Weekly Roundup, 29th November 2018

We begin today’s Weekly Roundup in the FT, with Jason Butler, who was writing about financial fitness.

Contents

Financial fitness

Jason Butler gave us a framework for working out how financially fit we are. (( I’m surprised that he didn’t save this column until January, when half the population signs up at a gym for a few months ))

About four in 10 us have money worries, according to a recent study of over 10,000 UK employees across 25 industry sectors. (( Note that the survey was run by a firm that Jason works for, so once again the FT is carrying advertorial content ))

People in this group were nearly nine times more likely to have sleepless nights; over seven times more likely not to finish daily tasks; nearly six times more likely to have troubled relationships with colleagues, and twice as likely to be looking for another job.

Surprisingly, one of the groups with the highest percentage of money worries (49 per cent) were those earning more than £100,000 per year.

Jason’s firm had a list of ten questions for us:

- How often does this happen to you?

- I run out of money before payday

- I don’t pay the complete monthly bill on my credit card

- I don’t have enough to spend on the things that I enjoy doing without feeling guilty

- I don’t have enough to take care of life’s unexpected expenses

- Without your current income, how long could you meet your regular expenses without borrowing?

- Would you agree or disagree that . . .

- My spending is under control and I always have a bit of cash left over each week / month

- I have long-term financial goals and a plan to achieve them

- I can afford to own a nice home

- I think I’ll have enough money to retire on

- I have a plan for most things in life

I like to think that most readers of this blog would sail through these entry-level questions, but perhaps I am hopelessly naive.

- The average score for UK workers is six out of ten. (( For some reason, the quiz converts ten questions into five points, but I’ve adjusted for that ))

- A third score four or under and 40% score eight or over.

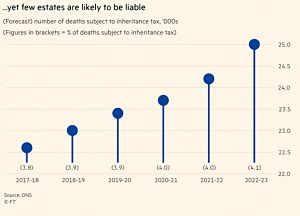

Inheritance tax

Lucy Warwick-Ching covered the interim report from the Office of Tax Simplification on inheritance tax.

- Although IHT brings in only 1% of total tax revenue, it is the tax most hated by the population.

IHT is progressive (“rich” people pay it), but not as much as people think.

- Really rich people have so much money that they can give most of it away before they die.

- So it’s the “mass affluent” who get it in the neck.

I had a quick look at the report myself, and it’s pretty boring.

This one is focused on admin rather than changes to tax law.

- Since these are likely to be negative changes, perhaps no news is good news – boring is fine.

The current consultation runs to June 2019, so the final report is probably a year away.

Corrections and puts

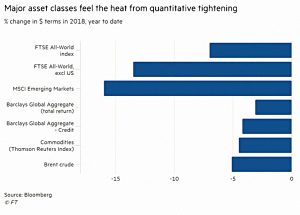

Merryn wrote about the sell-off in tech stocks (and crypto, and EMs).

The big tech companies aren’t actually a dream come true. They have had a wonderful time being the good guys in a low-interest rate, low-labour cost, low-regulation and nearly tax-free globalised world.

And their embrace of all these things has been a main driver of the doubling of US profit margins in a decade.

With labour costs rising and more regulation looming, the good times are over.

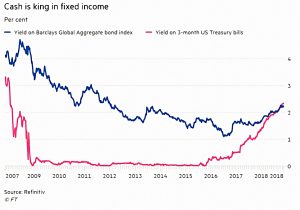

Michael Mackenzie’s column was on a similar theme.

- We are witnessing an overdue return to pre-QE investing.

Michael noted that the bond markets were pricing in a “Powell put” – a signal that there would be fewer Fed interest rate hikes in 2019 than previously predicted.

- This would be good for the US stock market, and bad for the dollar.

Unfortunately, at present it is “too late to buy equities and too soon to buy government bonds”.

- Michael concludes that cash is king.

In a speech to the Economic Club of New York on Wednesday, Powell delivered, as reported by John Authers in his excellent Points of Return letter for Bloomberg.

He [Powell] said the current target for the federal funds rate was “just below the broad range of estimates of the level that would be neutral for the economy.”

In questions on Oct. 3, he said, “We’re a long way from neutral at this point, probably.”

John notes that:

Bond markets are smarter than stock markets. Bonds responded instantly (that is, they fell) to his comment on Oct. 3 that rates were “well below” the neutral rate, and had already fully discounted today’s more dovish tone.

Stocks took a week to crash after the Oct. 3 comments, and took Wednesday’s announcement as a big surprise.

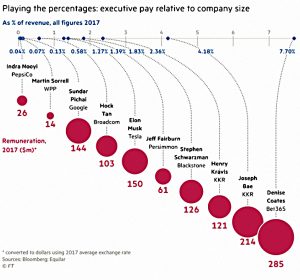

Nice work

Denise Coates – the boss of Bet 365 , the world’s largest online gambling company with an 8% share of a $43.1bn market – has come in for some stick for trousering £220M this year.

It’s a lot of money, and she made it from gambling.

- But she built the business up from a portakabin in a Stoke car park.

- And gambling is legal.

So I can’t see what the fuss is about.

Smartphone GDP

Gillian Tett wrote about the GDP generated by your smart phone.

We’ve written about the problems with GDP before (1 and 2), but essentially it is this:

The framework for GDP, which was devised in the 20th century for an industrial economy, measures activity in terms of money.

Whereas smart phone services (other than the basic data connection) are bartered for user data.

GDP has always excluded unpaid activities like housework.

- And it struggles to cope with stuff that gets cheaper and better (like technology).

But this is another step down that road.

Google and Facebook (soon to be joined by Amazon) make lots of money from ads, but the services are worth even more to their consumers.

- A recent study found that Facebook was worth an average of $42 a month to consumers.

- Which translates to 0.11% of US GDP.

- Maps and WhatsApp are also particularly valuable.

Gillian also points out that in 2000 the photo business was worth $40 bn.

- Today, twice as many photos are taken, at negligible marginal cost.

There’s no easy answer to all of this, but it’s worth remembering to take GDP numbers with a pinch of salt.

Stamp duty

The Economist came out against transactional property taxes – stamp duty, as we call it in the UK.

Even an average terraced house in London attracts tax of over £15,000 ($19,000) every time its ownership changes, a year’s earnings at the minimum wage.

The problem is that a wedge between what buyers pay and what sellers receive slows the pace at which properties change hands. A 1% increase in stamp duty reduces annual churn in property ownership by 3.5%.

This means fewer job switches, and slower productivity growth.

- It also discourages downsizing by the elderly.

I’m totally behind the newspaper’s plan to scrap stamp duty.

- But they want to replace it with a land tax.

This sounds like a good idea, but it would be very tricky to implement in the UK:

- A vast proportion of private wealth is tied up in property.

- London has extreme prices, and a switch to land tax would be hard for many incumbents to cope with (both in terms of initial capital loss and of funding the annual payment).

It also amounts to a massive retrospective tax on those who have played the system well to date.

- Canberra in Australia is phasing in land tax over 20 years – that might work.

Supply and demand?

A second Economist article on property blamed low interest rates and easy mortgages – rather than constrained supply – for high house prices.

A 1% increase in the number of houses should mean that prices fall by 2%.

- Yet prices have increased in real terms by 161% since 1996.

- That’s a lot more houses needed to bring them back down.

If you treat a house as a financial asset – its return being the rent you don’t have to pay – then as interest rates fall, so can this yield.

- Which means that the price of the underlying asset can rise.

Rents are astronomical where I live, but so are prices, meaning average gross yields of around 3%.

The second factor is mortgage availability:

To bid prices up to the point where rental yields are comparable to bond yields, households need sufficient access to mortgage credit.

Buy-to-let (BTL) mortgages, rising multiples (( We could only borrow three times salary when I bought my first house )) and rich foreign buyers who don’t need mortgages are all factors here.

- But tightening mortgages would mean fewer people on the housing ladder, which is bad politics in the UK.

BTL is being discouraged (with tax changes) but the small investors will just be displaced by institutions, without much impact on prices.

The Economist is not against building more houses, but only in the places where rents are rising (where they are most needed).

- These tend to be the places where existing residents are least keen on new builds.

So better designs will be needed to win over the NIMBYs.

- See the YIMBY movement for more on this.

Social credit

The Spectator had a couple of articles on the new Chinese “social credit” system (1 and 2).

As the train sets off from each station, an announcement plays in both Chinese and stilted English: ‘Dear passengers, people who travel without a ticket or behave disorderly, or smoke in public areas, will be punished according to regulations.’

‘Personal credit’ is essentially a permanent record of an individual’s behaviour. In the case of the train announcement, the record is maintained by China’s transport department.

If you’re caught travelling without a ticket or smoking on the train, you’ll be put on a blacklist. You may even find yourself banned from the railways.

I quite like the idea of a society where citizens are rewarded for good behaviour and punished for bad.

- But even I can see how things might get out of hand under an authoritarian government.

Quick links

I have eleven for you this week:

- Why diversification beats conviction – another look at the Bessembinder report from Morningstar.

- Catco’s Firestorm – Adventurous Investor

- More on the Powell Put from the Humble Student of the Markets.

- This Blog is Systematic asked Is Trend Following Dead?

- And also whether Maths in Portfolio Construction is Bad?

- The Economist reported on the FDA targeting menthol cigarettes.

- And also on the fall in tech stock share prices.

- And had a special report on crypto.

- Forbes explained why you would not have invested with Warren Buffett.

- Flirting with Models looked at portfolio construction.

- Alpha Architect asked what is the correct benchmark for trend following?

Until next time.