Weekly Roundup, 9th October 2019

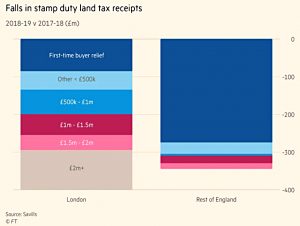

We begin today’s Weekly Roundup in the FT with the chart that tells a story, which this week was about stamp duty.

Contents

Stamp Duty

Katherine Gemmell (( I couldn’t find a photo)) reported that the stamp duty take has fallen by £745M, to £8.32bn.

- This is the first fall since 2008-09.

The chart this week was pretty good, dividing the fall across six price bands and twp geographies (London and the rest of England).

- In London, half of the fall comes from properties over £1M, but elsewhere, first-time buyer relief is to blame.

Overall, first-time buyer relief is responsible for about half of the fall.

- The additional homes surcharge of 3% has also had an impact, with such transactions falling by 6.6% and raising £160M less in tax.

Minimum wage

Tim Harford wrote about Chancellor Sajid Javid’s plans to increase the UK minimum wage to £10.50 per hour (albeit in 2024).

- In the US, Democrats are targeting $15 per hour by the same date.

Tim has three worries:

- The number of people affected – 2M in the UK now, but perhaps 5M when the target of two-thirds of median income is met.

- The replacement of technocratic committees used to set the best level of the minimum wage by politicians aiming to win votes.

- Since the benefits of a minimum wage increase are immediate, and the costs (lost jobs) are delayed, this is a bad idea.

- The branding of the minimum wage as a “living wage” when it should be set to maximise the cost/benefit function, regardless of the relationship to living costs.

- Where the minimum wage is below living costs, negative income tax (tax credits) would also be needed.

John Lee portfolio

John Lee has his regular update on his small-cap portfolio.

- Events company Tarsus has been taken over, turning 20% of John’s ISA portfolio into cash.

- He also held Greene King in his family charitable trust.

These are just two of more than 50 takeovers that John has been involved in.

John reinvested the ISA portfolio into Legal & General, Vitec and Goodwin (each of which I hold), plus Hansteen, Photo-Me, Sempa, Town Centre Securities and PZ Cussons.

- He also made top-ups in Air Partner, Anpario, Christie, Cerillion, Concurrent echnologies, Daejan, MP Evans and Park Group.

Quite an active period, all told.

No sooner had I reinvested my Tarsus proceeds, however, then along comes another unexpected takeover of insurance services company Charles Taylor — a significant Isa holding. Here we go again . . .

Wealth tax

Paul Lewis compared the excessive fees extracted from their clients by financial advisers, investment platforms and fund managers with a wealth tax.

- The UK has never had a wealth tax, though they appear from time to time on the continent.

They don’t usually last for long, because of their negative effects (rich people leave).

I agree with Paul that fees need to come down, but I’d like to see the savings end up in the pockets of investors, rather than be swallowed up by a state wealth tax.

The Economist also had an article on wealth taxes.

- The argument against them is that today’s wealth is yesterday’s income.

- So if you tax wealth, you discourage income generation (more popularly known as work and investment).

In a new paper published by the National Bureau of Economic Research, a team of five economists argues that:

Shifting the burden of tax from capital income to wealth would reward investors capable of achieving outsize returns on their investments, and shrink the fortunes of those unwilling or unable to put their lucre to productive use.

This is viewing the tax as an additional cost of capital – a higher rate of interest on borrowings, even if you are “borrowing” from yourself.

- It’s a neat bit of mental gymnastics, but like all redistributive welfare, it rewards failure (to accumulate in the first place, not in the subsequent reinvestment) and punishes success.

- It’s the same argument that is used in favour of land taxes (which I am also against).

I’d like to see how popular this approach would be if it were applied from zero net worth – to the home equity and cash savings of the middle classes.

Wealth taxation seems to be a theme in the FT at the moment.

- Reader Hari Seldon, replying to an article on Thomas Piketty’s plans for a wealth tax, spoke for me when he said:

I thoroughly approve of wealth taxes- providing the thresshold is set a couple of million above my net worth.

Otherwise, I’m off to Portugal, and I’m taking my money with me.

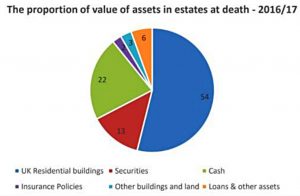

Inheritance tax

In FT Adviser, Amy Austin reported on hints dropped by Sajid Javid that he might be planning to scrap IHT.

- Ironically, this came in the week that my own AIM IHT portfolio reached the grand old age of two, and became exempt from IHT.

The Chancellor said:

I do think that when you pay taxes already through work or through investments and

capital gains and other taxes there’s a real issue with then asking [individuals], on that income, to pay taxes all over again.

I couldn’t agree more, and let’s get rid of the pensions LTA while we are at it.

Imogen Tew wrote that more than £17 bn of inheritance each year is left as cash, an average of £69K per estate, or 22% of the total.

- In contrast, £10 bn (13%) was left as securities, highlighting the need for financial education.

Loans made up 6% of the total, and insurance was 2%.

- Dominating everything was property at 54%.

Financial plans

Back in the FT proper, Josephine Cumbo had a confession to make:

I have been covering pensions for nearly seven years but I haven’t got a retirement plan.

Regular readers will be aware that You Need A Plan.

I bring attention to Josephine’s plight not to pick on her in particular (and indeed, she may have no plight at all – perhaps her FT pension is so generous that no plan is required) but rather to highlight that – in the same way that cobblers’ children have no shoes – financial journalists are not always paragons of virtue when it comes to following best practice.

- It seems obvious to me that few mainstream journalists run large, self-directed portfolios – David Stevenson and the Money Week crew being the obvious exceptions.

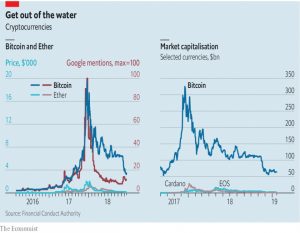

Crypto derivatives

The Economist reported that crypto-derivatives are about to be banned for retail investors, amidst fears that they exacerbate short-term crashes.

[In September] bitcoin fell by $1,000 in 30 minutes. Exchanges that sell “long” bitcoin derivatives contracts, with which traders bet that prices will rise without buying any coin, soon asked punters for more collateral.

That triggered a stampede. By the end of the day $643m-worth of bitcoin contracts had been liquidated on Bitmex.

Japan is considering stringent registration requirements. Hong Kong bars retail investors from accessing crypto funds; Europe has had stiff restrictions since last year. Now the Financial Conduct Authority is proposing a blanket ban on selling crypto-derivatives to retail investors.

That seems a shame, especially if the derivatives are largely spread bets.

- These are favoured in the UK because of their advantageous tax treatment, but they are probably less likely to move the underlying price than other derivatives.

And there’s always the risk that a ban will push punters towards raw crypto, which is arguably more dangerous.

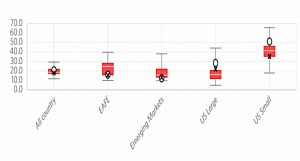

Home bias

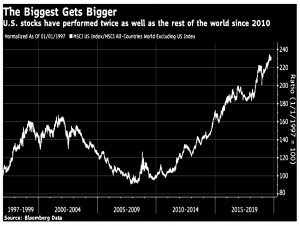

In his Bloomberg newsletter, John Authers reported on an interesting side effect of home bias.

- Current market cap weights for stocks are fairly extreme, and not many people should want to invest like that.

Victor Haghani of Elm Partners Management has carried out an experiment to show the impact of home bias, which is how most people invest.

- He imagines a world with 11 countries, one of which has 50% of global market cap, and the rest each have 5%.

In the big country, home bias is 80% 30% overweight).

- In the small countries, home bias is 50% (a larger 45% overweight).

Here are the resulting allocations:

The large country sends 20% of its money abroad but receives 25% of money from the small countries.

- This should drive up prices in the large country (the US).

Rob Arnott has found that:

U.S. stocks, and particularly small stocks, are more expensive, and are also expensive compared to their history, while stocks in the rest of the world are cheaper, and also cheap compared to their own history.

As John points out:

Home bias is not irrational if you are attempting active investing, because it is far easier to research opportunities in your own country and conceivably spot bargains that others have missed.

But that still means we have over-valuation:

Haghani thinks that market cap allocations are the solution, but I think that risk parity might be even better.

Quick links

I have a bumper 13 for you this week:

- The Adventurous Investor wondered how bad things were for European banks

- Flirting With Models looked at Macro Timing with Trend Following

- And at Macro and Momentum Factor Rotation

- Merryn Somerset Webb wrote that Negative Rates are tarnishing central bankers’ halos

- The economist had two articles on computers in finance – 1 and 2

- And two on Greek debts – 1 and 2

- Alpha Architect wrote about Alternative Investments

- And about the Short Duration Stock Anomaly

- And about Quality

- UK Value Investor looked at the hidden debt of lease obligations

- And Musings on Markets wrote about Resilience in US Equities.

Until next time.