LEAPS

Today’s post looks at long-term options – LEAPS.

LEAPs

LEAPs are long-term equity anticipation securities (so the acronym is plural, to begin with).

- They are options contracts with expiration dates longer than one year, (( Strictly speaking, longer than nine months )) and usually up to three years from issue.

They were first introduced by CBOE in 1990 and other than the long expiry, they are functionally equivalent to other options.

- They grant the right (but not the obligation) to purchase (if a call) or sell (if a put) 100 shares of an underlying asset at the strike price on or before the expiration date.

They are available on indices and on individual (US) stocks.

- As you would expect, premiums are usually higher than for shorter-term options in the same underlying.

This is because the further out expiration date gives the underlying asset more time to make a substantial move.

- This is the time value of the option, as opposed to the intrinsic value which arises from the strike price being in-the-money (ITM).

Because longer-term options have a greater proportion of time value, LEAPS are less sensitive to movements in the underlying than are shorter-term options.

- Daily time decay (theta) increases exponentially as an option approaches expiry and will not significantly impact the pricing until the last 60 days before expiration (DTE).

You can protect against this by rolling your position some months from expiry.

Strategies

LEAPS can be used to trade long-term trends (including the tendency of stock markets to move upwards) or in hedging strategies.

- Buying calls provides exposure to a stock or index using less cash upfront than would be required to buy the underlying directly.

- This is known as a stock replacement strategy and effectively provides leverage (potentially enhancing returns whilst capping your max loss to the cost of the option).

- Really long-term buy-and-holders might buy the 2-year LEAP and roll to the next 2-year LEAP after a year.

- This works best with low-volatility stocks, and in particular with indices, and with ITM calls.

- Investors general look for a delta (the sensitivity of the option to price movements in the underlying) of 0.80 or more – a $1 move in the stock should produce a $0.80 move in the option (( Delta also gives the rough probability of an option ending up profitable – here 0.80 means an 80% chance ))

- Buying puts gives a hedge against a fall in the price of the underlying (assuming that this is already owned by the investor).

- Out-of-the-money (OTM) LEAPS can protect against black swan events (eg. puts to protect against stock market crashes)

- If the investor does not own the underlying, buying a put is the equivalent of short-selling, where you profit from a decline in the price of the underlying.

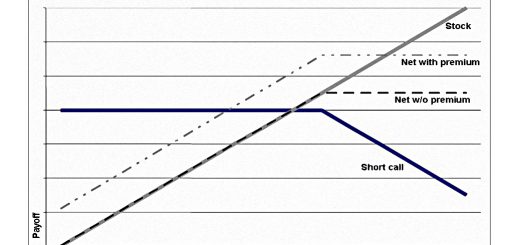

- Buying a deep ITM call LEAP as a proxy for equity and then selling an OTM nearer-term call against it.

- This converts the Stock Replacement strategy into a diagonal spread which is also known as a Poor Man’s Covered Call (PMCC).

Disadvantages

LEAPS have several downsides:

- Higher premiums, including a lot of time value which will decay away

- This means that the underlying must go up to compensate or you will lose money (when buying a call)

- Money tied up for longer

- Lower sensitivity to price changes in the underlying (can be a positive thing, too)

- Higher sensitivity to changes in volatility (vega) and interest rates (rho)

- LEAPS are best bought when implied volatility is relatively low.

- Unfortunately, low volatility is usually associated with market tops, which works against the stock replacement strategy.

- Large bid-ask spread, which will hurt if you decide to close early

- You don’t receive the dividends from the underlying

Conclusions

LEAPS provide a third way (besides spread-bet margin and leveraged ETFs) for retail investors to access long term leverage.

- I’ll be giving some thought to how they might be used in HFEA-style strategies, and will also look at PMCCs as part of our ongoing investigation of options.

I have in mind something like a bond ladder, with 12 LEAPs spread out three months apart across the three years.

- At this stage, I have no idea how practical or profitable this might be, or how much capital might be needed to implement this.

Until next time.