Weekly Roundup, 4th October 2022

We begin today’s Weekly Roundup with a look at the UK property market.

UK property by age

In the FT, Neal Hudson analysed the UK property market by the age of the owner.

- Zoopla recently estimated the value of all homes in the UK as £10 trn, but Neal thinks that rising interest rates and the cost-of-living crisis, plus inflation, will mean that this is a record high for the time being (at least in real terms).

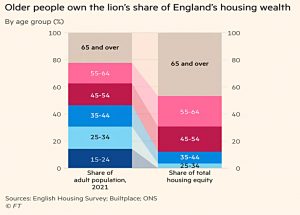

After removing mortgages, UK housing equity is concentrated in older age groups.

- This is as you would expect since older people have had longer to accumulate wealth in general – I would predict a similar profile for all categories of assets.

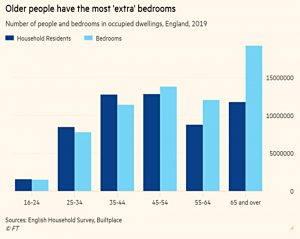

Neal also notes that older people have the most “extra” bedrooms (bedrooms beyond the number of people in the household).

- Again, this is not surprising.

Many will be the bedrooms of children who have now left home, though in some cases they may be transformed into home offices or some other use that appeals to those in retirement — probably more gyms than model railways these days.

There’s a misplaced idea that these extra bedrooms could solve the housing crisis, but they are probably in the wrong places, and older people won’t want to move.

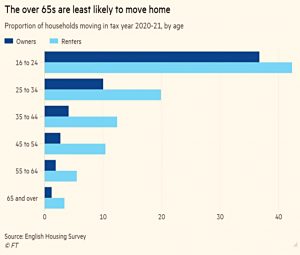

More than a third of over-65 households have lived in their current residence for 30 or more years.

There are several reasons for this lack of mobility:

- People get attached to homes they have lived in for decades

- There’s a lack of suitable alternative accommodation for older people at attractive prices

- Stamp duty is outrageously high

I have “extra” bedrooms, and this last point is most significant for me – I would pay six figures in tax if I swapped homes.

- If the UK wants a more liquid housing market, stamp duty (a transaction tax) has to go.

Coming back to the affordability of alternative accommodation, it’s a myth that older people have tons of equity.

- There are a lot of baby boomers around, and their average equity is just £322K.

With an average flat selling for £295,000 in 2021 and a bungalow for £337,000, there has been little financial incentive for people to downsize — even before accounting for moving costs.

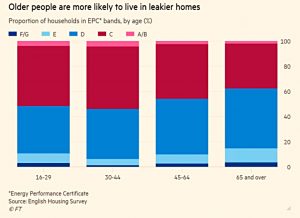

Neal wonders if the cost-of-living crisis might change this.

- OId houses are hard to insulate, and that’s where a lot of older people live.

Some 48 per cent of [households] headed by someone aged between 16 and 29 had an energy efficiency rating of D or lower; for the over-65s, the proportion rose to 62 per cent.

He’s got a point, though I expect Liz Truss’s energy price cap to reduce my peak spend on my old draughty house (the April 20023 forecast) by around 50%.

ETH merge

The Economist looked forward to the Ethereum merge, which took place last month.

- The newspaper felt that the future of crypto was at stake.

The merge is the name the crypto-community has given to the point at which the

Ethereum blockchain will transition from using “proof-of-work” as a consensus

mechanism, to using “proof-of-stake”.

It’s called the merge because the testbed Beacon chain will be connected to the main Ethereum chain.

This is no mere technical tweak. It is a complete overhaul of a $200bn piece of software that has been running for seven years, which will, if all goes to plan, be implemented with no downtime. People in crypto like to compare the process to changing the engine of an aeroplane mid-flight.

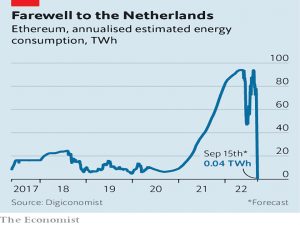

The motivation for the change is the huge energy consumption of PoW.

- PoS will use 9.99% less energy.

The effect on emissions will be as though, overnight, the Netherlands had been

switched off.

The merge should also act as a proof of concept that major blockchains are able to successfully evolve.

[Ethereum] developers are a rag-tag bunch. Some are employed by firms, some are employed by the Ethereum Foundation. Others are hobbyists incentivised to help out because they hold tokens. The ability to buy a stake in its success, through ether tokens, provides an incentive to get involved in maintenance.

It remains to be seen whether this leads to good and/or decentralised governance.

Implementing the merge requires consensus:

All the major clients must agree to write the software, enough nodes must update their software and all the real-world applications layered on the blockchain—like stablecoins backed by dollars in bank accounts—must accept the new merged chain.

Obviously, miners, with their heavy investment in hardware (around $5 bn in total) are not happy.

- But despite this, around 75% of nodes had updated their software to be ready for the change.

But a minority of miners may support a fork (along the lines of “Ethereum Classic” in 2016).

- Ethereum Work (ETHW) is the likely candidate.

The economics of trying a forked chain will probably not add up. It will only make sense to mine ethw if the value of the token is worth enough. And a version of Ethereum minus DeFi apps, stablecoins and developers is probably not worth

very much.

The impacts of the merge will include lower electricity demand (particularly in the US, home to 50% of nodes) and lower demand for graphics cards from Nvidia.

- Rewards for validating transactions will also fall since they no longer need to cover the costs of hardware and electricity.

Providing a regular financial return of the order of 3% or 4% would mean a 90% decline in token payouts.

The new chain will also be more secure, in the sense that buying enough hardware to get a 51% vote in a PoW system would cost upwards of $5 bn.

- Staking 51% of ETH tokens would cost around $20 bn.

The looming merge has led to a 50% appreciation in the ETC price in recent months, whilst the rest of crypto has traded sideways.

Post-merge, the big problem for the blockchain will be “gas fees” – the charge to have transactions recorded which is so high (sometimes $100) as to overwhelm the underlying efficiencies of the technology.

- There are plans to lower gas fees by increasing efficiency and capacity (from 20 transactions a second to ten thousand).

John Lee

In his regular FT column, John Lee said that there were slim pickings in the markets.

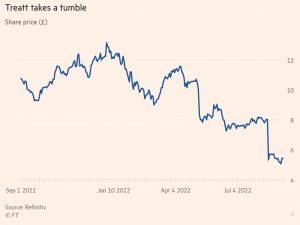

- In particular, John has suffered a big profit warning from his largest holding, flavourings maker Treatt whilst he was away salmon fishing.

A combination of currency losses and a fall in iced tea revenues in the US did the damage. Having already de-rated from a near £13 peak to £8, Treatt shares had plunged to £5.40 by the close on Monday.

As you might expect, John has no plans to sell.

I still regard it as a great company. Order books are at record levels and the move to its new state of the art Bury St Edmunds facility has gone well . As a patient long-term investor I will stay firmly aboard. Treatt has delivered spectacularly over the years and I expect a steady recovery.

John also had some thoughts on which sectors might benefit from the huge rise in energy prices (since capped):

Pawnbrokers, probably equity release providers, and likely two of my own holdings, insolvency specialist Manolete and business broker Christie.

Sadly, John’s wife died in October 2021, and he has spent time this year in reorganising his inherited portfolio.

- This included setting up JISAs for his grandsons, with holdings in 12 stocks they might recognise: Bloomsbury, Greggs, Halfords, Hollywood Bowl, Hotel Chocolat, JD Sports, Marks and Spencer, Ocado, Restaurant Group (Wagamama), J Sainsbury, Standard Chartered (the sponsor of Liverpool FC) and Tesco.

John is also worried that Labout might win the next general election, with a subsequent rise in income tax and CGT.

The question for investors holding shares pregnant with significant profits is whether to take profits. Similarly, will major shareholders in small-cap stocks court takeovers given the possible loss of other taxation benefits such as business property relief? Taking some profits now is something I will be seriously considering.

I have been helping to run an AIM IHT portfolio for my mother-in-law and would have been concerned about the possible loss of BPR.

- Sadly, my MIL died recently, and – current delays notwithstanding – I expect we will complete probate long before Labour comes to power (if indeed they ever do).

John Redwood

In John Redwood’s regular FT column, he wondered how short-term global inflation will be.

- Investors had wanted to believe in a Fed pivot but Jerome Powell’s Jackson Hole speech seemed to put an end to that.

He made clear that the Fed has only one aim, the reduction of inflation. Rates will go higher and stay higher to bring this about. It may well cause some economic damage, but to the Fed that is a necessary price to prevent inflation embedding in the conduct of employers, employees and consumers.

Equity markets reacted more than bond markets, which still predict that inflation will decline in 2023 and interest rates will not get too high.

The US is better positioned than Europe since it is much closer to energy self-sufficiency.

Europe is stuck with high and rising energy prices taking an increasing share of incomes, leaving the prospect of reduced demand, squeezed profits and lower employment from non-energy purchases. It also drives up the costs of most products and services as they need energy.

John still expects a pivot, but in 2023 rather than this year, and he is preparing to deploy his accumulated cash:

The time is approaching when a better return will be offered on longer dated bonds. When markets and the Fed think inflation is under control these will then look attractive.

US bonds will be most attractive, but shares have yet to bottom.

Quick Links

I have five for you this week, all from The Economist:

- The Economist said that Global rate rises are happening on an unprecedented scale

- And that Financial markets are in chaos – What next for the real economy?

- They explained Why some chipmakers are hurting much more than others

- And said that A reckoning has begun for corporate debt monsters

- They also noted that Markets are reeling from higher rates – The world economy is next

Until next time.