Weekly Roundup, 15th October 2019

We begin today’s Weekly Roundup in the FT with the chart that tells a story, which this week was about mortgages.

Contents

Mortgages

Katherine Gemmell (( Still no photo)) reported that 57% of mortgage deals now offer a 40-year term.

- That’s up from 36% in March 2014.

In 2005, only 3.5% of new mortgages were for 35 years or more.

- By 2017 this was up to 16%.

Mortgages longer than 25 years now make up 41% of the total, and 66% of loans to first-time buyers.

The point about longer loans is that the monthly repayment is lower.

- Which means that borrowers find it easier to comply with affordability regulations from 2014 that compare payments to income.

The downside is that some people will still be making repayments as they move into their 70s.

Ruffer Review

Sticking with charts, last week I came across the inaugural Ruffer Review, which contained a few interesting ones.

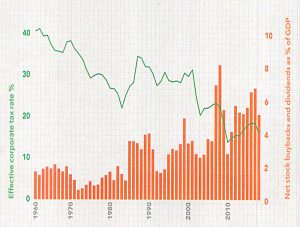

The first shows that as US corporate tax rates have fallen over the past 60 years, shareholder returns have increased.

- Meanwhile, corporate investment has declined from 4% of GDP to 2%.

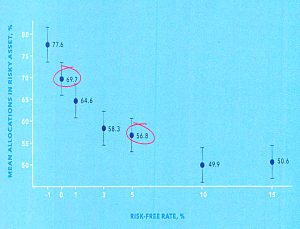

This one shows that as the risk-free rate declines (from right to left), the proportion of a portfolio allocated to risky assets increases.

- This is yield chasing in action.

More worryingly, this experiment looked only at nominal rates – the real rate after inflation was assumed to be constant.

- Nominal returns are visible, whilst real returns are not.

Investors also anchor to initial rates, and some (institutional investors) will have nominal return targets.

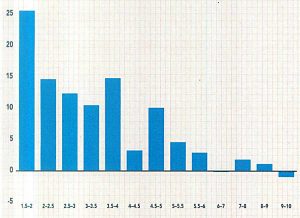

The third chart looks at the prevailing yields at the times that US bond funds made their purchases.

- More than half the money has been invested at yields below 3%.

So if yields were ever to rise above that point, the funds would lose money.

- Ruffer also warn about a loss of liquidity in the underlying bonds which might cause prices to gap down aggressively.

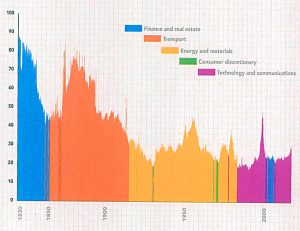

The final chart looks at two hundred years of market concentration in the US.

- It puts the current tech boom into perspective.

The market has been dominated by banks, railroads, oil firms and lately tech.

- But the current boom is nothing like the dot com bubble in the 1990s.

VCTs

Emma Agyemang looked at VCTs.

- Regular readers will know that I am a fan of the sector and that I run a portfolio of funds.

Because they invest in small, young companies, they are risky – though arguably not as risky as EIS/crowdfunding or P2P lending.

- But they come with tax breaks which mean that decent returns are available from diversified portfolios.

New issues provide income tax relief if held for five years, and capital gains (not common) and dividends (very common) are also tax-free.

Emma says:

The top 20 VCTs at least doubled investors’ money on a net asset value total return basis over the past 10 years.

Annabel Brodie-Smith of the AIC (Association of investment companies) says:

VCTs have a well-established record, having been around for 24 years. They have performed well with the average VCT returning 166 per cent over 10 years to the end of September.

Demand has risen in recent years as pension allowances have been trimmed, and I now have to pick up funds throughout the tax year rather than take my chances in the year-end panic.

- The previous peak in 2005 came just before tax relief on VCTs was cut from 40% to 30%, and pension limits were simultaneously relaxed.

Green revolution

In his regular update on the dummy ETF portfolio that he runs for the FT, John Redwood looked at the challenges and opportunities thrown up by the environmental agenda.

- There’s no portfolio breakdown this month, but the fund is up 12% for 2019.

The EU wants to get to net-zero carbon emissions by 2050, whereas the US is more sceptical.

The issues John foresees include:

- Greening jet flights when the US has cheap shale oil and gas.

- Installing the infrastructure for electric vehicles (charging points).

- Replacing the heating systems in every home, and adding insulation.

Equity release

In her FT column, Merryn Somerset Webb looked at a new flavour of equity release known as a RIO mortgage (retirement interest-only).

- She explains how they can be used to pass on more of your pension to your children.

That’s not an issue for me, but your mileage may vary.

- In general, I’m not a fan of borrowing against the home you live in, other than as a last resort.

Narrative economics

In the Economist, Buttonwood looked at Narrative Economics, a new book from Robert Shiller.

- The book’s subtitle is “how stories go viral and drive major economic events”.

The most contagious economic narratives drive boom-and-bust cycles. Such narratives have common features.

They tend to be oversimplified models of reality and thus catchy. Their success may owe to a “super-spreader”, perhaps a celebrity, capable of infecting many people.

I think Shiller is on to something, though I’m not sure what we can do about it, other than pay attention to sentiment surveys.

Pensions tax relief

Josephine Cumbo and Emma Agyemang reported on OTS recommendations that pension tax relief rules be reformed.

There were three main proposals, but the FT article focused on the idea that the MPAA be raised from £4K for those in receipt of pension money.

In FT Adviser, Maria Espadinha looked at the other two proposals:

- Removing the annual allowance for DB schemes,

- And taking away the lifetime allowance for DC schemes.

Sounds good to me.

Probate fees

Amy Austin wrote about the government’s U-turn on probate fee hikes.

- Justice Secretary Robert Buckland said there would be a review instead, which would consider small adjustments to cover costs.

While fees are necessary to properly fund our world-leading courts system, they must be fair and proportionate.

The original proposals topped out at a £20K fee for estates over £2M, though this was later cut bak to £6K.

- Existing fees are “just” a few hundred pounds.

Quick links

I have nine for you this week:

- Flirting with Models looked at Yield Curve Trades with Trend and Momentum

- Klement on Investing wrote about our limited reserves of morality

- And about the J-curve of parenting

- Musings on Markets looked at IPO lessons for public market investors

- The Economist wrote about the jam that driverless cars are stuck in

- And about the different route to driverless cars being taken by Chinese firms

- And about plant-based meat

- And about the major differences between Airbnb and Uber

- Alpha Architect looked at using firm characteristics to enhance momentum strategies

Until next time.