Diversification Landscape 2021 – Morningstar

Today’s post looks at a report from Morningstar on the current diversification landscape.

Contents

Diversification

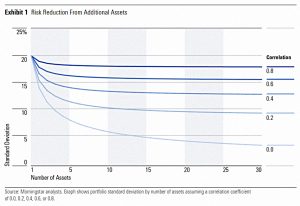

Diversification is famously the only free lunch in investing.

- Combining assets with imperfect correlations (anything less than 1) reduces the risk profile of a portfolio.

The three things to watch out for are:

- Correlations can change over time (and between economic regimes)

- Low correlation assets are sometimes also low-return assets (as often with bonds).

- Correlations often increase during periods of (stock) market crisis – so not all assets can protect you (not many assets provide “crisis alpha”).

The holy grail of diversification (as described by Ray Dalio in his early papers on the risk parity approach to portfolio construction) is to find a number of uncorrelated assets with comparable expected positive returns.

- This is not so easy to do.

Downturns

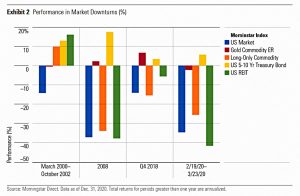

During the Covid crash in March 2020, the US market dropped 34.5%.

- A flight to safety meant that cash and short-term Treasuries held their value, and long-term Treasuries went up.

So the traditional 60/40 portfolio only lost around 22%. (( Here in the UK, the FTSE-All-share also lost more than 30%, whilst my own risk-parity style portfolio lost “just” 12% ))

- Amongst the other common diversifiers, gold lost 2.3% but commodities and REITs sold off sharply.

Morningstar notes that each crisis is different.

- Value worked well in the dot com crash of 2000, but not in 2020.

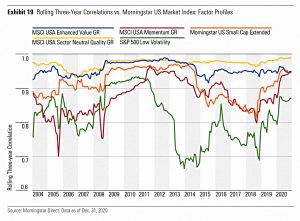

Correlations trending up

The red line shows correlations within an equally-weighted portfolio of six (non-bond) assets, whilst the blue line shows 14 assets including bonds.

Even with bonds included, the trailing three-year correlation was close to a 20-year high as of the end of 2020, almost reaching the levels shown in the wake of the global financial crisis.

Correlations have in general trended up over time, making diversification more difficult.

Assets

Bonds

High-quality bonds (particularly US Treasuries) remain good diversifiers, but low-quality bonds (corporates, junk and EM) behave more like stocks.

- Cash is also good, particularly now that bond yields are so low.

TIPS (inflation-linked bonds) have been much worse than Treasuries.

Demand for TIPS’ inflation protection is likely to stall out when worries about the economy are running high and equities are dropping. TIPS are also much less liquid than nominal. While TIPS play a role for inflation protection, investors have not been able to rely on TIPS to diversify their equity exposure.

Of course, that might change were inflation to return.

Munis

Municipal bonds are issued by US state and local governments and have tax advantages for US investors.

- There is no direct equivalent in the UK – premium bonds probably come closest.

Historically munis have been decent diversifiers for US investors, but they didn’t work in 2020.

Over longer time periods, munis have exhibited a higher correlation with equities than high-quality taxable bond indexes, especially Treasury bonds. One of the key reasons may be that the muni market is less liquid than that of Treasuries, and it has often seized up in periods of equity market stress.

International stocks

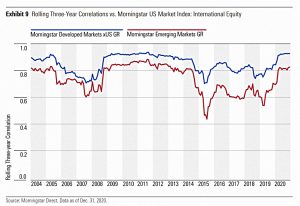

International stock diversification would not be expected to work in a crisis like Covid, and it didn’t.

- Looking longer-term, developed markets are more highly correlated with the US than are emerging markets.

It’s also worth considering the outperformance of US stocks relative to the rest of the world over the last 15 years, and whether that can be expected to continue in the future.

- The strength or weakness of the dollar is a similar consideration.

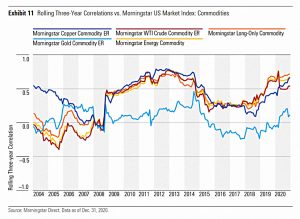

Commodities

Commodities have two properties that make them interesting in portfolios:

- The price drivers are production costs and supply/demand, which can mean low correlations with other assets.

- They usually offer decent inflation protection.

Some commodities were useful in 2020, but not energy-related ones (not surprising in a world facing a pandemic lockdown).

- Correlations have risen over time, which Morningstar puts down to their increased use for diversification by institutional investors.

Once again, the economic regime is relevant: rising inflation and/or interest rates would make commodities attractive diversifiers when compared to bonds.

Alternatives

Bear market (short) funds and managed futures (trend) were the winners here in 2020.

- Depending on the time frame of the trend they were following, some trend funds missed the rapid recovery, which would reduce correlations but also overall returns.

Short funds also suffer from low or negative expected returns.

- In general, correlations for alternatives are increasing, but trend funds still appear suitable for the more normal duration of a bear market.

Styles, Sectors and Factors

Equity styles

Morningstar looked at small vs large-cap and growth vs value, in a 3×3 matrix (small, mid, large and value, core, growth).

- Correlations with the US market are unsurprisingly high, though small-cap has the lowest correlation.

Once again there are regime complications – since large-cap growth has outperformed since the QE plus low-interest rate (financial repression) regime was imposed in the wake of the 2008 financial crisis.

- In 2020, correlations were uniformly high, but returns were massively different (large growth beat small value by 17%).

Looking longer-term, small-cap often decouples from the main market, but returns are key.

- The implication is that broad diversification is better than style-picking.

Stock sectors

Most investors don’t use sector funds, but an increasing number use thematic funds (eg. tech, biotech), with which there is some overlap.

In 2020:

The consumer-defensive sector and healthcare sectors were the best diversifiers. Makers of pharmaceuticals, as well as staples like paper towels and laundry detergent, often hold up better than the broad market when investors are worried about the health of the economy.

Over the whole year, utilities had the lowest correlations, but they underperformed the market.

- Utilities also have the lowest long-term correlations, but they are one of the smallest sectors.

REITs are not good long-term diversifiers.

Factors

In early 2020, all five of the major factors—value, small-cap, momentum, quality, and low volatility—suffered losses of at least 30%. Quality and momentum held up slightly better, while small-cap and value suffered the deepest losses.

Longer-term, low vol has the lowest correlation and quality the highest.

- Correlations for all factors are trending up over time – Morningstar speculates that this is because so many investors are now following the same factors.

Of course, even with high correlations, factors could be useful if they lead to outperformance.

Conclusions

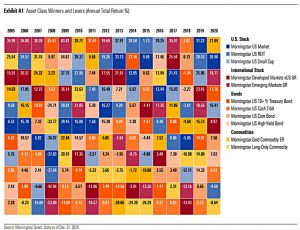

The basic arguments in favor of diversification still hold. Asset classes that are winners in one year often sink to the bottom of the heap in future years. Holding a variety of asset classes helps guard against being overly exposed to an area that falls out of favor.

But areas often touted for their diversification benefits—including REITs, smaller-cap stocks, lower quality bonds, and some commodities—have often moved more in tandem with the broad U.S. equity market than investors might expect.

Within the U.S. equity market, different sectors, investment styles, and factor profiles also tend to move in line with the broader market.

Here are the main points from Morningstar, together with my commentary:

- The simplest diversification methods (stocks plus Treasuries) have worked the best.

- There’s no denying the success of the 60/40 portfolio over recent decades.

- But a regime change to rising inflation and interest rates and/or an end to the outperformance of large-cap growth would change this.

- Treasuries would be less reliable because their correlations might flip and their yields are low, to begin with.

- Over the very long term, the best-performing portfolios are quite diverse.

- Correlations increase during periods of market stress, including the Covid crisis in 2020.

- This is more the case for the most commonly used asset classes.

- Approaches like trend, long vol and risk parity can work well through crises.

- Gold also performs well (usually).

- Correlations between and within asset classes have increased over the last 20 years.

- Low-quality bonds are now poor diversifiers.

- With quality bonds so expensive (with yields so low), cash is a viable alternative (particularly for private investors without investment mandate constraints.

- International stock diversification is still worthwhile, despite high correlations during 2020.

- Commodities have become less useful as more investors have adopted them, with the notable exception of gold.

- A move to an inflationary regime could restore their utility.

- Most equity styles, sectors and factors have become closely aligned with the market, limiting their usefulness as diversifiers.

- Some styles and factors can still be justified on their potential for future outperformance.

That’s it for today.

- Until next time.

As you suggest – it is complicated.

IIRC, munis have, at least in theory, issuer/credit risk.

Municipals have declared themselves bankrupt, see e.g. https://www.pewtrusts.org/en/research-and-analysis/articles/2020/07/07/by-the-numbers-a-look-at-municipal-bankruptcies-over-the-past-20-years

Not so long ago I also recall reading that some commentators reckoned that Municipals have an incentive to default, seek bankruptcy and thus be relieved of their pension obligations!

Premium bonds do not have issuer risk.

“The five-year all-rated cumulative default rate (CDR) of municipal bonds throughout the study period (1970-2020) was unchanged at 0.08%”

https://www.nasdaq.com/articles/high-yield-munis-worth-considering-as-default-rates-cooperate-2021-09-07

Thanks, puts a hard number to the size of my theoretical risk.

I guess diversification (across munis) should help to manage any low probability high impact scenario.

Thought you might like this:

https://www.collaborativefund.com/blog/historys-seductive-beliefs/