of arrogance-driven overexpansion. And in both cases the influence of pushy personalities seems to have replaced good governance. In both cases, the founders have been able to jump ship as very rich men.

Woodford has made £60M from his business, small beer to Neumann’s $1.7 bn.

“The bezzle” is a term from JK Galbraith used to describe the period in booms between the embezzlement itself, and its discovery.

- Note that Merryn is not suggesting that either Woodford or Neumann did anything illegal.

Instead they are examples of the way our distorting easy-money environment can work to transfer large amounts of cash from ordinary savers to ridiculously overconfident individuals — a modern type of bezzle, the defining feature of which seems to be not so much theft from but lack of concern for the financial futures of those who support you.

She refers to loss-making IPOs like Spotify, Uber, Lyft, Beyond Meat and Snapchat as other examples.

- Too much cheap money looking for a home is the underlying cause, and Merryn fears that we’ll have to wait for an economic slowdown – which might not be far away – for things to change.

Uncertainty

Tim Harford looked at uncertainty.

- The human preference for known probabilities and issues seems entirely reasonable to me.

In the face of uncertainty – large, “one-off” uncertainty that won’t recur each year – optionality has value.

- But indefinitely postponing the resolution of major issues is the worst of all possible worlds.

Savings

Jason Butler wrote about a shop caretaker who built an $8M fortune.

He lived a lifestyle that cost much less than his modest income and invested the difference in a range of blue-chip, dividend-paying companies. He reinvested those dividends in more company shares and owned his shareholdings for a long time.

And that’s pretty much all there is to it – though he lived to the age of 92, which helped.

Green growth

Simon Kuper – whose writing about football I much prefer to his political stuff – looked at the myth of green growth.

Green growth probably doesn’t exist. We can be green or we can have growth, but we can’t have both.

IPPC targets require a 50% cut in carbon emissions by 2030, but emissions are still rising.

- And the world’s population is both growing and growing richer.

And when people have money, they convert it into emissions. That’s what wealth is.

To achieve green growth, we’d have to emit radically less carbon per unit of gross domestic product.

REN21 – a think tank – says that the carbon intensity of the global economy would need to fall 10 times faster than it currently is in order for temperatures to remain within safe levels.

- Renewable energy could be at 30% globally by 2050 – but it needs to be at 60%.

It’s true that European economies have become greener, but that’s largely by offshoring emissions to Asia.

- Electric cars and bans on plastic straws won’t save us.

Simon quotes William Jevons, who back in the 1860s noted that when things become cheaper, we use more of them.

- That’s why we have more cars, more flights and more shipping each year.

If we listen to Greta, we’ll need to ban almost everything that makes life worth living and suffer an extended economic depression.

- I agree with Simon that no electorate will vote to destroy its own lifestyle.

Human nature will always choose growth over the climate.

Business footprint

Jevons also popped up in an article by Schumpeter in the Economist which looked at whether business can tread more lightly on the planet.

- Andrew McAfee of MIT (and “The Second Machine Age” fame) has a new book out – called More From Less.

He thinks that mankind is reaching peak stuff – people consume more but business uses fewer resources to produce it.

- Because of this, he says that climate change fears are overblown.

Schumpeter thinks this is an oversimplification.

- Corporate use of resources is improving, through globalised markets and under pressure from governments and popular opinion.

But as Jevons points out, when something becomes more efficient, total consumption usually goes up.

- The Economist fears that some of the rich world’s “dematerialisation” is simply exporting manufacturing to less-developed nations.

By 2011, mobile phones were six times lighter than they had been in 1990.

- But instead of 11M, there were 6 bn in use, weighing 100 times more in total.

The way out of this paradox is regulation:

Governments can make citizens want less by making consumption pricier, with carbon taxes. Until they do, firms will try to sell more stuff—because most people want more of it.

IPOs

In a second article, Schumpeter argued that IPOs are a racket, but not easy to replace with something better.

The trick is to find an IPO price that satisfies the company but also stimulates buying—providing a “pop” on the first day of trading.

The trouble with the “pop”, though, is that it represents money left on the table that should by rights belong to the company’s sellers, not its buyers.

The average pop over the last decade has been 14%, to which can be added investment bankers’ fees of 7%.

- Yet auctions and direct sales of shares remain unpopular alternatives.

Investment clubs

Lindsay Cook wrote about investment clubs, which I’ve covered in a couple of previous articles – 1 and 2.

- My offer to run one still stands, if we can get a critical mass of readers together.

Quick links

I have just five for you this week:

- Alpha Architect looked at The Quality Factor

- And at Superstar Investors

- The Economist wondered whether Libra is doomed

- And looked at Dismembering Big Tech

- And Klement on Investing insisted that he was not a Grumbletonian.

Until next time.