Weekly Roundup, 9th October 2018

We begin today’s weekly roundup in the FT, with Terry Smith. This week he was talking about income.

Who needs income?

Terry was disputing the received wisdom that most of the returns from stocks come from reinvested dividends.

- In fact, they come from retained profits.

Obviously, if you reinvest your dividends rather than spend them, your account will grow significantly more quickly.

- But that’s not quite the same thing.

We made a similar argument to Terry a couple of years ago when we said that Dividends Don’t Matter.

- Warren Buffett has also said the same thing in his Annual Letters.

Terry uses as an example a stock with a payout ratio of 50%, ROE (after tax) of 15% and price to book value of 3.5 times.

- Dividends will be taxed (apart from the first £2K per year) which is one drawback.

- And any reinvestment is done at a price to book of 3.5 times.

So for a UK higher rate tax payer, each £1 of dividends will be taxed down to £67.5p and then reinvested to buy just 19p (67.5 / 3.5) of book value.

- Any retained profits still own £1 of book value per £1 of profits.

Of course, holding shares within ISAs and SIPPs will get rid of the tax impact.

- But there’s nothing to be done about the price to book impact.

Terry says this compounding effect of retained earnings is unique to equities.

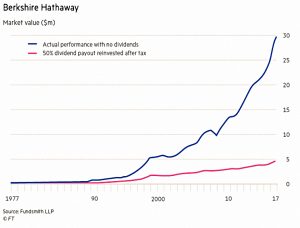

Terry uses Buffett’s firm Berkshire Hathaway to illustrate the difference.

- The chart uses a 50% payout rate and a 30% tax rate.

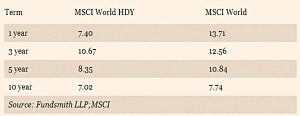

He also notes that the World Index outperforms its High Dividend Yield (HDY) subset over one, three, five and ten years.

Terry is also cross that funds can use the popular equity income label if their yield exceeds that of the FTSE ALL-Share over a rolling three years by any amount at all.

- That seems OK to me.

On the other hand, once a fund has this name, it doesn’t have to remove the word “Income” if it’s yield falls below this (fairly low) bar.

- I agree with Terry that this is wrong.

Redwood

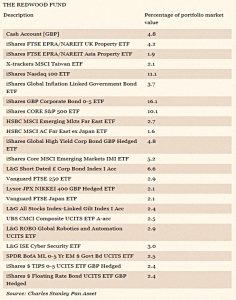

John Redwood was back again, talking about how the US-China stand-off is bad news for investors.

- This worry is preventing him putting the money he holds in cash and short-dated bonds back into shares.

Pot stocks

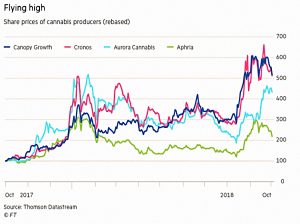

Aime Williams looked at the investment returns from cannabis.

The market for cannabis is divided into two parts:

- Medicinal

- Recreational

Most of the stocks she mentioned are listed in Canada – which plans to legalise the drug this month – or the US (cannabis is already legal in nine US states).

- Sativa Investments (NEX:SATI) is a UK-listed medicinal cannabis company.

- So is Ananda Developments (NEX:ANA)

Both are listed on the NEX exchange, which is enough to put me off.

- The larger GW Pharmaceuticals was previously listed on Aim but has since relisted in the US.

The prospect of wider legalisation has let to Bitcoin-like behaviour in some cannabis stocks in recent weeks (particularly the Tilray IPO).

- Personally, I think that legalisation will turn the crop into a low-margin commodity.

And incumbents will face competition from established tobacco and drinks firms (the drugs firms have kept away to date, as there is no defensible IP involved).

- Though of course, this interest could lead to takeovers and buyouts.

The long view

Michael Mackenzie took over the Long View column from John Authers (whose new Bloomberg newsletter has yet to turn up in my inbox).

- Michael noted that oil prices are at a four-year high (> $80 a barrel) and long US Treasuries are at their highest yields since 2011 (3.2%).

If both trends continue, the US economy (and the US stock market) could face problems.

- Michael thinks that a 10-year yield of 3.5% pa could be the trigger for a fall.

If stocks do crumble, bonds could rally.

- Which means that there might be a good entry point into bonds in the coming months.

Moving abroad

The Economist had three articles about moving abroad.

The gist of these was that countries should be free to sell citizenship, so long as they don’t sell it to crooks.

- More than a dozen countries sell passports for between $100K and $2M.

- A hundred countries sell residency rights.

Within the EU, those selling passports include Austria, Cyprus and Malta.

- Malta charges €650K plus $150K in shares or bonds, but rejects 22% of applications because of a “lack of clarity” about the source of their wealth.

Some people object to rich people jumping the queue, but it seems only logical that a person’s contribution to a society can come in more than one form (time, effort, cash).

- So long as a person is a net contributor, what’s the problem for everybody else?

The Economist thinks that member states within the EU should agree on common principles for awarding citizenship, since a passport from one country provides access to live and work in all.

- That sounds like another opportunity for Germany and France to bully the smaller EU nations, and another good argument for getting out of the EU.

The legitimate reasons for a second passport include:

- protection against instability in your home country,

- avoiding persecution, and

- bypassing the travel hassles you might receive if you were, say, from a Muslim country.

The main bad reasons are financial: to launder money from crime, or evade tax on legitimately earned cash.

The European Commission will publish a report on the schemes offered by EU members later this year.

- The CRBI (citizenship and residence by investment) industry fears the worst.

The third article focuses on Portugal, the non-habitual residence (NHR) scheme that we looked at earlier this year.

- The Economist naturally describes this deliberate government regeneration policy as a “loophole”.

As previously discussed, the NHR gives you ten years to draw your (foreign) pension free of Portuguese tax.

- You need to be tax-resident in Portugal (so that the UK doesn’t tax the income) and resident there for at least six months a year.

France also has some concessions for pensioners, and Malta has a flat rate of 15% tax on pensions over €13.2K pa.

- Cyprus has no tax at all on pensions taken as a lump-sum.

Other countries are not happy.

- Finland has withdrawn its tax treaty with Portugal and will tax its expatriates’ pensions from January 2019.

Sweden may follow suit.

- And who would bet against a Corbyn-led UK government doing the same?

Civil partnership

The government has announced that civil partnerships – legally equivalent to marriages – will be extended to heterosexual couples.

- This would make it easier for couples who don’t want to get married to pass assets between themselves.

- And when one half of the couple dies, assets (including ISAs) can be passed on without attracting IHT.

Offsetting these advantages would be the loss of the ability of an unmarried couple to be treated as two single independent individuals.

- This has advantages in certain areas (eg. around second properties).

The wider downside could be that this new status makes it impossible to extend similar rights to cohabiting (but not civilly partnered) couples.

Quick links

I have ten for you this week:

- The Adventurous Investor says that despite surging bond yields, the heavens are not crashing in yet.

- The Economist reported on Elon Musk’s loosening grip on Tesla.

- Pragmatic Capitalism looked a the cost of having a Taper Tantrum.

- And the same site asked who are the greatest investors of all time?

- Alpha Architect supplied a 3-slide summary of diversification.

- And the same site reported on when diversification fails.

- John Authers looked a breakdown in trust between the media, finance and the public.

- The FT Adviser reported that financial planning literature has been branded “naive” (because it ignores sequencing risk).

- Flirting with Models looked at how to measure Risk Tolerance.

- And Quartz looked at income-sharing arrangements for student funding.

Until next time.