Weekly Roundup, 5th October 2020

We begin today’s Weekly Roundup with a look at investment returns.

Returns

In the Times, Patrick Hosking looked at the returns needed to make investors suspicious that something might be Too Good to be True.

- According to FCA research, an advertised return needed to be more than 29% pa to become remotely suspicious.

This is better than Buffett and would grow £1K to £26.5M over 40 years.

- But there are a lot of people on Twitter and the bulletin boards claiming annual returns of more than 30% pa.

In reality, Patrick explains:

Average real equity returns in the UK have in fact been 5% over the past 120 years, Average real returns from UK government bonds have been 1.4%, while cash has delivered a real 0.7% a year.

Which – over the long-term – is plenty.

Of course, stock returns over the past decade have been much higher, particularly from the US and from Tech.

- But that doesn’t mean that this will go on forever.

My personal safe withdrawal rate (SWR – the amount I expect to be able to get from a diversified portfolio on an indefinite basis) is just over 3% real pa.

- Be very wary of people who claim that they can consistently deliver much more.

Patrick says:

Unrealistic expectations are a curse. They partly explain the mini-bonds debacle of recent years, when thousands of small investors saw nothing suspicious about investment schemes advertising returns of 8 to 12 per cent from the high-risk activity of lending to small businesses.

He also notes that pensions are in trouble:

Defined benefit schemes will need fantastically improbable returns over the next decade to fix their shortfalls.

More on this below, also.

Joachim Klement pointed out that the higher you aim, the worse you get.

Investors tend to have return goals that are way too high to be realistically achievable in the long run.

A study of 4,000 retail investors in Belgium found that one third targeted 8% real and another 41% targeted 5% to 7% real.

- A similar study across 22 countries found an average target of 9.5% real.

Investors with a higher return target did miss their targets by a wider margin than investors with average return targets. And they did worse in terms of total return achieved.

Joachim says that the same is true of CEOs, who earn more as they outperform their peer group.

If CEOs fall behind their peers, they crank up the risk of their business. The worst performing CEO increases financial leverage, R&D spending and restructure[s] the business to such an extent that stock price volatility increases by 18% and ROA volatility by 31%.

Unfortunately, the increased risk doesn’t usually pay off and the companies underperform.

Writing in the FT, Inigo Fraser Jenkins from asset manager Bernstein argued that pension funds will not be able to ignore stocks as they seek higher returns.

Many institutional pension funds and individuals do not save enough now to meet their future cash flow needs. Post-coronavirus, the level of risk carried by pension plans has to materially increase.

He also believes that bonds and stocks will become more correlated, and the tradition 60/40 split will no longer provide protection against equity volatility.

Most high-grade government and some corporate bonds are at risk of delivering negative real returns. Since investors are being asked to take on more duration risk, it is likely that the future allocation to such bonds will fall materially.

He notes that the coronavirus response is likely to be inflationary (eventually), which is bad for bonds.

- So pensions will need more stocks, more infrastructure and more long/short (hedge fund strategies, as well as greater use of factor strategies.

Also in the FT, Charles Calkin of JF Hambro looked at how to calculate when you can retire, which depends on the SWRs we met earlier (and hence on expected rates of return).

- He starts with Bengen’s four per cent rule and notes that exactly when you retire has a big impact on how well it works.

There are good arguments for deferring retirement if the timing is wrong.

Alternatively, you can use a failsafe SWR – which always works – which is my personal approach.

- 3% real pa should work in all situations if you get your asset allocation right

Charles suggests 3.25% pa, which is reasonable.

Wellesley

Circling back to unfeasible returns, it was reported last week that Wellesley Finance is in trouble.

- This is one of those firms which advertises high rates of return (4% to 8%) on accounts that seem like savings (or bonds) but in fact loan money to property developers.

So you are taking on credit risk without FSCS insurance, perhaps without knowing or fully understanding.

- In this respect, it’s a lot like the “mini-bonds” which have been blowing up for the last couple of years.

Wellesley was founded in 2013 by an Earl and used TV ads to attract £571M of savings.

- It still owes 12,00 investors around £118M.

But because of the pandemic, a lot of building projects have now stalled, leading to defaults from builders.

- Interest payments have been frozen, and Wellesly is proposing a CVA which the investors must vote on.

They have to choose between losing some of their money and losing most or all of it.

- Without the CVA, Investors in “secured” mini-bonds will receive 77p in the pound.

- Regular bond-holders will get 66p.

- P2P investors will get just 44p.

With the CVA, these numbers rise to 84p, 71p and 48p.

Crowdfunding

I had an email from Seedrs this morning (I’ve been to a few of their pitch evenings, but never invested) announcing their plan to merge with Crowdcube, one of the other leading equity crowdfunding platforms.

By joining forces, we’ll be able to harness the strengths of both businesses as we accelerate our shared mission to create the world’s largest private equity marketplace. Together, we will help fund thousands of ambitious, fast-growth businesses and deliver exceptional returns to the investors who support them.

Since 2011, over £2 billion has been invested in campaigns on Seedrs and Crowdcube. Together, we have helped more than 1,500 companies secure investment, including Brewdog, Revolut and Perkbox.

I remain of the opinion that this type of investment is suitable for very few people, and definitely not for the young relatively poor retail investor at which it seems to be aimed (and with whom it seems popular).

- Unlisted equity is very risky and should make up only a small portion of your portfolio.

And the deals on these platforms will be some of the riskiest and most aggressively priced available.

- Fill up your SIPP and ISA first, and if you need income-tax incentivised investments beyond your pension, look first at VCTs.

Only when you can’t access them should you think about EIS, and only when the established EIS funds are full should you look at crowdfunding.

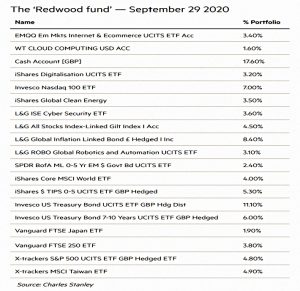

Redwood

In his regular update on the ETF portfolio he runs for the FT, John Redwood warned that a Biden win in the Presidential election could mean that the US would follow the EU’s environmental lead.

John believes that central banks are propping up the markets at present.

It is going to take further stimulus to extend the bull run.

He remains a fan of the digital revolution and doesn’t believe in a V-shaped recovery.

The EU aims to reduce CO2 emissions to 45% of 1990 levels by 2030.

- Before the pandemic, they were at 75% (after 30 years of effort).

The green revolution would have us all eating less meat and dairy produce, trading in our current car for an all-electric vehicle or a good bicycle, forgoing jet travel to a foreign holiday, changing our gas or oil boiler for something greener [and] insisting on renewable electricity.

The drivers for all this are a wider emission trading scheme and more carbon taxes – ones that affect home and car owners as well as businesses.

John’s fund is up 3% in 2020, due to high weightings to US and Tech.

- He has now moved some of the US exposure to cash.

Cars in cities

I looked at the prospects for big cites like London and New York a couple of weeks ago, and last week the Economist covered one of the hot topics in London – car use.

When covid-19 hit Britain in the spring, several London councils moved to head off an expected surge in driving as people tried to avoid public transport. New planning rules allow them to close roads to cars without holding lengthy consultations.

With extra bridge closures, Journey times in and out of Central London have tripled for me (to 90 mins for five miles – around walking pace).

- It’s also very easy to be fined for turning into a road which was open last week but is closed this.

Which is not great for London’s economic recovery.

On the local residents’ news boards, younger, richer people are fine with this, telling everyone to cycle or walk.

- Older, poorer, less fit people are not so keen.

It turns out that another split is how long you have lived in London.

People who moved to the capital several decades ago are much more likely to own a car than new arrivals. The opponents of low-traffic neighbourhoods are fighting to save the old, chaotic, dirty London.

It reminds me of Brexit, so count me in.

Quick Links

I have a miserly one for you this week, from Alpha Architect:

- They looked at Lottery Preferences and Their Relationship with Factor Investing.

Until next time.