Weekly Roundup, 1st June 2020

We begin today’s Weekly Roundup with another look at whether current market levels are justified.

Market levels

In his Bloomberg newsletter, John Authers said that stocks have reached a tipping point.

- He’s referring to the tension between the attempts to re-open the US economy and the US-China beef.

In the three days since he wrote the article, we could also add riots across America, but this morning the markets remain positive.

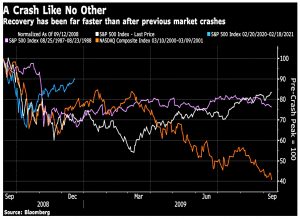

He notes that this is the fastest recovery ever.

- 90% of S&P 500 stocks are now above their 50-day MA, which usually means there are more gains to come (positive on 15 out of 16 previous occasions after a further 12 months).

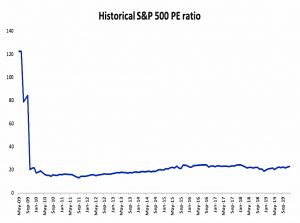

Based on prospective earnings, stocks haven’t been so expensive for 20 years (back to the dot com boom).

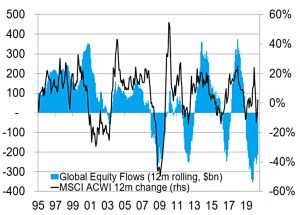

Citgroup has said that the rebound comes against terrible cumulative inflows to equity funds, but then retail money has been dumb for decades.

Their suggestion that the rally has been largely driven by short-covering is more worrying, but at least the shorts are themselves worried enough to cover.

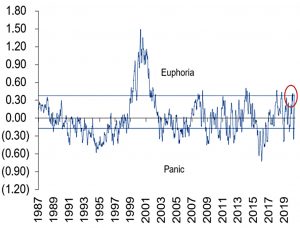

The third chart from Citi is the scariest – we have left the panic of March far behind and are now back in euphoria.

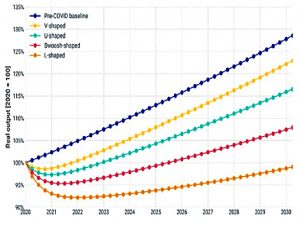

On his Adventurous Investor blog, David Stevenson looked at a paper from MSCI and noted that investors are pricing in a V-shaped recovery which seems unlikely to materialise.

On ETF Stream, they made the argument that there is no V-shaped bubble and that rather, stocks are fairly priced:

- The S&P 500 is stuffed with low cost-of-capital tech companies who will benefit from Covid- driven increased internet use.

- And with healthcare and biotech firms which are making more money than ever.

- High PE ratios are common in busts (eg. 2009 – at the best time to buy).

- Tech firms have never had low PEs, even at IPO.

Improving momentum

Joachim Klement had a tip for improving momentum strategies.

- Joachim sees the market as an aggregation of lots of investors with different objectives and strategies.

It’s the way these strategies combine which explains the market’s swings between value and momentum.

- In the case of momentum, these strategies use a variety of look-back periods.

The standard momentum factor is usually calculated as 12-month return minus 1-month return (to eliminate short-term reversals).

- Some investors will use 6-month momentum instead, to get into these momentum stocks before the 12-month investors.

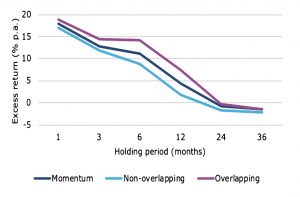

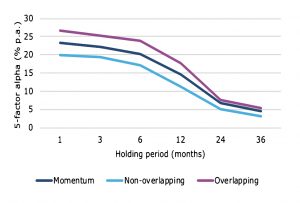

A recent study (Blanco et al, 2020) shows that only selecting stocks which appear on both the 12-month and the 6-month screen improved performance.

It’s the same picture through a Fama-French 5-factor alpha lens, and the “overlapping momentum” approach doesn’t introduce extra volatility.

In a real trading system, you would use a blended momentum signal over several timescales.

- And that signal would then be combined with the signals from other strategies (eg. carry) for each instrument in turn.

GDP

The Economist forecast that the pandemic could make statisticians change how they work out GDP.

- Just when the stats might be most useful (in order to work out the likely severity of the looming recession), the methods of collecting them have been found wanting.

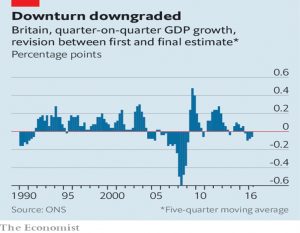

The consensus estimate for the 2Q20 fall in US GDP is around 12%, but the initial stats are likely to show a fall of “only” 7% or 8%, meaning that there will be later revisions.

- In the UK, the ONS is thinking of introducing confidence intervals for its numbers.

These later downward revisions are common in recessions, as the chart shows.

- Firms doing badly are more likely to stop responding to surveys, and the guesses made by wonks to fill in the gaps are often optimistic.

Lockdowns are likely to exaggerate this effect, and so the statisticians are moving towards the inclusion of real-time data.

- Credit cards transactions, Amazon prices, restaurant reservations and passengers numbers are likely to be incorporated.

So when we get out of this, the numbers will be better (though obviously not quite as useful as they would have been right now).

Japanification

In the FT, John Plender wrote that fears of Japanification (deflation) spreading to Europe and the US are misplaced.

Economists tended to assume that as the Japanese population aged, private savings would fall because the elderly consume most or all of their retirement incomes. This has not happened. While households have indeed run their savings down, the decline has been offset by a huge increase in corporate savings.

This happened mainly because Chinese manufacturing growth has capped Japanese wages (and also those in other countries).

- Japanese firms have lost global market share, but have maintained high profits.

To counteract excess savings, the government has run deficits which have increased net debt to 154 % of GDP (the highest in the rich world).

John doesn’t expect corporate profits to hold up so well in Europe and the US.

- Reasons include Covid-driven de-globalisation and increased resilience, plus higher taxes, fewer zero-hours contracts and a shrinking workforce.

He also expects the new version of QE to get money closer to industry, leading eventually to inflation. but not necessarily to interest rate rises.

- Which is plausible – but the big question is when?

London

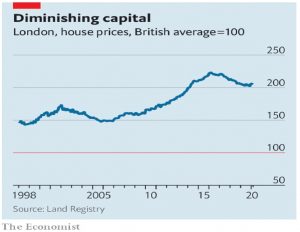

As someone who has lived in London for 35 years now, I note with some sadness that the Economist thinks that Covid-19 may signal peak capital.

- Even before the pandemic, the government was committed to “levelling-up” the regions (though of course, that is easier said than done).

The London I relocated to in the 1980s was a pale shadow of the current version – fewer people, fewer jobs, terrible food and drink, not much money around.

- That all changed with Big Bang (the deregulation of financial services) in 1986, and the city (and the CIty) have never looked back).

In recent years, FinTech and the just Tech have also become prominent.

The big drawback has always been prices and in particular the cost of housing.

- After paying for somewhere to live, Londoners have less money than those in the rest of the south.

Offices are even more expensive, so remote working – and a new desire for a private garden – could be a turning point.

- The new normal is also likely to put off clever foreigners, which will, in turn, reduce the “fun factor” of living in the capital.

The “flat white” economy is under threat.

- As are pubs, restaurants, theatres and concert halls – everything in London is of necessity designed to be overcrowded.

So London could become a more expensive and congested Frankfurt.

There are also plans from lefty councils to steal road space from cars and give it to walkers and cyclists.

- This may be environmentally sound, but it will make the city less attractive to those with money, and to the old.

If cars are frowned on, then public transport needs to be excellent – which brings us back to post-Covid restrictions once again.

- I am definitely reconsidering my options.

West coast

There are similar pressures on the West Coast.

- Facebook has said that anyone can work from home, but they won’t be paid the same wages as if they were in an office in an expensive city.

U.S. staffers [have] until Jan. 1, 2021 to update the company on where they plan to base themselves, at which point their salaries will be adjusted to reflect the local cost of living.

Locations will be checked via VPN access points and the company’s own social apps.

In the long run, this could be bad for California, as other states cut taxes to complete for an exodus of rich, educated tech workers.

Quick links

I have just three for you this week:

- Disciplined Systematic Global Macro Views explained that if you want convexity, you have to hold trend

- Alpha Architect warned that adjusting everything in a crisis is a bad idea, and

- The Economist wondered what will await tourists when they emerge from lockdown?

Until next time.