Weekly Roundup, 12th November 2019

We begin today’s Weekly Roundup with the big story of the week, which was billionaires.

Billionaires

The Economist had a couple of articles in defence of billionaires – 1 and 2.

- UBS also reported that companies run by billionaires do better than peers with less wealthy chief executives.

After Elizabeth Warren proposed last week to raise her wealth tax on billionaires to 6% pa, Bill Gates pointed out that he had already paid $10 bn in tax.

- He wasn’t against paying another $10 bn, but Warren’s proposed $100 bn (over less than 20 years) wouldn’t leave much for him.

Social media went a bit crazy, and Bernie Sanders doubled down by saying he would take the $100 bn upfront.

- He says that billionaires “should not exist”.

Jeremy Corbyn has also said that a fair society would contain none and has singled out five “plutocrats” as targets in his speeches.

Wealth taxes have been tried before and usually fail.

- Only four countries have them today – Norway, Spain, Switzerland and Belgium.

Warren’s tax might raise 5% of US GDP initially, at least until people take countermeasures.

- She also plans a 40% exit tax on anyone renouncing US citizenship to avoid the tax.

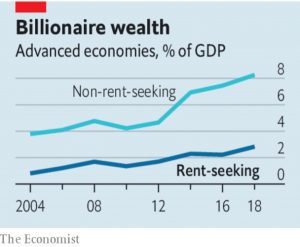

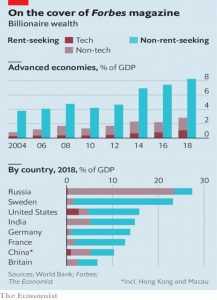

The Economist focused on challenging the idea that large personal fortunes are only possible when government policy has gone wrong,

- They acknowledge that weak competition has left corporate profits too high – Facebook and Google’s domination of online advertising is a good example.

But only one-fifth of US billionaires made their money in markets with weak competition.

- And acquisitions of startups by incumbents can produce billionaires directly through the mechanism of competition.

Warren’s tax – and Piketty’s proposed 90% levy – would stifle innovation, and impede the correct allocation of capital.

- And everyone would end up worse off.

The Economist has issues with inherited wealth (I don’t) and with overlong copyright protection for IP (me too).

- Billionaires are not the problem.

I’m a little puzzled by people’s obsession with the ends of capitalism’s bell curve.

- Surely it’s the middle that counts – and I can see that during my lifetime, the situation of the middle in the UK has improved immeasurably.

I’ve never had a problem with the billions earned by Gates or Bezos – good things have happened to the world as a result of their actions.

- If you think a billionaire is standing in your way, you probably have bigger problems to sort out, a lot closer to home.

Inequality

On a related note, in her MoneyWeek column, Merryn Somerset Webb looked at Ray Dalio’s claims that inequality in the US is a national emergency.

- US wealth is up to 550% of GDP and the one per cent has 20% of that.

James Ferguson of MacroStrategy points out that much of the rise in wealth comes from the bond market – as interest rates rise and defaults begin, a lot of this will go away.

- And people are living longer – older people are naturally richer and most don’t pass on wealth before they die.

So the bottom wealth quintiles are just the young.

IPOs

Merryn’s FT column was about the dangers of investing in IPOs.

There have been a lot of IPO losses in the past year or so, including Blue Apron, Uber, Snapchat, Pinterest, Aston Martin, Peloton and Lyft.

That’s something that we’ve pointed out before.

Verdad found that of the last 3,700 IPOs since the late 1980s, the median one lost 31 per cent of its value [over] three years. Over five years, that number was 41 per cent. Not all growth stocks grow enough to justify growth valuations.

Merryn tipped the UK, Russia and Japan as good markets to invest in instead.

In the Economist, Buttonwood looked at the illiquidity premium.

- His first example uses higher trading costs as the illiquidity friction, but most investors would think of it in terms of having money locked away for a certain period.

Here the higher trading cost is replaced by a loss of opportunity or optionality.

- Investors with longer time horizons can afford to take on instruments that take longer to return their cash.

In return for this service, they expect a higher return than those dealing in more liquid investments.

- Going back to the trading costs example, longer-term investors would be able to spread those higher costs over more years.

Another kind of illiquidity is the difficulty of trading small-cap stocks or shares in those companies that are closely held.

- Again, investors should demand a premium return for holding these stocks.

And on this measure, bonds – where there are several issues per stock, which are not fungible – are less liquid by definition.

In general, the more specialised the asset, the higher the transaction costs, and potentially, the long-term returns.

- The snag here is that the person on the other side of the trade may know more than you, so you might buy a lemon or sell a gem.

Corbyn watch

Lucy Warwick-Ching wrote about investor fears over Labour policies, as relayed by their financial advisors.

- Stock market impacts, higher taxes and a tightening of gifting rules appear to be the main worries.

Labour has previously said it would lower the threshold for people paying 45 per cent tax from £150,000 to £80,000. It has also floated the idea of a new 50 per cent rate for anyone earning above £123,000.

Labour has also talked about replacing IHT with a (much lower) lifetime gifts allowance.

- And they have said they will “donate” 10% of shares in UK firms to their workers, over a period of ten years.

Advisors reported that clients were bringing forward dividends, bonuses and ca[ital gains to avoid any tax increases.

- Others were considering making early gifts to their children.

They are also prioritising foreign markets over the UK.

- And they are avoiding sectors that Labour has said they would nationalise – railways and utilities.

Of course, given the relatively remote prospects of a Labour win, this could be a buying opportunity.

SIPP millionaires

Interactive Investor has released some information about the SIPP millionaires on their platform.

- About 2.5% of their SIPP accounts are larger than £1M, and their average age is 61.

They have 35% in funds (OEICs), 29% in ITs, 15% in stocks, 13% in cash and only 8% in ETFs/ETPs.

- Fundsmith Equity, Lindsell Train Global Equity and Vaguards equity funds are the most popular funds.

- Scottish Mortgage, Alliance Trust, RIT Capital Partners, FInsbutyu Growtn & Income and Murray International are the most popular ITs.

- Dividend stocks like Shell, BP Lloyds and Glaxo are popular, along with Vodafone.

- FTSE 100, FTSE 250 and Gold were the asset classes for the most popular ETPs.

No surprises there.

Turnover is quite high:

- 82% have traded in the last year

- 45% make more than 12 trades per year and 23% make more than 24 trades per year.

Quick links

I have eight for you this week:

- Flirting With Models wrote about The Limits of Factor Timing

- Alpha Architect looked at AQR’s work on the returns that investors should expect from Private Equity

- The Economist reported that Litigation Finance faces ethical quandaries

- And that these are hard times for SoftBank

- Portfolio Adviser had an article from Peter Sleep, who spotted Woodford Red Flags back in 2011

- UK Value Investor looked at The Restaurant Group (and didn’t like what he saw)

- JP Koning described Bitcoin – 11 Years In – as a Chain Letter Game

- And Klement on Investing asked how far inequality could rise.

Until next time.

Mike,

Re SIPP millionaires: I think it might be 13% cash.

Also, ii’s charging structure (fixed fees) tends to favour folks with larger balances that do a lot of trades – so this may explain a few things.

Thanks for catching the typo.