Weekly Roundup, 14th December 2020

We begin today’s Weekly Roundup with a look at annuities.

Contents

Annuities

Joachim Klement wrote about the use of annuities in retirement.

- As we’ve discussed many times before, in these days of low interest rates and low bond yields, annuities offer low returns – an index-linked annuity for a 55-year-old yields just 2.1% pa (and you have to hand over all your capital upfront in order to get this).

As Joachim points out, annuities offer guaranteed income for life.

- In the industry, this is known as longevity protection – you can guard against the risk of running out of money before you die.

But when the yield is 2.1%, you can fund your own protection for 48 years (taking you from 55 to 103).

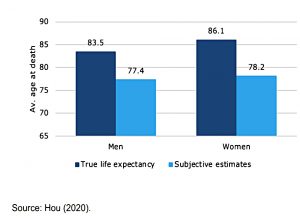

Joachim quotes a recent paper which shows that people underestimate their life expectancy.

- At age 65, men are wrong by 6 years, and women by eight years.

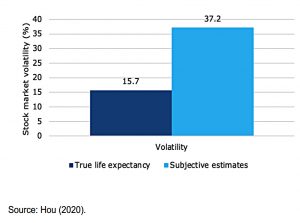

Investors also overestimate the annual volatility of stock markets.

- Real volatility in the US is 15%, but people think that it’s 37%.

Which means that they put too much money in bonds and other “low risk” assets, and not enough in stocks.

- The paper calculates that the optimum allocation for a 65-year-old is 85% stocks.

Whereas the traditional advice from the industry might suggest 35% or 40%.

- Remember folks – stick with stocks.

Rational Exuberance

In his Bloomberg newsletter, John Authers looked at the circumstances surrounding the CAPE ratio, which is currently higher than it was before the 1929 crash.

- Of course, bond yields and interest rates are at historical lows and might support high stock prices.

- They make bonds (the main alternative to stocks) more expensive, and they mean that the future earnings from stocks can be discounted at a lower rate, making them more valuable today.

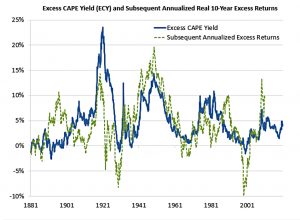

Robert Shiller has joined the debate by introducing a new tool, the Excess Cape Yield (ECY).

This is a good predictor of returns for the following ten years.

- It’s currently suggesting that US stocks will return 5% real pa, which I think most investors would be happy with.

Other countries are even cheaper, with the UK and Japan at record highs:

- Europe and Japan are at 6% and the UK is at 10% pa; China is at 5%.

So globally, stocks look attractive (relative to bonds), and Shiller won’t call a bubble:

Eventually, bond yields may just rise, and equity valuations may also have to reset. But at this point, stock-market valuations may not be as absurd as some people think.

A tough year

In the FT, John Lee looked back on a tough year for his portfolio.

I think he’s done okay, with a 6% return (I’m up 8.8% as I write this, and feeling pretty good about it).

- His biggest winner was Treatt (up 50%) and his biggest mistake was Aviva, which pulled its dividend.

Other good buys include Air Partner, Anpario, Christie, MP Evans, Goodwin, Jarvis, L&G, M&G and STV; Appreciate, Nichols and Tate & Layle have not progressed.

- Sales include Gooch & Housego and FW Thorpe.

John is now 78 and has finally decided to stop reinvesting his dividends.

- He’s going to spend them from now on, and will also set up a charitable trust with a portion of his portfolio.

As we approach 2021, we should be moderately optimistic. There should be a sharp rise in economic activity, dividends should pick up, and we will probably see significant M&A activity. Also, most businesses have cut costs during lockdown, potentially boosting bottom-line earnings.

Central bank digital currencies

The Economist looked at central bank digital currencies (CBDCs).

- These are intended to act as government-backed stores of value which democratise access to the central bank’s balance sheet (which can only be used at the moment by other banks).

The other goal is to head off private-sector cryptocurrencies like bitcoin and Facebook’s Libra (now known as Diem).

But if CBDCs paid interest (ie. were part of monetary policy), they might be more attractive than regular bank deposit accounts.

- Which might in turn impact mortgage lending (as well as lending to SMEs).

One option is to limit an individuals allocation to CBDCs (as with premium bonds at present), and another is to use commercial banks to hold customers’ CBDC wallets (in the same way that the government underwrites £85K of cash savings).

- A third option is to reorder the “chain of funding”, with the central bank lending the public’s money to the commercial banks.

The fourth option is to make banks fund themselves with equity rather than deposits.

- Which would turn them into investment funds.

And the final one is that perhaps in the age of electronic money, we don’t need traditional banks at all.

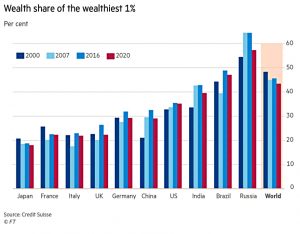

The one per cent

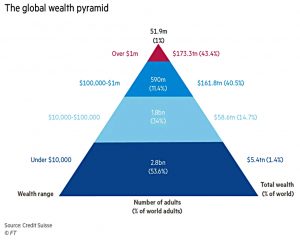

In the FT, Stefan Wagstyl warned the wealthy to prepare for depressed asset growth.

- Central bank stimulus has allowed asset prices to recover during 2020, but some of this money is likely to leak into the real economy during 2021.

The total number of ultra-rich people (with $50M or more) has barely changed.

And the ratio of very rich to less rich has not changed either, for three reasons:

- lower consumption, leading to higher savings

- low interest rates propping up property

- pandemic support helping all classes to similar extents

Income inequality is likely to have worsened, though.

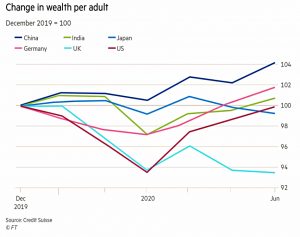

Looking at individual countries, the UK has fared the worst:

The future could be different though, as support dries up, interest rates rise (perhaps in response to inflation) and governments raise taxes to pay for the pandemic.

Europe

Buttonwood asked whether you should buy European shares.

- I have been doing so recently, albeit I’m only unwinding my underweights from the sales I made back in March.

His pitch is the lukewarm claim that things are not as bad as you think:

The euro-zone’s weaknesses have not gone away, but are much less crippling. It is likely to do quite well in the early stages of economic recovery.

The central problem with the EU is that it is a “half-finished project”:

It is a monetary union, but not a political one. The single market is fragmented in services and banking. Tax and spending decisions are made at the national level.

But there is a recovery fund, and the ECB is committed to reflation.

Next, we come to the sector makeup (which the UK also suffers from):

Too few of the digital companies of the future; too many of the industrial companies of the past.

Here again, things are slowing getting better (though not to the extent of catching up with the US).

But EM stocks offer similar economic recovery potential, plus more tech kickers and a potential benefit from a weaker dollar.

- So I have been buying those as well.

Quick Links

I have eight for you this week, the first five of which are from The Economist:

- The newspaper thinks that the pandemic could lead to productivity growth

- And wondered whether the OPI bonanza can last.

- The Economist also wrote about Uber’s sale of its autonomous vehicle division

- And OPEC’s loosening

- And the record corporate capital raises of 2020.

- UK Value Investor explained how to categorise stocks as quality, defensive or value

- Early Retirement Now explained how to beat the stock market

- And Disciplined Global Systematic Macro Views explained that forecasters give good commentary but they don’t predict well.

Until next time.