Weekly Roundup, 16th October 2018

We begin today’s Weekly Roundup in the FT, with Maike Currie, who was writing about oil.

Contents

Oil

Maike thinks that it’s time to add some oil to your portfolio.

Commodities are a good way of diversifying a portfolio with a high equity content.

When the economy moves into the late cycle, risky assets such as shares can move in the opposite direction to oil.

Oil has been going up in price over the past year, while copper has been drifting down.

It looks a bit late to be getting in to me, but a trend is a trend.

Buckle up

Michael Mackenzie advised investors to buckle up for a bumpy end of year.

Bond yields and oil prices are going up, and the renminbi is coming down.

- Higher yields mean higher discount rates, and lower present values of future earnings and dividends.

Which means stock prices have to come down.

The next recession

On a similar note, the Economist looked forward to the next recession.

- 2017 was a good year for the world economy, but this year has been different.

The US is booming but everywhere else is slowing, and emerging markets are struggling.

- The Fed has raised rates eight times since 2015, driving up the dollar and pushing Argentina, Turkey and now Pakistan into trouble.

With emerging markets now responsible for 59% of output (compared to 43% twenty years ago), their problems could be come global ones.

The good news is that the banking system is in better shape than in 2008, and no economies look like they will get into such serious trouble this time.

- The bad news is that even the Fed has only half of the leeway it usually needs to fight a recession (two percentage point of interest rate cuts, compared to the normal 5%).

- Things are worse in Europe and Japan.

So there will be more QE, and possibly helicopter money.

- And fiscal stimulus will drive up government debt even further, politics permitting.

International cooperation will also be more difficult than last time, since a decent minority of governments are now “populist” (ie. more nationalist, less internationalist in thinking).

- Protectionism is likely to increase and competitive devaluations are possible.

The Economist would like to see central banks announce “catch-up” targets for growth and inflation, and higher inflation targets in general.

- But none of this seems likely at the moment.

Good shorters

The newspaper also decided that – contrary to what Elon Musk now thinks – short sellers are good for markets.

Short-sellers are savvy investors who help to keep the market’s exuberance in check.

Musk is in good company – Napoleon prohibited shorting and Herbert Hoover called it unpatriotic after the 1929 crash.

Obviously, shorter profit when others are losing money.

- But there has to be some mechanism for correcting prices that are too high.

And of course, bets in the “other” direction increase market liquidity.

- When shorting is banned, spreads widen.

On top of this, shorters have a good track record of rooting out fraud in its many forms.

The article notes that shorters are also good stock-pickers.

- Heavily shorted stocks underperform by 16% pa.

But sometimes they take a long time to crash, so if you are tempted, be patient (and careful).

Long and short

Buttonwood looked at whether time horizons matter.

Paul Samuelson was puzzled as to why “Investors” would take 100 bets with a 2:1 payout ratio (win $200 vs lose $100) but not a single bet.

- The sequence greatly increases your odd of coming out a head, but introduces a very small chance of a much larger loss.

This is the law of large numbers, which explains why a casino’s edge works.

Samuelson later showed that investors should keep the same fraction of their portfolios in risky stocks whether their time horizon was one month or a hundred months.

- But only under certain conditions.

One is that returns follow a random-walk.

- If you introduce long-term mean reversion, then a higher stock exposure can be tolerated in the long run.

A second is that risk tolerance is constant.

- In practice, people are more risk averse when they are close to broke and when the are close to their financial goals (financial independence, say).

- And young people with decades of human capital (work) ahead of them can afford to take more risks.

Climate change

The most popular topic of the week was climate change.

- The Intergovernmental Panel on Climate Change (IPCC) issued a report that claimed that things were much worse than previously thought.

The plan (the Paris agreement) was to keep temperature rises to “well below” 2 degrees Celsius more than pre-industrial levels.

- The report make it clear that 1.5° is a much better target.

It would save some coral reefs, lower sea levels by 10cm and save 420m people from record heat.

It won’t be easy:

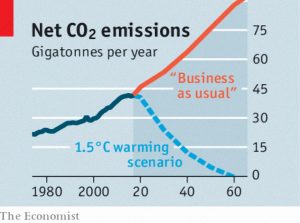

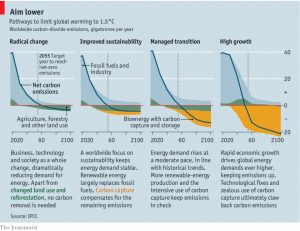

To achieve 1.5°C, the world would by 2050 need to eliminate all 42bn tonnes of carbon-dioxide in annual emissions.

Renewables, including hydropower, would have at least to treble their share of electricity generation from today’s 25%.

Internal-combustion engines, which power 499 out of 500 cars on the road today, would have to all but vanish.

I certainly wouldn’t bet on it.

By coincidence, the Nobel Prize in Economics was awarded this week to two scholars whose work touched on climate change.

The central questions behind the research of Paul Romer and William Nordhaus are:

Why do economies grow, and why might growth outstrip the natural world’s capacity to sustain it?

Romer worked mostly on endogenous growth models but Nordhaus in particular has studied how we should respond to climate change.

- He produced models to show what level of reduction in carbon emissions would be economically optimal.

And he was one of the first to suggest the 2° target.

Tim Harford commented on both the IPCC report and the Nobel Prize, and suggested that we innovate our way out of looming climate change disaster.

One of Tim’s favourite economics papers was written by Nordhaus, who tracked the cost of illumination through the millenia.

- He compared burning wood, the many varieties of candles and then incandescent bulbs.

In Babylonian times, a day’s work could pay to light a room for just 10 minutes.

- By the year 2000, a days work could light a room for 10 years.

Better still, the environmental impact of lighting had plummeted along with the cost.

Tim hopes that the same thing will happen with carbon dioxide emissions.

- I admire, but don’t share his optimism.

But innovation is a better bet than demands that global economic growth comes to a halt.

- Try selling that one to China or India.

Four day week

This week’s bonkers plan from Labour is a compulsory four-day week, as reported by Matthew Lynn in the Spectator.

- Apparently the rise of robots and AI mean that we won’t need to spend so much time in the office.

I seem to remember that John Maynard Keynes made a similar prediction around a century ago.

According to Labour, if the working week isn’t cut back, it won’t be possible to share out the remaining work fairly.

- Perhaps they haven’t noted the (welfare-sponsored) rise in part-time working, zero hours contracts and the gig economy.

Apart from the major risk that AI will – like all waves of automation to date – simply change our work (perhaps for the better) rather than reduce it , there’s a basic issue of freedom here.

- Individuals and companies need to set the hours that they want to work / offer work – not the government.

Not everyone will have the same preferences for work versus leisure versus income, and this shouldn’t be down to Stalinist central planning.

Quick links

I have eleven for you this week.

- The Economist looked in more detail at the next economic downturn.

- They also reported on Unilever’s decision not to leave London after all.

- They wrote about tabletop gaming in the UK.

- And about Amazon’s new $15 minimum hourly wage.

- Flirting with Models looked at how to manage equity risk when rates rise.

- Alpha Architect looked at market timing with factors.

- And they wrote about the importance of how a multi-factor portfolio is constructed.

- The Adventurous Investor looked at panicking investors.

- He also commented on the coming carbon crunch.

- The UK Value Investor wondered whether Hargreaves Lansdown’s dividend yield was too low.

- Research Affiliates looked at the risks of factor investing.

Until next time.