Weekly Roundup, 2nd December 2019

We begin today’s Weekly Roundup in the Ft, with the Chart That Tells A Story. This week it was about property cash buyers.

Property cash buyers

Katharine Gemmell reported that the share of UK homes bought with cash has fallen to its lowest level since 2007.

- It’s down to 28% for the UK as a whole, and only 19% in London.

Ten years ago, 36% of properties were bought with cash.

The average cash purchase price is still going up – is the UK as a whole, but not in London – so it’s possible that the rise in house prices has something to with the decline in cash buyers.

- There’s also speculation that the number of downsizers has declined, perhaps in response to increased stamp duty.

There are more smaller homes (2-beds) being bought with cash, but the number of buy-to-let cash buyers is down.

Election special

There were a lot of articles about the election this week.

Merryn Somerset Webb wrote about the difficulty in identifying exactly who are the rich that so many people would like to soak.

- Labour is targeting those on more than £80K pa, but Merryn notes that the top 20% are on an average of £88K.

She also points out that the post-tax (and welfare) income ratio between the top and bottom quintiles is only 3.4 times (compared with 11 times pre-tax).

- The hourly income differential is even smaller, since those at the top work more hours.

There’s also the issue of the shape of careers.

- 14% of workers pay higher rate tax, but it’s not the same 14% each year.

People are paid little, to begin with, then more in the middle years of their career, and then often less again at the end.

- Merryn estimates that 25% to 30% of people pay high rate tax at some point.

On wealth inequality, she notes that more education and longer lives mean that the passing down of assets is taking longer that it used to, making older people richer than before and young people poorer.

Equality — or the lack of it — should be judged over a lifetime. Young people may think now that anyone richer should be taxed more. But age is a huge driver of wealth and income. And it comes to us all.

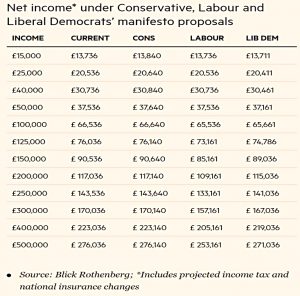

The FT also had a multi-author article on how the various manifesto pledges would affect our finances.

- There was nothing new in there, but the article included a useful summary table of net income levels.

Of course, income tax is just part of the picture – Labour is also targeting corporation tax, capital gains tax and inheritance tax increases, plus increased tax on dividends and the “reform” of entrepreneur’s relief.

- And they will add stamp duty to all financial transactions, not just those in large UK shares, and allow double council tax on second homes.

In MoneyWeek, Dominic Frisby pointed out that at 45%, the tax take is close to the 50% levied by medieval lords on their feudal serfs.

- And of course, all of the manifestos mean that tax will rise after the election.

For a typical British middle-class professional, the lifetime bill totals £3.6m – considerably more than the typical house. You will spend a full 20 years of your life or more in obligatory service to the state.

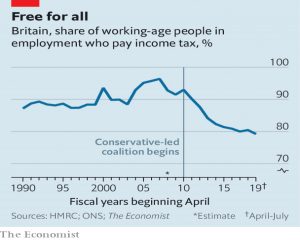

The Economist noted that the UK tax base has been falling, particularly under the Tories.

- It’s down from more than 90% to fewer than 80% of workers, largely because the annual tax-free allowance has risen sharply in recent years, to £12.5K.

At the same time:

The burden on the richest has grown. The top 1% of income-tax payers contribute 30% of the total take, up from 22% in the mid-2000s.

Of course, that’s not enough for Labour.

Inequality

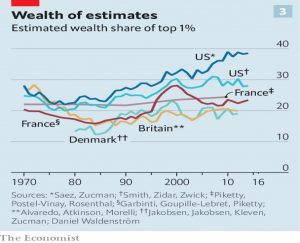

The Economist also had a couple of articles (1 and 2) on new research which suggests that income and wealth inequality may be less than previously thought.

In Britain the share of income of the top 1% is no higher than in the mid-1990s, after adjusting for taxes and government transfers.

And even in America, official data suggest that the same measure rose until 2000 and since then has been volatile around a flat trend.

Now some economists have re-crunched the numbers and concluded that the income share of the top 1% in America may have been little changed since as long ago as 1960.

Sources of error include:

- falling marriage rates which divide income amongst more households, but the same number of people

- corporate profits flowing to middle-class people with pensions that hold shares

- the treatment of inflation and government transfers

You also have to claim that four decades’ worth of innovation in goods and services, from mobile phones and video streaming to cholesterol-lowering statins, have not improved middle-earners’ lives.

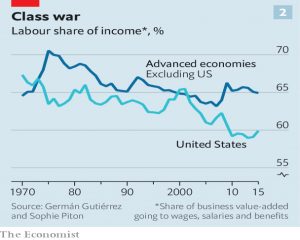

There are also problems with the idea (popularised by Piketty, who has since called for a 90% tax on wealth) that capital has triumphed over labour:

The decline in labour’s fortunes is explained in most rich countries by exorbitant returns to homeowners, not tycoons. Strip out housing and the earnings of the self-employed, and in most countries labour shares have not fallen.

Amerca is the exception, with lax anti-trust regulation permitting industry concentration.

The newspaper calls for more houses to be built in cities with attractive jobs, and the removal of regulation and licencing that protects high-income jobs.

Vanguard SIPP

Vanguard finally announced the launch of their much-delayed SIPP – and unfortunately, it was a bit of a damp squib.

- It has a platform fee of 0.15% pa, capped at £375 per year, which is the equivalent of no fees above £250K invested.

The AJ Bell SIPP has an annual fee of £100, which makes it better value for pots bigger than £67K.

- And you aren’t restricted to just Vanguard funds.

Still, the good news is we don’t need to wait around any more wondering if the Vanguard SIPP will be better than what we have – because it won’t.

- Even HL is cheaper for large pots.

Quick links

I have just four for you this week, three of which are from Alpha Architect:

- They looked at Enterprise Multiples and Equity Country Allocations

- And at whether Earnings Forecasts from Sell-side Analysts are biased

- And at Long-only Factor Investing.

- In his Virtuous Investor series, Klement on Investing also looked at Analyst Forecasts.

Until next time.