UK Private Investor Weekly, 12th November 2014

Welcome to this week’s roundup of of all the financial news that’s relevant to the UK private investor. If you find this post useful, you can find all the weekly updates here.

Today’s weekly roundup begins with Merryn’s column in the FT about automation.

As the minimum wage increases in developed nations, so do the profits to be made from replacing these jobs with robots. As Merryn points out, “robots don’t get sick, get pregnant, ask for more money, argue about repetitive tasks, or fall in love with colleagues.” This is potentially very deflationary, though Merryn predicts growth in personal care for the elderly (servants, in other words).

Investing is this revolution is not easy, though Merryn has a couple of suggestions:

- The Global Robotics and Automation Index ETF (US listed, annual charges of 0.95%)

- The Guinness Global Innovators Fund (UK, but not focused on robotics).

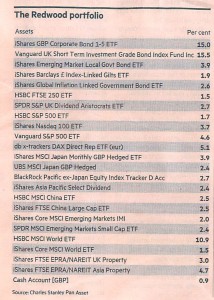

A few pages later, John Redwood presented his regular update on the ETF portfolio he runs for the paper.

Over in the Economist, there was an interesting article about the trend for institutional investors to cut out the middlemen.

Large pension and sovereign wealth funds are trying to recruit talents from private-equity and hedge funds to look after their fund in-house. This is an extension of the practice of co-investing into individual deals alongside funds they are already invested in, and the joint-ventures between sovereign wealth and pension funds that have been seen recently.

Just as with private investors, the financial crisis has driven these funds to better understand where their portfolios are invested and – in the light of lower projected returns for the forseeable future – to cut costs. A further issue is the long-term investment horizon of sovereign and pension funds (as with DIY private investors) and the increasingly short-term perspective of asset managers.

In practice, recruiting the necessary top talent is proving difficult, with low government salaries and unglamourous locations both obstacles. It is worth trying though – in-house deals are more profitable because of the lower costs.

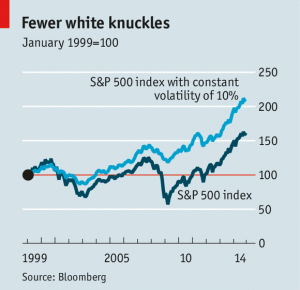

The magazine also looked at a new strategy designed to enable pension funds to achieve the high returns they need to fund defined benefit plans, but with reduced volatility. The idea is to maintain constant volatility across an equity portfolio by borrowing money when volatility is low, and selling shares to hold cash when volatility is high. This produces a smoother ride at the cost of underperforming in steadily rising bull markets.

A key issue is the tendency of volatility to appear suddenly. Indeed, a low value in a volatility index (such as the VIX) is often seen to be a sign of complacency and impending instability. To counter this, investors buy put options in the volatility index, at a cost of around 0.68% per year. This reduced maximum drawdowns over 20 years in the S&P 500 from 56% to 28%.

The Economist draws a parallel with the portfolio insurance widely held to have caused the Black Monday crash in 1987, when the Dow fell almost 23% in a day: as the market dropped, investors sold futures, causing a further drop in the underlying market. Widespread adoption of the new strategy could lead to similar risks.

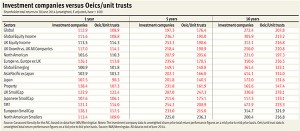

I don’t subscribe to the Investor’s Chronicle (part of the FT stable) but I am on their mailing list. This allows me to print out the odd article and means that I receive their monthly update of free features. Amongst the pages on offer from October were updates on a stock screen and some small cap tips, but of more interest was a feature on the outperformance of investment trusts.

And finally, I couldn’t ignore an email from Bengt Saelensminde, who writes a free column from the Money Week stable called The Right Side.

Bengt noticed that Apple – a business already drowning in cash – has managed to raise money in the eurobond markets at extraordinary rates: 1.08% over 8 years, and 1.67% over 12 years. German government bonds currently return 0.83% over 10 years. The bond market is in a bubble, caused by too much money chasing too little yield.