Weekly Roundup, 7th February 2022

We begin today’s Weekly Roundup with the yield curve.

Inversion

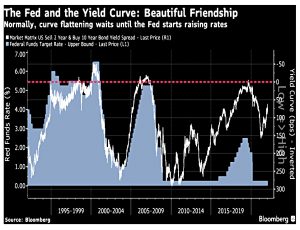

John Authers worried that the yield curve is already flattening, and is quite close to inversion even before the rate hikes start.

US GDP growth came at its highest reading since 1984 when Reagan was elected after declaring “Morning in America”.

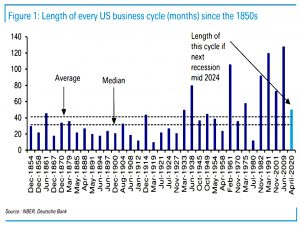

Looking before 1984, however, we see that growth faster than this used to be quite a common occurrence, and that economic cycles were much shorter.

Much lengthier ones seem to have arrived, along with a typically slower rate of growth, in 1982. The long cycles of the last four decades didn’t exist when rising prices were a fact of life. They’ve only become the norm since Paul Volcker tamed inflation.

So we need to brace for a shorter cycle.

Which is what the yield curve is telling us.

- Jerome Powell’s press conference at the end of January made short yields rise and long yields fall.

When the economy is strong and in danger of overheating, the curve steepens (longer yields will be much higher, reflecting the belief that rates must rise), and this will prompt the Fed to start tightening.

When the curve inverts, a dreaded signal of an approaching recession, the market is saying that rates will be lower in 10 years than in two years — that the Fed has tightened too much and will need to start cutting.

Flattening before the hikes is unusual.

- The market expects the hikes to be brought forward, but the required amount of raising has not increased.

Five hikes in 2022, ending at 1.75% is the consensus.

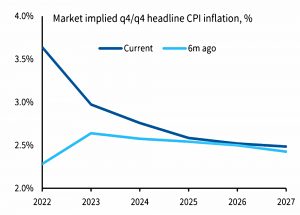

The market is expecting a short cycle, and expectations for inflation beyond the current year have hardly changed, despite the current rises.

- So the Fed will tame inflation, potentially at the expense of growth.

Quantitative tightening

The Economist was worried that Quantitative Tightening (QT) might prove to be an unreliable tool.

- QT hasn’t been tried yet, as central banks have preferred to raise interest rates instead.

The Fed announced in late 2017 that they would let their balance sheet “run-off” by not making reinvestments.

- This got rid of $710 bn over two years but since Covid, another $4.5 trn has been added back.

The BoE had previously said it would start QT when rates hit 1.5% but now it plans to stop reinvestment when rates hit 0.5% (which might be this month).

Some central bankers also think that QT could allow them to fight inflation without raising interest rates as much as would otherwise be necessary. The theory is that QE holds down long-term bond yields, so reversing it will cause them to rise, slowing the economy.

But although QE seems to bail out markets in a crisis, it’s not really clear that it has a sustained effect on long-term bond yields.

- The term premium (the excess return for locking up money in long-term bonds) doesn’t track central bank balance sheets, but rather inflation forecast dispersion (inflation risk).

QT (and indeed the end of QE) should work as a signal (that rates will rise soon, just as QE signals that rates will remain low).

- The taper tantrum of 2013 suggests this much.

After that, central banks tried to play down the signalling, but with the return of inflation, they are trying to show that they are serious about tightening.

- The risk is that QT comes to mean fewer rate rises, causing bond yields to fall (and making QT a bizarre form of stimulus).

Crypto

There are quite a few crypto stories this week.

In FT Adviser, Sally Hickey wrote about the UK government crackdown on crypto ads.

- It’s bringing them inside the existing financial promotions legislation, the Financial Services and Markets Act 2000.

This means that only firms which are authorised by the FCA or the PRA will be able to promote crypto-assets.

- The government definition of crypto-assets is “a cryptographically secured digital representation of value or contractual rights which is fungible and transferable”.

This would therefore seem to exclude NFTs.

- However, it will take some time to make the legislator changes, and a six-month transition period is planned – so the final regulations might include non-fungible tokens.

Chancellor of the Exchequer Rishi Sunak said:

Cryptoassets can provide exciting new opportunities, offering people new ways to transact and invest – but it’s important that consumers are not being sold products with misleading claims. We are ensuring consumers are protected, while also supporting the innovation of the crypto-asset market.

2.3M people (4.4% of the UK population) hold crypto.

- But only 71% of those who have heard of crypto assets can correctly identify their definition.

The implication is that some people don’t understand what they are buying.

Myron Jobson of interactive investor said:

We’ve been crying out for greater measures to prevent the scourge of misleading and downright harmful advertising of cryptocurrency. “Many cryptocurrency adverts I’ve seen tap into the FOMO (fear of missing out) culture and effectively gaslights would-be investors into thinking cryptos are a sure bet, without flagging the high-risk and highly volatile nature of the asset.

Our research found that 45% of young adults aged between 18 and 29 are getting their first taste of investing through cryptocurrency. The concern is first-time investors who experienced a baptism of fire by losing money on crypto bets could be put off investing for life.

Not everyone was happy with the change. Laura Suter of AJ Bell said:

The regulator’s data showed that only 2 per cent of the people it questioned were led to buy crypto from an advert when they previously hadn’t planned to, and just 5 per cent who were thinking about buying made the leap because of an advert.

It won’t stop the outright scams that have exploded off the back of Bitcoin and other cryptos soaring in price. What would have a far bigger impact is cracking down on social media accounts where people claim to have made their millions from buying Bitcoin, most of which are ultimately scams or glorified pyramid schemes.

Sounds good to me.

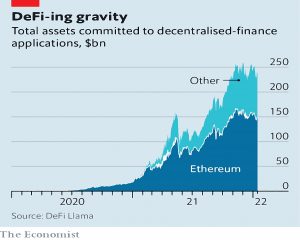

The Economist explained why Ethereum is losing market share in the DeFi space.

- DeFi apps support trading, loans and deposits, with the aim of replacing centralised intermediaries like banks, tech platforms and fintech.

ETH was invented in 2015 as a more general-purpose version of Bitcoin, by running the code of apps.

- And like Bitcoin, it is slow and clunky.

Both Bitcoin and Ethereum use a mechanism called “proof of work”, where computers race to solve mathematical problems to verify transactions, in return for a reward.

BTC runs at 7 transactions per second, ETH at 15.

- When the network is busy, your transaction will be slow or expensive (or both).

So ETH plans to shift over to “proof of stake”, which is more scalable.

- An alternative approach is to split the blockchain into sections (this is called “sharding”).

There are also ideas around bundling transactions so that fewer of them need to be verified.

- But all these options risk making the platform less secure or more centralised.

As ETH developers have argued over what to do, rivals have been developed.

- The key ones are Avalanche, Binance Smart Chain, Terra and Solana (which can handle Visa-like volumes).

The experience of USD Coin illustrates these shifts. The token was launched on Ethereum just over three years ago, but has since been launched on a number of competitor networks, including Algorand, Hedera and Solana.

SushiSwap is also on several chains.

Yet another approach is to access the public data on these blockchains and build bridges between them (apps that use data from all of them).

- Polkadot and Cosmos are the most well-known “multi-chain” blockchains.

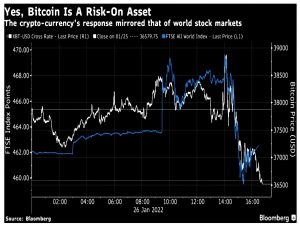

John Authers noted that BTC is behaving more like a risk-on asset than as a hedge against the collapse of the existing financial system.

And The Economist asked whether Web3 will reinvent the internet business.

- Web3 (which includes crypto and NFTs) is billed as a better, more decentralised version of the internet.

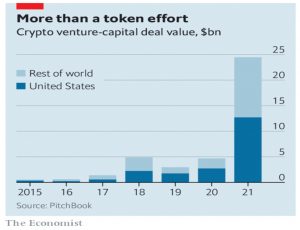

The promise of Web3 is attracting new investment.

The value of VC deals in the crypto-sphere reached $25bn last year, up from less than $5bn in 2020.

Opponents (including Moxie Marlinspike of Signal and Jack Dorsey, formerly of Twitter) claim that Web3 is not decentralised, but is owned by VC and has its own gatekeepers.

Computing is a constant struggle between decentralisers and recentralisers. In the 1980s the shift from mainframes to personal computers gave individual users more power. Then Microsoft clawed some of it back with its proprietary operating system.

More recently, open-source software took over in parts of the industry—only to be reappropriated by the tech giants to run their mobile operating systems (Android) or cloud-computing data centres (Amazon, Microsoft and Google).

The internet is in one sense the greatest centralisation of all (though components are decentralised).

- Even blockchains are centralised in terms of computing power (miners) and ownership (whales and founders).

It is not clear how much demand exists for truly decentralised projects. A service like OpenSea [an NFT marketplace] would be much faster, cheaper and easier to use “with all the web3 parts gone”, says Mr Marlinspike.

And centralised stuff tends to evolve more quickly than decentralised stuff.

The Economist doesn’t expect Web3 to take over, except perhaps in a few niches.

Whether or not people keep splurging on NFTs, such tokens make a lot of sense in the metaverse, where they could be used to track ownership of digital objects and move them from one virtual world to another. Web3 may also play a role in the creator economy.

In other words, niches where they can be used to monetise.

- Meta (Facebook) and Twitter have already integrated NFTs into their platforms.

Quick Links

I have eight for you this week, the first four from The Economist:

- The newspaper reported that the global interest bill is about to jump

- And that interest rates may have to rise sharply to fight inflation.

- The Economist also explained how Sony can make a comeback in the console wars

- And reported that Mike Lynch has lost Britain’s biggest fraud case.

- Alpha Architect said that Frog-in-the-Pan explains the Momentum Factor

- And that the value premium is smaller than we thought.

- Monevator wondered whether our spending would decline in retirement

- And Pragmatic Capitalism said that bitcoin is a terrible form of money (but a very good store of value).

Until next time.