Weekly Roundup, 10th October 2022

We begin today’s Weekly Roundup with inflation.

Inflation

John Authers looked at the bad surprise from the US inflation report for August.

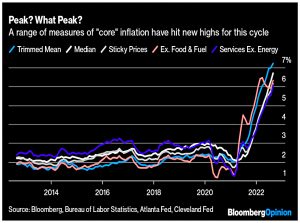

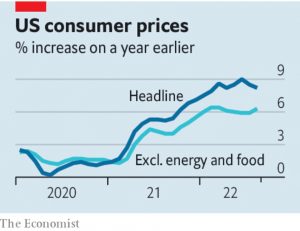

- Though the headline number went down slightly (because of the falling oil price), many underlying measures hit new highs.

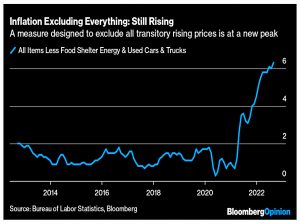

Even the measure invented last year to exclude “transitory” factors is now at a new high.

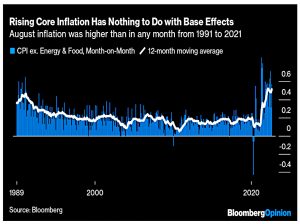

And core inflation increased after falling in July.

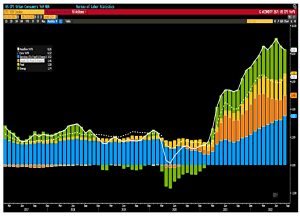

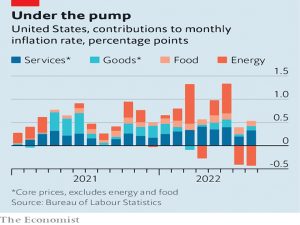

The breakdown of contributions shows that services have taken over from energy as the key driver.

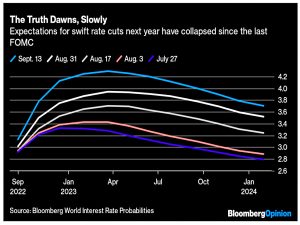

As a result, expectations of rate cuts early next year are fading:

Fund manager expectations

John also looked at the monthly survey of fund managers from Bank of America.

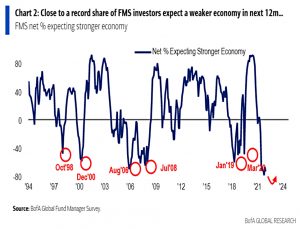

- 72% now expect a weaker economy in the next 12 months.

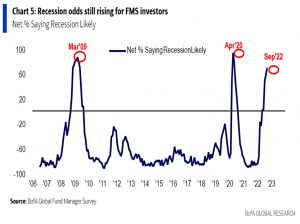

And 68% now foresee a recession, the highest proportion since early in the Covid crisis.

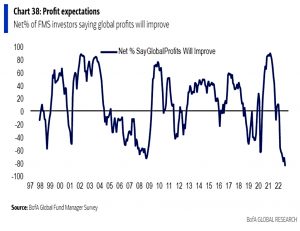

Negativity about future corporate profits is at a 25-year high.

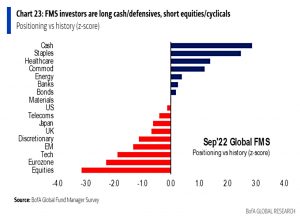

Not surprisingly, the fund managers have a defensive allocation – overweight in cash, defensive and energy, and underweight stocks, the eurozone, emerging markets and cyclicals.

Buying

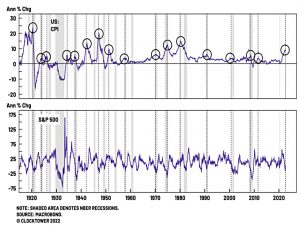

John also looks at work from the Clocktower group which shows that peak inflation usually leads to growing confidence in risk assets and big equity rallies.

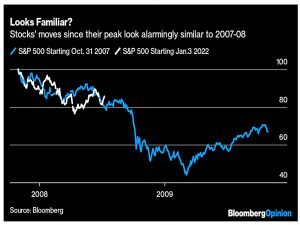

At the same time, the S&P is still tracking its 2007 course, which means that a shock like the Lehman bankruptcy could trigger another big leg down.

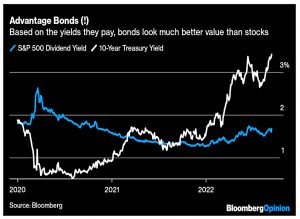

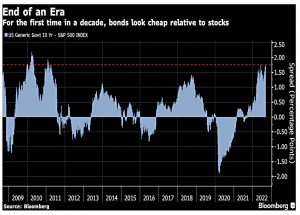

John also thinks that it might be a good time to buy bonds.

The gap between S&P 500 dividend yields and 10-year yields suggests that equity valuations are supporting bonds. Buy a 10-year bond, and you’ll get double the yield you would get from stocks.

That’s only in the US, of course (UK bond yields are lower and stock yields much higher) and it’s only a good idea if you think that the peak in interest rates is close (we probably have another six months of hikes to go).

The spread of bond over dividend yields suggests bonds are more appealing than at any time since early 2011.

But they could get more appealing in the coming months.

Go big

The Economist agreed that the US still has an inflation problem.

Energy lowered the month-on-month in§ation rate by nearly half a percentage point. It was the other components—food, goods and, especially, services such as rent—that pushed up prices.

The monthly number for August was 7.4% annualised, way above the 2% target.

One critical factor is labour-market tightness. With roughly two jobs available per unemployed person, workers have strong bargaining power.

It will probably take higher unemployment to fix this.

In a second article, the newspaper recommended that the Fed “go big“.

The economy is still overheating. The effects of generous fiscal stimulus during the pandemic linger today. Households in aggregate are still sitting on more than $2trn in excess savings, equivalent to 10% of annual GDP.

US inflation is sticker than that in Europe since it is driven by local demand rather than the energy price shock.

- The Economist recommends strong medicine:

Rather than continuing the cycle of tardiness and surprises the Fed should act in bigger increments, by bringing forward to this year the interest-rate rises it had planned for 2023.

If we assume that rates will peak at 4.5%, then two 1% rises would get us there.

- In practice, we’ll probably get 0.75%, two shots of 0.5% and a final 0.25%.

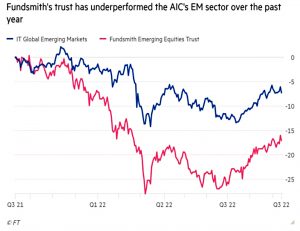

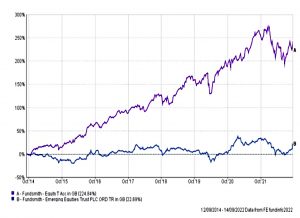

Terry Smith

Terry Smith’s £377M EM fund (LON:FEET) is to be liquidated after poor performance and the resignation of Smith’s group Fundsmith as the investment manager. Smith said:

We have always maintained that we would only run funds where we felt we had a particular edge that would allow us to deliver superior risk-adjusted returns. Whilst the trust has made a positive return since launch in 2014 it has fallen below our expectations.

Unlike other fund managers who might seek to hold onto the fund for the sake of the fee income, we feel it would be in the best interests of shareholders to receive their investment back in cash through a liquidation of the portfolio and wind-up of the trust.

Terry ran the fund himself for five years after the launch in 2014, before handing it over to Michael O’Brien.

It’s possible that other asset managers may pitch to take over the portfolio, and there could be other ITs who want to explore a merger.

- If not, the winding up is scheduled for November.

The trust’s NAV is down 6% in a year and the share price is down 11%.

- The discount to NAV was around 14% before the announcement.

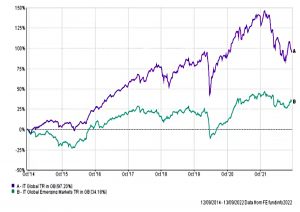

FEET has trailed the MSCI EM index since launch (43.6% gain vs 67.9%).

- Including the NAV discount, total returns are just 22.3%

The last investment report for the half year to June 30th highlighted issues for emerging markets:

Included in these are inflation, rising interest rates, leading to deteriorating terms of trade for a number of emerging market economies, the Russia-Ukraine War, China’s Covid-zero policy and the continued dislocation of global supply chains.

Capital suddenly has a cost, and current financial liabilities and earnings weighted to the future have a cost. For emerging markets, this has also been exacerbated by the potential rate of increase of US interest rates, leading to capital outflows as investors chase a higher headline ‘riskfree’ dollar return.

When FEET was launched, Terry said:

The emerging markets trust should be able to outperform Fundsmith over 10 years.

Unfortunately, this hasn’t been the case.

- FEET has suffered from a tilt towards India and underexposure to China, tech and e-commerce.

EM markets in general have also underperformed.

Whilst it’s always good to see a manager facing up to not meeting expectations, the poor performance is more evidence for the theory that star managers generally have one winning style, which is rarely transferable across markets or asset classes.

- Terry’s strength is established relatively mature “quality” growth firms, and there are fewer of these in emerging markets.

He also has a bias against macroeconomics, but these drivers can have more influence in emerging economies.

It should also be noted that FEET is a small part of Fundsmith’s income, as FEET is dwarfed by the £23 bn flagship Fundsmith Equity fund (which is the UK’s largest retail fund, but which has also struggled this year).

- The third fund in the stable is Smithson (SSON), a £2.3 bn global “smaller” company fund.

Woodford

Sticking with star managers, the FCA is planning to recover £306M from Link Fund Solutions (LFS) because of its failings in managing the liquidity of the Woodford Equity Income fund.

- Canadian firm Dye & Durham (D&D) has bid for LFA parent Link Group and has been told by the FCA to keep this amount of money available.

Representatives of Dye & Durham have raised objections to this capital condition.

The FCA said:

The FCA has investigated the circumstances leading to the suspension of the Woodford Equity Income fund and is likely to seek to require LFS to pay a financial penalty and/or consumer redress. However, this is not a final decision – LFS can challenge any proposed action at the regulatory decisions committee.

There are multiple parties under investigation in relation to the circumstances that led to the suspension of the LF Woodford Equity Income Fund. These investigations continue and they will consider any further failings which may have negatively impacted investors.

Link is not in agreement:

Link Fund Solutions will explore all options, including challenging any warning notice that may be issued as Link Fund Solutions does not agree with the FCA’s view. Link Group considers that any liabilities relating to the Woodford matters will be confined to Link Fund Solutions.

Woodford Equity Income started to struggle in 2019 after a wave of redemption requests.

- It was suspended in October when it was worth £3.5bn (down from a peak of £10bn), trapping 300K investors.

By the time capital started being repaid from the winding up of the fund, its value had shrunk further to £2.9bn.

- Some £2.5bn has now been repaid, with £140M outstanding.

It’s not clear how any redress payment would be transmitted to the affected investors.

- AJ Bell calculated that if the full £306M was paid and all existing assets liquidated, investors will still only receive 80p in the pound from the date the fund was frozen.

It’s also possible that the fine will put D&D off the takeover, and that Link itself doesn’t have enough money to pay the proposed fine (though its market cap in Australia is £1.1bn, even after a 20% fall on the FCA announcement).

LFS reported pre-tax profits of £7.2M (from revenues of £42.6M) in June 2021, with net assets of £49.8M.

- Link is also being sued directly by investors, in a joint action from law firms Harcus Parker and Leigh Day.

And claims management firm RGL is expected to file another lawsuit in the coming weeks.

- As well as Link, this will target Hargreaves Lansdown, who promoted Woodford’s fund via its best buy list.

The FCA statement makes fund administration a little less of a cushy number.

- LFS is one of a small number of “authorised corporate directors” in the UK.

These firms monitor investment managers on behalf of the underlying investors, but (as with auditing) a conflict of interest arises from their appointment and payment by the manager they are scrutinising.

Quick Links

I have six for you this week, the first three from The Economist:

- The Economist said that America’s economy is too strong for its own good

- And that The inflation problem will get better before it gets worse

- And that Policymakers are likely to jettison their 2% inflation targets.

- Mohamed El Erian was interviewed on the Looming Recession — and What He’s Doing With His Money

- Alpha Architect found Momentum Everywhere, Including Emerging Markets

- And ERN looked at Building a Better CAPE Ratio.

Until next time.

Terry Smith’s take on the current debacle in DB pensions is IMO an interesting read, see:

https://www.ft.com/content/677243dd-2b21-4baa-8c5e-3dc6b53ad0e3

Yes. I’m halfway through writing my LDI article, and Terry’s take should be in there (I have 36 sources so far – it’s a popular topic).

The comments to TS’s post are IMO a good source of info/thoughts too.

FWIW, my take is (and has been for a good few years) that vanilla LDI (for want of a better phrase) is basically fine, albeit there are some uncertainties around the precise timings of the cash flows required – but the statistics of the fund should assist.

However, vanilla LDI requires a fully funded scheme.

Fully funded DB schemes are rare; so leveraged LDI (LLDI) appears.

LLDI then seems to have been ‘sold’ as some form of risk reduction exercise whereas IMO it at best should have been described as a re-risking exercise.

Here is a classic piece of mumbo jumbo from an annual trustee report:

“These changes are expected to reduce the level of investment risk whilst maintaining the current level of expected return, thereby further enhancing the overall …”!!

I agree with all that, apart from I do believe that you can (in general, not with LDI specifically) maintain returns whilst reducing risks.

I think another problem is the general short-termism around economic regimes. People have given up believing that interest rates/bond yields can rise (particularly as quickly as last month), or that rising yields would reverse the stock/bond correlation and break the 60-40 portfolio.