Weekly Roundup, 25th November 2019

We begin today’s Weekly Roundup in the FT with Tim Harford, who was writing about algorithms.

Algorithms

It appears that some people feel that the Apple/Goldman Sachs Credit Card is sexist since some men have reported higher credit limits than their wives.

But as Tim points out, there is more than one definition of equality:

One definition of equal treatment would be that credit was extended equally to both, regardless of the fact that women tend to be paid less than men. Another would be that people with the same income got the same credit.

It’s impossible to offer both forms of equal treatment simultaneously.

This is the big problem with identity politics.

- To divide people into groups, you need some separating parameter, which will likely mean that the groups don’t line up neatly on some other parameters.

And then the world (including credit card algorithms) will start to treat them differently.

- Which means that for fans of identity politics, pretty much everything is unfair in one way or another.

And as Tim says, most of it doesn’t matter:

One reason I am sanguine about the Apple Card is that other credit cards are available. If Goldman is mistakenly turning down creditworthy people, other companies will want their business.

That’s the beauty of capitalism.

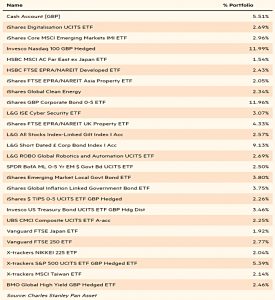

Redwood fund

John Redwood gave his regular update on the ETF fund he manages for the FT.

- Trade wars and the anti-Chinese demos in Hong Kong have led him to reduce his China and Germany positions.

USA, USA, USA

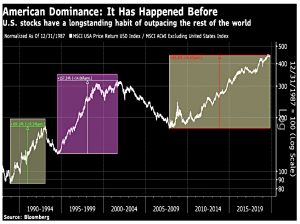

In his Bloomberg newsletter, John Authers looked at US market outperformance relative to the rest of the world.

The most likely explanation for the recent outperformance is the US dominance of the tech sector.

This kind of thing has happened before, but the market usually snaps back eventually.

- At the moment, the US has better and more stable growth in earnings per share and a shareholder-friendly economy.

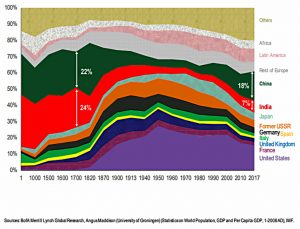

But the US share of global GDP is falling, and that of China and India is rising.

- This should eventually be reflected in stock market performance.

The dollar is also overvalued, against the euro, yen and sterling.

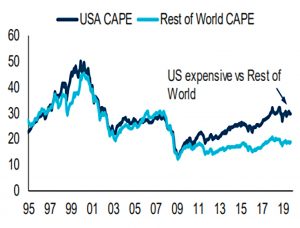

John’s final point is about PE – the US is expensive, and this must mean-revert over time.

Extrovert CEOs

In a second column, John looked at the dangers of having an extrovert CEO.

- A new study has analysed Q&A sessions with investors of 2,880 CEOs of S&P 1500 firms from 1993 to 2015.

Three personality traits were measured:

- conscientiousness in a CEO leads to outperformance in return and (lower) volatility

- neuroticism leads to increased risk

- and extroversion leads to both higher volatility and lower returns

I think we can all pick out a few companies to avoid on that basis.

Fees

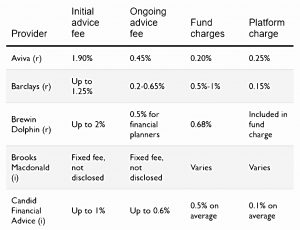

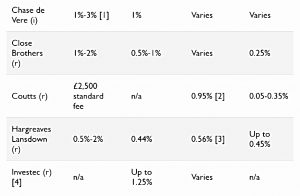

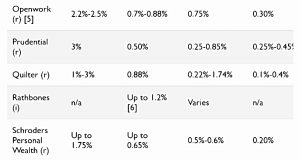

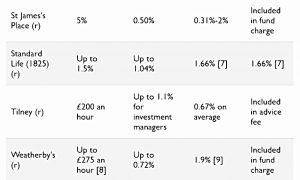

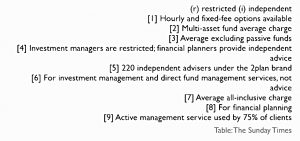

In The Times, Ali Hussain tried to untangle the cost of financial advice.

- He surveyed 30 advisors who between them hold £250 bn of investors’ funds.

He found that:

Many firms fail to publish their charges online, use dozens of different terms for fees, apply up to six layers of costs and even levy negative interest rates on some cash holdings.

The scary thing about this chart is that none of the numbers are cheap. Ali notes:

A 1% fee can eat up to a third of your profits over 20 years, according to Candid Financial Advice.

Gina Miller commented:

In any other industry it would be illegal not to disclose the total cost to consumers in a readily accessible place. Many of these companies are complying with the letter of the law but appear to be deliberately avoiding the spirit of the law.

The attitude of the FCA to such widespread consumer detriment is a complete disgrace.

Stick with DIY investing.

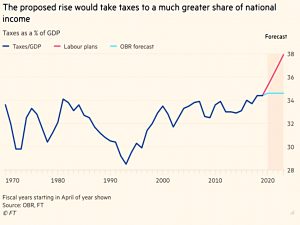

Corbyn Watch

The Labour party manifesto was published last week, and as expected it contained a lot of spending commitments.

We’ve already discussed the nationalisation proposals for utilities, railways and the Royal Mail – and of 10% of any large firms dim enough to remain in the UK.

- And now of part of BT, so we can all have “free” broadband.

Amongst the tax rises announced yesterday to offset spending were:

- An unspecified increase in income tax for those earning more than £80K pa (not enough to buy a flat in my street).

- And an even higher rate for those on more than £125K pa.

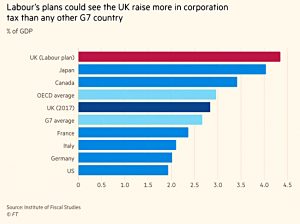

- Higher corporation and capital gains taxes, and more tax on dividends.

- Recent corporation tax cuts would be reversed, taking the rate up from 19% to 26%.

- Capital gains and dividends would each be taxed as income – so get your savings inside a tax shelter.

- Stamp duty on shares to be extended to other financial instruments.

- This is intended to stop high-frequency trading, but would just move trades away from the UK.

- Which in turn would reduce liquidity and increase volatility.

- Abolition of the Residential IHT allowance (effectively lowering the IHT threshold from £500K to £325K).

- A tax on second homes.

- And the introduction of “unitary taxation” of multinational profits according to a company’s level of operations in the UK, rather than declared local profits.

- This is unlikely to be acceptable to foreign states and could have serious consequences.

Here’s what Paul Johnson, Director of the Institute for Fiscal Studies, thought:

It’s impossible to understate just how extraordinary this manifesto is in terms of the sheer scale of money being spent and raised through the tax system. These are vast numbers, enormous, colossal in the context of anything we’ve seen in the last…ever, really.

The Labour manifesto suggests they want to raise £80 bn of tax and they suggest all of that will come from companies and people earning over £80,000 a year. That is simply not credible. You cannot raise that kind of money in our tax system without affecting individuals.

Labour also committed to holding the pension age steady at 66, which makes no sense as people live longer.

- And for physically demanding jobs, the age might even come down.

More good news for pensioners is that Labour would retain the triple lock.

- And there would be a cap of £100K on care costs.

In addition, Labour plan to end the tax advantages of private schools and to raise the minimum wage to £10 per hour (£20K for a 40-hour week).

- And a few days after the manifesto launch, they announced rent controls – another crazy idea.

The impact of this manifesto on the UK economy makes any kind of Brexit look like a trivial event.

Quick Links

I have nine for you this week:

- Musings on Markets wrote about the Aramco IPO

- And then wrote about it some more

- CityWire looked at the uncertain future of Hadrian’s Wall Secured Investments

- The Economist wrote about Google’s game-streaming platform

- And looked at Big Tech’s attempts to take on retail banking

- UK Value Investor described his worst investment ever.

- Alpha Architect looked at whether Carry, Value and Momentum are Regime-Dependent

- Edhed wrote about the promises and perils of crowdlending (P2P)

- Ans the FT looked at How quants and QE shook the cult of the stockpicker

Until next time.