The Free Lunch

Today’s post looks at a white paper from Salient Capital on diversification.

Contents

Salient Capital

Salient Capital Advisors are an asset management and advisory firm based in Houston Texas.

- I hadn’t come across them before this paper, which I found via the Epsilon Theory blog.

The Free Lunch

The paper looks at the value of decoupling diversification and risk.

- Everyone understands diversification as something that reduces the risk of a portfolio whilst maintaining its expected return.

This can lead people to see diversification and the reduction of risk as the same thing.

- Salient argue that thinking about diversification and risk independently will lead to more efficient portfolios.

The key points are:

- Adding assets that reduce risk does not mean that you are diversifying

- Traditional “balanced” portfolios contain unintended bets

- Higher volatility diversifiers are very powerful

Risk and diversification

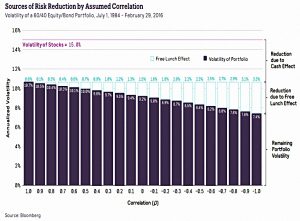

The paper begins with the volatility of the S&P 500 from 1984 to 2016, which is 15.1% pa.

The traditional way to diversify this portfolio (at least as described by the mainstream retail investment firms) is to put 40% into bonds.

- This reduces volatility to 9.5% pa.

This reduction of 5.5% has two sources:

- diversification (the less than perfect correlation between stocks are bonds)

- the lower risk (and therefore, unfortunately, the lower return) of bonds themselves

It turns out that the second effect is much stronger (4.1% compared with 1.2%).

- 80% of the risk reduction comes from bonds being less risky.

The Free Lunch Effect (pure diversification) is only 20%.

Assuming a rule of thumb that a portfolio with 10% volatility would return around 3% pa, Salient price the cost of the de-risking with bonds at 1.3% pa of returns.

This is not a better portfolio than equities, it’s just a less risky one.

In contrast, the Free Lunch does not impact returns at all.

- Looked at another way, the free lunch improves Sharpe ratios, but de-risking doesn’t.

As expected, the Free Lunch is largest when correlations are negative, and zero when they are perfect.

- But it never rises above 3.3%.

The orchestra

Bonds can’t diversify away much of the volatility of equities because they themselves are not volatile enough.

- Bonds aren’t really much more useful than cash in this situation.

Salient use the analogy of a (tiny) orchestra of three instruments.

- Different instruments have different decibel levels, and you can’t build a balanced chord using a loud trumpet with a quiet clarinet or violin.

Orchestras get around this by using more violins than trumpets (usually 6 to 7 times as many).

Salient also look at sine waves.

- Out of synch sine waves can only cancel each other out if they are of similar amplitudes.

Otherwise, the bigger (louder) wave dominates.

In investment, setting the risk of the portfolio (the volume, or amplitude) is the most important task.

- Or looked at from the opposite direction, you will probably have a target return in mind (say an SWR), which will, in turn, require a certain level of risk (volatility) to be taken on.

High volatility diversifiers

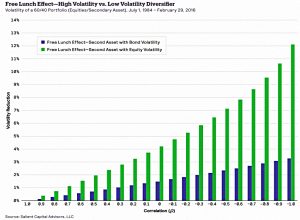

Using a diversifier with volatility similar to that of equities greatly increases the Free Lunch effect.

- Even small positive correlations result in more Free Lunch than perfect negative correlations using a bond diversifier.

Note also that low volatility diversifiers can be turned into high volatility diversifiers by using leverage (what Salient call “adding more violins”).

Theory

The next section of the paper is a recap of Modern Portfolio Theory:

- Start with a risky asset (stocks).

- Adding a perfectly correlated asset with lower volatility reduces risk (and return) but does not offer diversification.

- If the assets are not correlated (zero correlation) then the portfolio can have higher returns for the same risk or lower risk for the same returns.

- If the uncorrelated assets have the same volatility, these effects are magnified.

This is simply a restatement of what has already been demonstrated, but using more maths (in Salient’s paper, not here).

Equal Sharpe ratios

As we have seen elsewhere, an assumption that Sharpe ratios are equal across assets (which is approximately true over long historical periods) leads to a preference for the most diversified portfolio possible.

- Historically, US stocks have an SR of 0.28, as do commodities, whilst US bonds have an SR of 0.24.

Of course, this may not hold over shorter periods.

The implication is that investors who over-allocate to stocks assume that they will have a higher future SR than bonds.

- Those who over-allocate to bonds assume that bonds will have a higher future SR.

Alternatively, investors like myself may simply believe that stocks will have higher absolute returns, and may need a 75% stock allocation to hit a future 3.25% pa return rate (ie. an SWR).

Diversification strategies

Salient note that the simplest way to improve diversification is to use leverage with the least correlated assets (sovereign bonds).

- But many investors – myself included – are not comfortable with this.

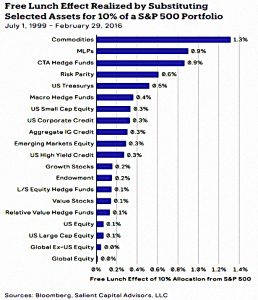

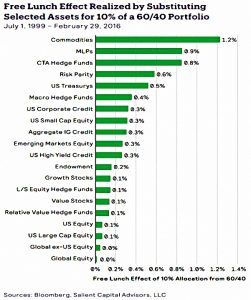

Instead, they offer two tables showing the Free Lunch effects of a 10% allocation to various assets from two base portfolios:

- a 100% stocks (S&P 500) portfolio, and

- a 60/40 stocks/bonds portfolio.

The poor to moderate diversifiers fall into two categories:

- good diversifiers with low volatility (non-government bonds)

- poor diversifiers with high volatility (small caps)

The best diversifiers are fairly exotic: commodities, MLPs, hedge funds and risk parity portfolios.

Salient also note that the effects are not dissimilar over the two base portfolios.

- This supports their position that the 60/40 portfolio is simply a lower risk portfolio than the stock portfolio and not one that has already been significantly diversified.

Conclusions

It’s been a fascinating and relatively short and math-light look at diversification.

Salient has two fundamental points:

- High volatility diversifiers are the best diversifiers of portfolios with high volatility.

- Most low volatility diversifiers don’t have enough of an impact.

- Government bonds are acceptably diversifying.

- Investors should understand and be comfortable with the implications of an over-allocation to stocks (or to bonds).

- In my case, a high stock allocation is justified by a requirement for a high (max) return from the portfolio, and the associated higher volatility must be tolerated.

My belief in risk parity allocations incorporating exotic diversifiers remains intact, as does my preference for a 75% stock allocation.

Until next time.

Interesting post.

OOI, have you ever seen this paper: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3805927

No, but I wrote about a related Ed McQuarrie paper last month: https://the7circles.uk/buy-and-hold/

Indeed you did.

For some reason I had forgotten that post of yours – which is especially dumb seeing as I downloaded and read the the McQuarrie paper too.

In any case, both papers IMO are a timely reminder that:

a) there is no physical law that states stocks must increase; and

b) risk is risky!